What do Barbie, Nicki Minaj, and potato chips have in common?

What do Barbie, Nicki Minaj, and potato chips have in common?

They're all involved in a lawsuit filed by toymaker Mattel (MAT).

The company is suing a business called Rap Snacks – which makes hip-hop-themed snack foods – for its Barbie-Que Honey Truffle chips, inspired by rapper Nicki Minaj. Mattel claims that the chips infringe on its Barbie trademark.

Minaj has had a close relationship with the Barbie intellectual property ("IP") during her rap career. Several of her songs were inspired by Barbie, and she often wears colorful, over-the-top Barbie-like costumes. In 2011, Mattel even made a Nicki Minaj Barbie doll.

Mattel hasn't traditionally had a problem with the link between the two. But it seems potato chips were a step too far...

The company claims that Rap Snacks didn't get permission to use the Barbie name to sell its products. And considering that Mattel already sells its own snacks using the brand, this is direct competition.

Barbie is Mattel's biggest and most easily recognizable brand. The company has invested heavily in it. Besides toys, it has produced 44 Barbie movies since 1987, not including a live-action movie coming out in 2023.

Mattel's lawsuit might seem like an overreaction...

Mattel's lawsuit might seem like an overreaction...

That's especially true when you look at the financials of Mattel and other toy companies. In general, toy IP just doesn't seem very valuable.

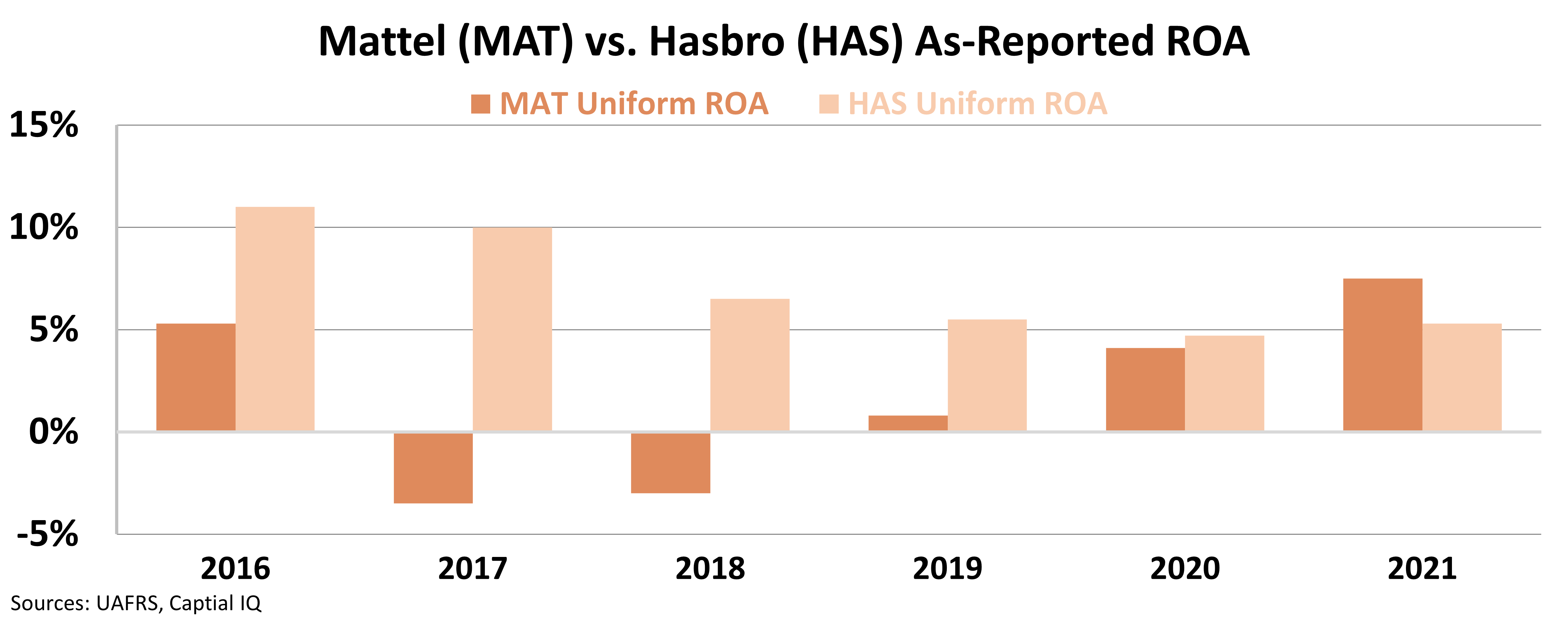

Consider the as-reported return on assets ("ROA") for Mattel and its largest competitor, Hasbro (HAS). It doesn't look like they've been able to capitalize on their flagship brands.

Since 2016, both companies have produced as-reported ROAs below the 12% corporate average. Mattel's has ranged from negative 3% to 8%. Hasbro's has been only marginally better, ranging from roughly 5% to 11%.

