Many students are taking online classes for the first time this year...

Many students are taking online classes for the first time this year...

With 15 of the biggest 20 public school districts starting online this fall, children are being forced to adapt to a new learning environment.

This shift could potentially cause students to lose ground in their learning. The most obvious effect of online or "hybrid" schooling is a lack of face-to-face interaction. Many students, especially younger ones, are missing out on important social interactions with peers and teachers. This can also have an adverse effect on mental health, as it causes many students to feel isolated.

Additionally, it's now difficult for educators to motivate and monitor their students. This could cause certain children to fall behind and not receive the attention they need.

Online learning also presents the issue of inconsistent access to Wi-Fi and technology. Students with older computers and slower Internet – or no home Internet at all – are likely at a disadvantage compared to wealthier students who do have those tools.

These and many other problems make this school year different than any other in recent memory. On top of all of these challenges, schools and districts now have a dilemma when it comes to standardized testing.

In-person tests are challenging to cheat on due to the presence of an eagle-eyed proctor. On the other hand, online tests from home provide little oversight... and students have a greater ability to cheat. However, artificial intelligence ("AI") can help identify outlier tests using pattern recognition. This can reduce the risk of cheating and keep the legitimacy of standardized tests intact.

AI can improve teaching in other ways as well...

Consider language instruction, both for young students learning their native language and students learning a second language. According to a recent piece from market-research firm CB Insights, AI can reduce barriers for learning languages.

Early education teachers will tell you that, when teaching children language and spelling, they try not to correct small mistakes. For example, if a student writes the letter "K" backwards, a teacher should wait to correct it. They should instead focus on the bigger picture and know the small mistake will be fixed in the future.

AI can take this a step further... It can use data analysis to analyze which words students learn faster and then show those same words to new students. This strategy helps expand a student's vocabulary with fewer setbacks.

With the possibility for many students to struggle as they adapt to online learning, any help is welcome... and the use of AI may be one of pieces of the puzzle in ensuring this school year is successful.

One firm is attempting to take advantage of schooling shifts in the age of the coronavirus pandemic...

One firm is attempting to take advantage of schooling shifts in the age of the coronavirus pandemic...

K12 (LRN) sells online schooling and curricula for kindergarten through 12th grade, hence its name. The company operates a number of both private and public online and hybrid schools around the country, and also offers programs for homeschooling.

K12 has taught more than 1 million students since its founding, and currently has more than 170,000 students enrolled in its managed public-school programs.

The company is also known for its Career Readiness Education. As an online program, K12 claims to be able to specialize its schooling for each student. Through its Career Readiness Education, K12 aims to help students discover their career path while still in high school.

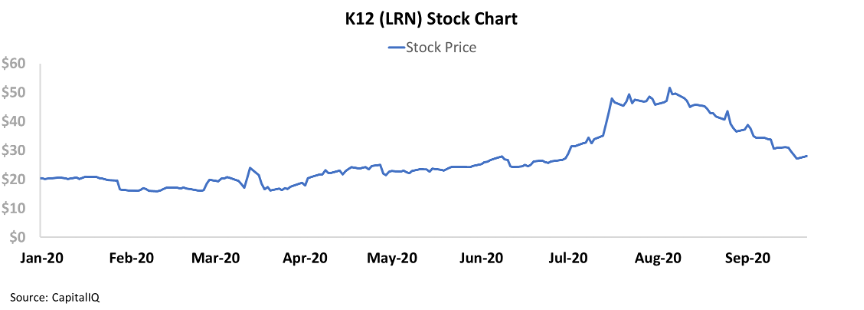

Due to its products and positioning as an online schooling system in an increasingly online world, K12's stock performed much better than the broad market from the onset of the pandemic through the middle of this year. LRN shares rose from $20 in January to more than $50 in early August. Investors seemed excited about this "learn from home" stock's potential.

But today, LRN shares now sit at $27...

