The market met strong first-quarter earnings with a shrug...

The market met strong first-quarter earnings with a shrug...

As many S&P 500 Index companies reported quarterly results over the past few weeks, analysts have gotten a better handle on earnings and outlook for the rest of the year.

While some analysts feared a sluggish recovery, the first quarter is shaping up to be a stellar one... especially for cyclical industries that were pressured last year.

Across industries such as finance, health care, and consumer discretionary, management teams have reported better-than-expected results. Analysts were already pricing in a significant recovery for these sectors, so these "beats" highlight just how strong earnings have been.

And yet, while all the earnings data and macroeconomic signals appear to be showing positive signals, the market itself doesn't appear to be moving on this good news.

Consider the banking industry... Morgan Stanley (MS) shrugged off a $911 million overhang from the recent blow-up of Archegos Capital Management. The small capital management firm had defaulted on margin calls from several big investment banks, leading to big losses... But Morgan Stanley and other Wall Street big banks still saw huge quarterly earnings beats.

Despite these wins, the KBW Bank Index – which tracks these large financial institutions – fell in the midst of the earnings calls.

At first, this seeming mismatch between earnings and stock price probably had investors scratching their heads...

At first, this seeming mismatch between earnings and stock price probably had investors scratching their heads...

With such a disconnect between a stock and the underlying cash flows anchoring its value, could pure fear or excitement be driving the market?

Of course, the reality is more complex...

As we often say here at Altimetry, stock prices change based on how the market's expectations for a stock change. These forward-looking expectations drive stock prices up or down.

Over the past few months, the market has seen a huge run up on the back of strong expectations. In other words, these robust earnings results were already priced into the stock before the results came out... And investors are now focused on other issues that could pressure returns.

With a market ready for a recovery, investors must make sure management teams are confident they can continue to deliver.

So, to invest in this market, investors need to know what management teams are thinking...

So, to invest in this market, investors need to know what management teams are thinking...

After the recent rally, investors are now dialing onto earnings calls expecting good news, not reacting to it. And they won't be happy hearing anything that changes that narrative.

Here at Altimetry, we get insight into what management teams across the market are really thinking by leveraging our Earnings Call Forensics framework and tracking overall management confidence and concerns.

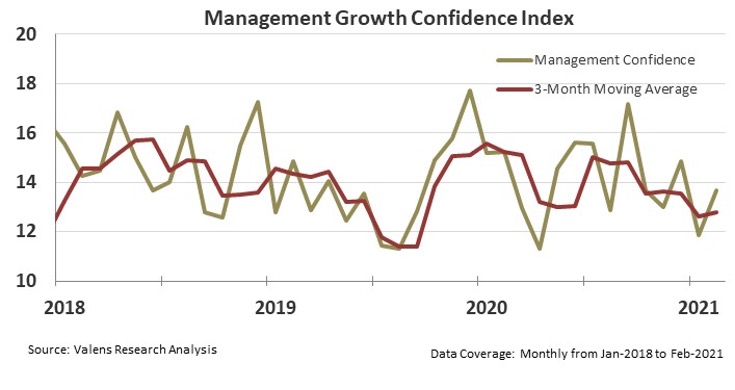

By gauging "confident" and "concerned" statements against each other, we can compile a Management Growth Confidence Index. We can track when management teams have confidence, and this generates highly confident ("HC") and excited ("EXC") markers. When management teams are more concerned and holding back on their outlook, it generates highly questionable ("HQ") markers.

If management teams are more confident, they're more likely committed to investing in growth and seeing "fair winds and following seas" in the market. This means they'll have more HC and EXC markers compared to HQ markers during calls.

Meanwhile, if management teams are scared to invest or see market expectations exceeding their ability to deliver, more HQ markers appear during the calls.

We can start to understand the recent disconnect between strong earnings calls and a weak market reaction when we look at the Management Growth Confidence Index...

We can start to understand the recent disconnect between strong earnings calls and a weak market reaction when we look at the Management Growth Confidence Index...

On an aggregate level, management sentiment isn't nearly as bullish as it was in the back half of 2020, when management teams were flush with stimulus cash and saw multiple avenues for growth.

While markets are still pricing in big potential for growth, management confidence to deliver on these expectations are much closer to the middle of the road... or even slightly more pessimistic than the past few years.

To be clear, this isn't a reason to panic or short the market.

The underlying credit profile of the market is still strong, which is a prerequisite for any protracted crash.

However, with this recent drop in management team confidence, investors shouldn't expect a bull run like the one in the back half of 2020 to carry into 2021. While the market is pricing in perfection, the next few months may be a little rockier as management teams push to deliver on these lofty expectations.

For a more complete picture of our thinking on the macro outlook – and how it should affect your asset allocation – the Timetable Investor feature of our Altimeter service has the details...

For a more complete picture of our thinking on the macro outlook – and how it should affect your asset allocation – the Timetable Investor feature of our Altimeter service has the details...

Once a month, we explain what all our macro signals – built off of our study of more than 150 years of market cycles – tells us for the market outlook.

The Timetable Investor gives more context on how management teams' lack of interest in investing in growth for 2021 fits in with the other signals we look at to understand where the market is heading... and what it means for your portfolio.

It's all included with our Altimeter service... which you can learn more about right here.

Regards,

Joel Litman

May 3, 2021

The market met strong first-quarter earnings with a shrug...

The market met strong first-quarter earnings with a shrug...