The start of a new year is often a time to reflect on big-picture things, like your investing portfolio...

The start of a new year is often a time to reflect on big-picture things, like your investing portfolio...

For decades, the "60/40" portfolio model has been a popular structure. This "one size fits all" portfolio has an allocation of 60% equities and 40% bonds.

The goal of the portfolio is to diversify across the economy and various asset classes. Bonds tend to be less volatile than equities... and during times of market volatility, they'll keep performance from spiking in either direction. They also offer a bit of interest income.

Although the 60/40 portfolio has performed satisfactorily since its inception, plenty of financial professionals have deemed it dead.

Some investors are concerned that the structure isn't able to generate high enough returns. This is in large part due to perception that the large bond allocation will drag down the portfolio's overall returns – bond yields have been declining and are far lower than in the 1980s and 1990s, when the 60/40 structure was at peak popularity.

Additionally, some investing professionals are turned off by the correlation between bonds and stocks. Macroeconomic conditions and company fundamentals affect both bonds and stocks... But as interest rates get closer and closer to zero, bonds and stocks start acting more alike.

Because of this, during periods of panic, the two asset classes move in tandem – defeating the purpose of the diversified portfolio approach. During the initial market panic in March, prices for both tumbled amidst fears about growth and liquidity.

Yet many retail investors and institutions still employ the strategy. And with good reason, as the structure's negatives appear to be greatly exaggerated...

The 60/40 portfolio performed well last year. It had a higher return than the global hedge-fund index and was in line with the performance of the benchmark S&P 500 Index. This simple framework isn't as bad as it's made out to be.

And yet, keep in mind that the overall structure can be customized based on the user...

Here at Altimetry, we believe in a slightly altered approach.

We think the 60/40 portfolio method should be optimized for when the investor needs to access their funds. The actual structure we espouse – what we call the "Timetable Investor framework" – is a bit more nuanced... but put simply, for those who don't need short-term access to most of their money, an 80/20 allocation may make more sense. For others who need to access more of their funds sooner, the ideal portfolio might be 30/70.

Nonetheless, the 60/40 portfolio has shown resiliency and it continues to have a strong pull on the institutional investing community.

The 60/40 portfolio is so widespread that it can even affect broad market returns...

The 60/40 portfolio is so widespread that it can even affect broad market returns...

Many institutions need to rebalance their portfolios monthly to keep a correct allocation. If equities had a great month, investors need to sell stocks and buy bonds to sustain their desired allocation. This means the 60/40 institutional portfolio tends to sell into strength.

At the same time, due to human nature, actively managed portfolios often sell when stocks are cratering. After all, someone has to be selling when stocks or bonds are dropping to cause them to fall in price.

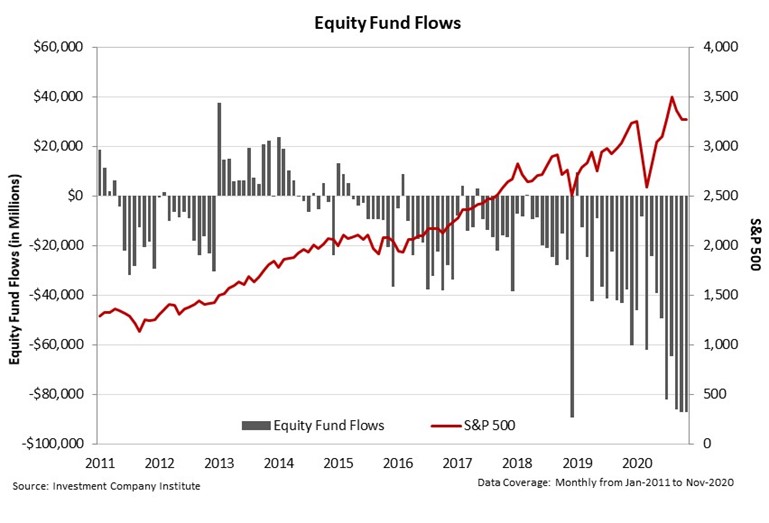

Due to these patterns, equity fund flows can help tell where market tops and bottoms are.

Equity fund flows measure the net inflow or outflow into equities. Folks might assume institutional investors are able to time the market and sell high and buy low.

However, this is rarely the case. A variety of factors affect the stock market – politics, interest rates, investor sentiment, and a plethora of other events can cause volatility.

Because of this, we suggest looking at a mosaic of data to understand the market.

Past patterns in volume and stock price can be one of those tools to help us gain insights. At market tops, passive portfolio rebalancers will often be sellers. At the market bottoms, active investors will likely be big sellers as capital is pulled out of funds.

Looking at equity fund flows over the past decade confirms this trend...

Looking at equity fund flows over the past decade confirms this trend...

Two of the biggest outflows took place when active investors were skittish. However, the market shot up higher soon after both instances.

In December 2018, active investors were concerned about the trade war with China, rising interest rates, whether the Trump administration's tax cuts were inflating companies' earnings, and whether the country was about to tip into a recession.

Additionally, last March also saw a large outflow. Investors were worried about the pandemic causing waves of companies to fail and economies dipping into deep recessions.

Looking back, both of these events were signs of capitulation. When active investors panic and bail out, it's a sign of a market bottom and can give investors the confidence to buy the dip.

At the same time, the major selling in August and September as the market was rallying might have been a sign it was only a short-term top. The fact that selling rallied indicates it was just programmatic trading to keep that 60/40 portfolio steady, as opposed to investors panicking.

It also signals that active investors weren't piling into the market to offset those 60/40 rebalancers. This could be a sign of euphoria... and reason to be concerned about the market.

However, the market is moving higher because fundamentals justify the climb. Its ability to move higher even while fund flows are rebalancing away from it highlights the strength of the market's tailwinds and should give investors comfort to continue to ride the rally.

Regards,

Joel Litman

January 4, 2021

The start of a new year is often a time to reflect on big-picture things, like your investing portfolio...

The start of a new year is often a time to reflect on big-picture things, like your investing portfolio...