Part of the reason why the stock fell in August is due to questions on the efficacy of K12's platform. This was made worse when the Miami-Dade School Board voted to stop using K12's platform in early September.

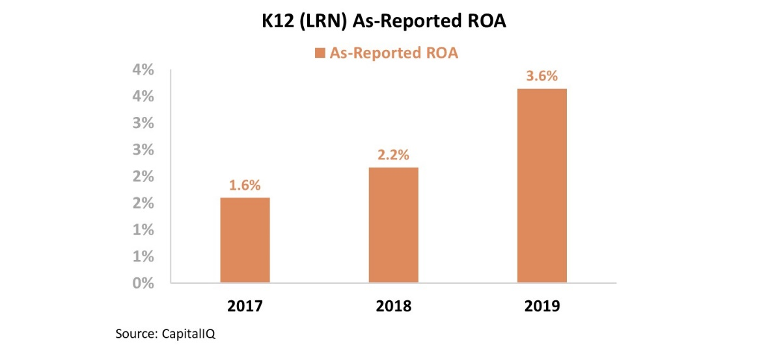

Another reason for the slide is K12's as-reported profitability metrics. According to as-reported accounting, it appears that the company hasn't been able to sustain a high return on assets ("ROA"). Over the past three years, K12's returns have never been above 4%.

However, due to distortions in as-reported accounting, this picture of K12's performance is inaccurate. GAAP's treatment of stock option expenses – among other distortions – mean that investors aren't seeing the real story.

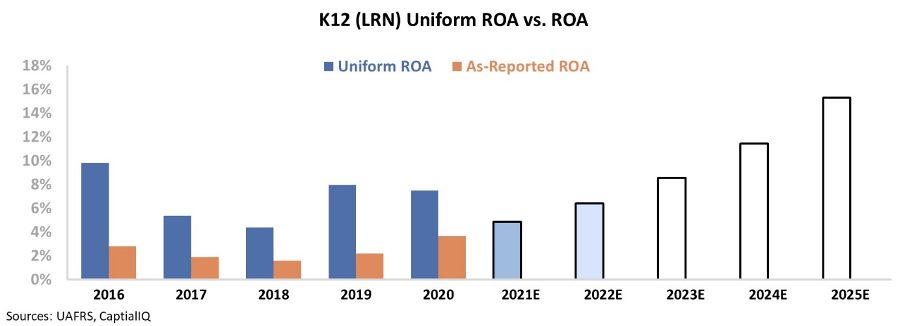

Uniform Accounting shows that the company has been able to improve its returns in recent years. K12's Uniform ROA was 4% in 2017 and reached 8% each of the past two years. Take a look...

Uniform Accounting is able to demonstrate that K12 is more profitable than some investors may realize. However, even with its stock price crumbling, the market still has aggressive expectations for the firm. K12 is still priced like a learn-from-home giant.

To evaluate these expectations, we can use the Embedded Expectations Framework...

The chart below explains K12's historical corporate performance levels, in terms of ROA (dark blue bars) versus what sell-side analysts think the company is going to do in the next two years (light blue bars) and what the market is pricing in at current valuations (white bars).

As you can see, sell-side analysts are expecting a small decrease in K12's Uniform ROA to 5%... even with more online schooling than ever before. Then, analysts are expecting a rebound to 6% the following year.

After that, the market is pricing in K12's ROA to improve to 15% by 2024. This would be the company's highest ROA since 2014.

K12 is seeking to take advantage of positive tailwinds in coming years, and the market is pricing in some kind of widespread adoption of the company's learning platform.

However, it's uncertain how long schooling will be fully online or taught in a hybrid model. With the market pricing in K12's returns to skyrocket, this may not be a realistic outlook. In this case, investors looking to invest in a learn-from-home stock are likely better off staying away from the company.

Regards,

Joel Litman

October 1, 2020

Many students are taking online classes for the first time this year...

Many students are taking online classes for the first time this year...