Take a look...

Generally accepted accounting principles ("GAAP") metrics suggest that toy IP doesn't pay very well. They make it look like Mattel is wasting its time fighting over the Barbie brand.

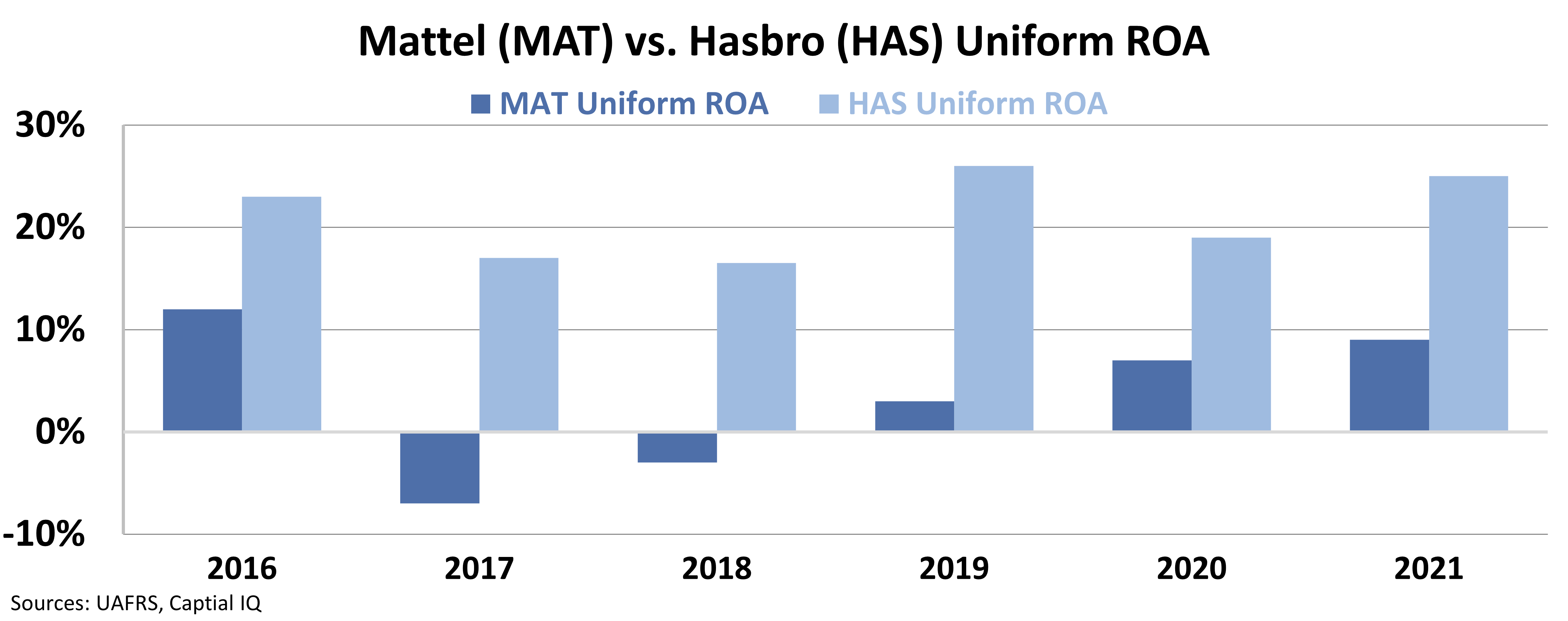

But using Uniform Accounting, we can clean up the mess that GAAP metrics made.

These companies' real performances show us why Mattel's Barbie battle is worthwhile...

These companies' real performances show us why Mattel's Barbie battle is worthwhile...

Hasbro has made the most of brands like Nerf, Play-Doh, and Monopoly. It has boasted ROA consistently above the corporate average. Notably, its Uniform ROA was above 20% in three of the past six years.

But Mattel hasn't been able to keep up. While its Uniform returns are better than the as-reported numbers, they're still not impressive.

Mattel has only beat the corporate average once since 2016, booking an ROA of 13% that year. Most recently, the company scraped together a meager 9% Uniform ROA...

That's why Mattel is fighting for Barbie. Without the brand, it doesn't stand a chance against the competition.

Hasbro has been able to maximize on its IP, leading to impressive returns. Mattel hopes to do the same with its flagship Barbie brand.

The company believes that if it invests correctly in Barbie and Barbie-related projects, ROA will rise to Hasbro's levels. And analysts agree. They expect Uniform ROA to climb to 18% in the next two years.

Uniform Accounting explains why Mattel goes to such lengths to protect its most valuable asset... even against a small potato-chip company.

Regards,

Joel Litman

September 6, 2022

What do Barbie, Nicki Minaj, and potato chips have in common?

What do Barbie, Nicki Minaj, and potato chips have in common?