McDonald's (MCD) isn't happy about California's latest labor law...

McDonald's (MCD) isn't happy about California's latest labor law...

The act, known as AB 257, will significantly change the way workers and employers negotiate compensation and working conditions in California. State Governor Gavin Newsom signed the bill over Labor Day weekend.

This could spell trouble for the restaurant industry. The law creates a council comprising worker and employer representatives. They'll determine the regulations that restaurants will need to follow.

The council's authority will only apply to restaurant chains with at least 100 locations nationwide. Large chains like McDonald's, Starbucks (SBUX), and Subway are scrambling.

One of the council's hot-button items is a proposal to raise the industry minimum wage to $22 per hour as soon as next year. The statewide minimum wage is currently $15.

This would put chains like McDonald's at a significant disadvantage compared to smaller restaurant groups that could pay their employees less. So it's no surprise that much of the fast-food industry has heavily criticized the new act.

Some restaurant companies claim that raising the minimum wage will force restaurants to either raise prices or invest in automated processes that will replace workers.

But the biggest worry for these big chains is that California is only the beginning...

But the biggest worry for these big chains is that California is only the beginning...

Activists are already lobbying to enact this bill nationwide. McDonald's may be able to afford higher costs in one state... but if this law spreads to all of the U.S., it will leave a serious dent in the company's bottom line. In 2021, the U.S. segment accounted for 46% of total operating income for McDonald's.

McDonald's USA President Joe Erlinger recently claimed franchises might have a hard time maintaining margins in an already razor-thin industry if the minimum wage jumps.

But Uniform Accounting tells a different story.

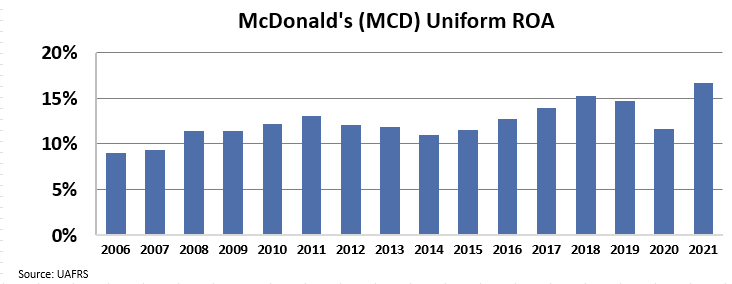

The company has been able to earn respectable returns – slightly above the 12% corporate average – in recent years. While its president may be calling for doom and gloom, McDonald's is still a good business.

You can see in the chart below that margins haven't pulled down return on assets ("ROA") for McDonald's...

Historical ROA levels are a positive sign for the business. That being said, AB 257 is still bringing up serious concerns for the stock price.

The market might be expecting too much from McDonald's...

The market might be expecting too much from McDonald's...

Uniform Accounting shows us that McDonald's has enjoyed steady profitability in recent years. The restaurant chain is a market leader – and it's one of the most well-recognized brands in the world.

Yet despite the company reaching already-lofty heights, investors are still expecting more from McDonald's.

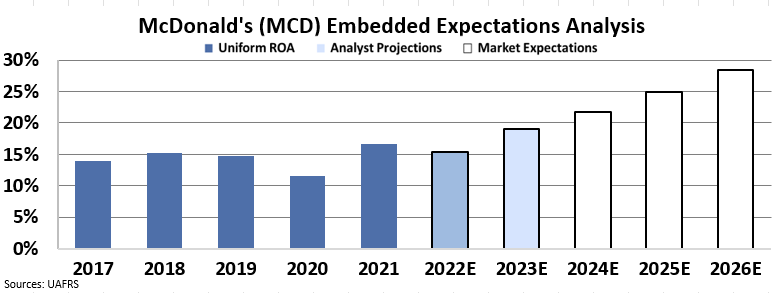

To understand how the market is valuing McDonald's, we can look at its Embedded Expectations Analysis ("EEA"). The EEA framework uses Uniform Accounting to show us exactly what the market expects a company to do at the current stock price.

Here's how it looks for McDonald's...

The market is expecting McDonald's to grow its business through continued franchising – its only option left to scale up. And it thinks ROA will expand massively... reaching 27% by 2026.

The company's previous all-time high ROA was 17% in 2021. That number has only climbed above 14% three other times since 2006. And all of this was without the added pressures of AB 257.

If business costs rise in California, franchise expansion will almost certainly slow. And those problems will only compound if the bill goes nationwide.

While McDonald's will undoubtedly remain the biggest name in fast food, that doesn't make it a good investment today. The market expects this business's profitability to reach unrealistic levels. This is a stock to skip for now.

Regards,

Rob Spivey

September 14, 2022

McDonald's (MCD) isn't happy about California's latest labor law...

McDonald's (MCD) isn't happy about California's latest labor law...