Most countries don't consider "Tax Day" a big deal.

You won't find it on a calendar.

You won't receive a reminder from your accountant.

You won't see the national news covering lines of people waiting to send in their tax returns.

In the U.S., though, taxes are complicated.

Tax Day is practically a national holiday in this country – the worst on the calendar. No, you won't get the day off from work. But chances are your office will be buzzing in the weeks leading up to April 15.

And if you own a business or get a Schedule K-1 from your investments, you know next month's final deadline can be even more stressful... October 15 is when taxes have to be filed if they've been deferred. And it's often a mad scramble for anyone with complex tax situations.

Taxes are big business in the U.S.

Accounting firms, CPAs, and financial-software companies are all fighting for the chance to file on your behalf. The complexity of the U.S. tax code makes it rare that people do their taxes on their own by hand.

More Americans turn to tax software on Tax Day each year. And with all the complications, loopholes, and special situations, it's no wonder many people purchase these software programs well in advance of filing to get a head start when it comes time to pay the taxman.

Big names like H&R Block (HRB), Intuit (INTU), and TaxAct from Blucora (BCOR) even offer free filing for certain people. They offer audit protection, check your deductions, and scan your documents to speed up the process.

You can take pictures of your tax documents, answer a few easy questions, and have your files sent in a few clicks. It's hard to beat.

Individuals and corporations trust these companies.

But what if we told you they can't even get their own accounting right? Should you still trust them with your taxes?

Intuit is one of the leading financial, accounting, and tax-preparation software providers in the U.S.

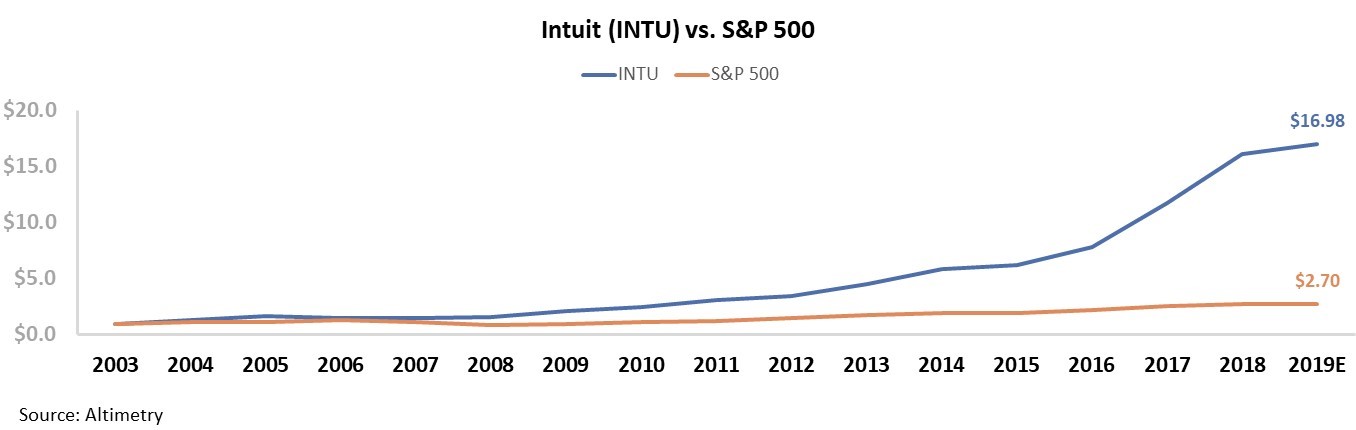

As more Americans switch to online tax-preparation software, Intuit shareholders have benefitted...

Since 2003, Intuit's stock has returned more than five times the S&P 500 Index. In recent years, its total shareholder return ("TSR") has accelerated as the company's tax programs continue to gain popularity.

More than 55 million individual filers use Intuit's TurboTax software. Another 50% of the company's revenues come from small-business accounting.

With numbers like these, Intuit looks like it's poised to keep generating value.

That is, until the real accounting experts step in...

As you know, we specialize in "Uniform Accounting" – a more reliable way of looking at companies than using the GAAP and IFRS accounting policies.

When we apply our Uniform Accounting metrics, the distortions from as-reported accounting statements are removed – including research and development (R&D) capitalization versus expensing, treatment of goodwill, and acquisition distortions – we can see that for as good as Intuit is, its stock is too expensive.

To its credit, Intuit is an incredibly profitable company...

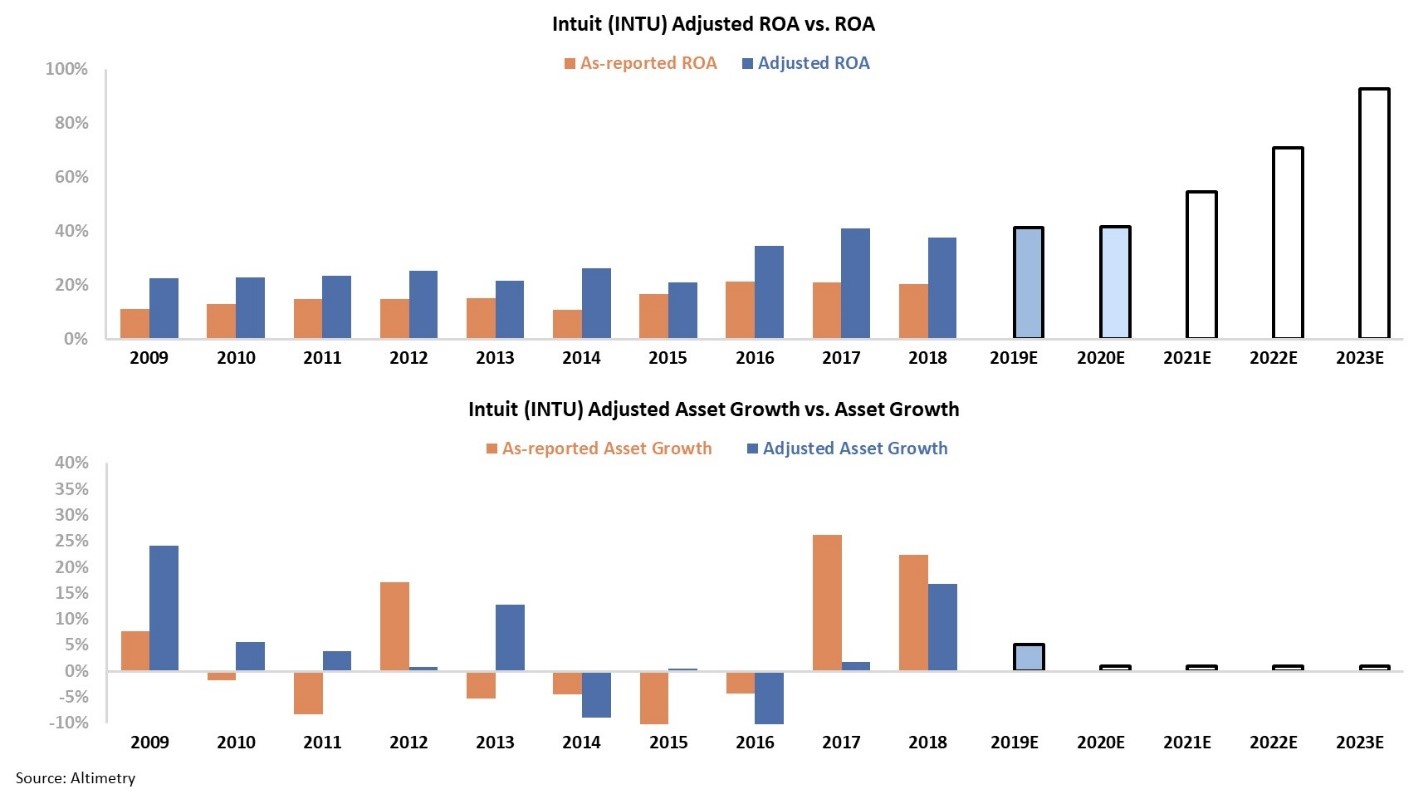

The two panels above explain Intuit's historical corporate performance levels, in terms of return on assets ("ROA") and asset growth (dark blue bars), versus what sell-side analysts think the company is going to do in the next two years (light blue bars), and what the market is pricing in at current valuations (white bars).

Traditional accounting metrics (orange bars) can distort how investors view a stock. Without understanding a company's true profitability, it is impossible to properly analyze the stock.

As the chart highlights, there is a reason Intuit's stock has done well recently... Since 2009, Intuit has kept Uniform ROA above 20% – well above corporate averages. Since 2015, Uniform ROA has nearly doubled.

This sounds great. Intuit is growing. It's incredibly profitable. But this is only half the story... As mentioned, the white bars in the chart show what the market expects.

To justify Intuit's current stock price, the company needs to see Uniform ROA jump to 93% by 2023 – more than double its current ROA. These are lofty expectations... Just about everything must go right for a company to see its ROA double. It's even harder to do it twice in a decade.

So what would it take for Intuit to double its ROA? It would need to file every tax form in the U.S. Even then, it's hard to justify the market's current valuation.

With a stock as expensive as INTU, the market seems to be pricing in the best-case scenario. When this is the case, there is much greater risk than there is reward. Even if Intuit maintains its historically high ROA, its stock is overvalued... And the stock market is in for a rude awakening.

Even so-called "tax experts" can't get their accounting right. Make sure you're looking at the right numbers.

Regards,

Joel Litman

September 19, 2019