Now that the dust is beginning to settle from 2020, airlines are measuring the damage from the coronavirus pandemic...

Now that the dust is beginning to settle from 2020, airlines are measuring the damage from the coronavirus pandemic...

The recovery for airline companies has been uneven. Back in April, during the depths of the lockdown orders, air travel was down by more than 94% from its pre-pandemic levels. By the end of 2020, it had recovered slightly... but was still down by 66%.

This year, traveler volumes are at lows last seen in 2000. Furthermore, capacity cuts have been massive, with more than 75% of international flights on permanent hold.

While airlines have been suspending services, they're still burning cash to stay afloat. The current burn rate average is approximately $5 billion to $6 billion per month.

The slow recovery isn't universal, though. The return to normal operations has been uneven, with short-haul flights bouncing back faster.

People are more likely to feel comfortable resuming travel with shorter flights at lower price points. And as vaccine distribution continues, pent-up tourism demand will cause air travel to surge.

Meanwhile, business travel – the largest driver of international flights – is predicted to go through a long slog before it returns fully (if ever).

This is why many analysts expect a quicker recovery for low-cost consumer airlines – including one that seemingly stands above the rest...

Southwest Airlines (LUV) is often held up as a beacon of hope in a challenged industry.

Southwest Airlines (LUV) is often held up as a beacon of hope in a challenged industry.

Business school professors love to teach about Southwest, with the company being the subject of numerous case studies. Even management consulting books preach about Southwest's strengths.

The company has thrived in the airline industry even as its competition has struggled. As the only large low-cost airline that has been in the U.S. for decades, Southwest has developed its own competitive advantage in the marketplace.

The company has focused on direct routing, buying the same aircraft type to reduce costs, and winning customer loyalty through price and customer service.

Investors have flocked to Southwest over the past decade as the company has executed on this strategy. However, these investors are analyzing Southwest using GAAP accounting metrics... which aren't telling the whole story.

To get a better understanding of Southwest, we can use our Altimeter tool...

To get a better understanding of Southwest, we can use our Altimeter tool...

Through the power of Uniform Accounting – which eliminates distortions in as-reported financial metrics – The Altimeter shows users easily digestible grades to rank stocks based on their real financials.

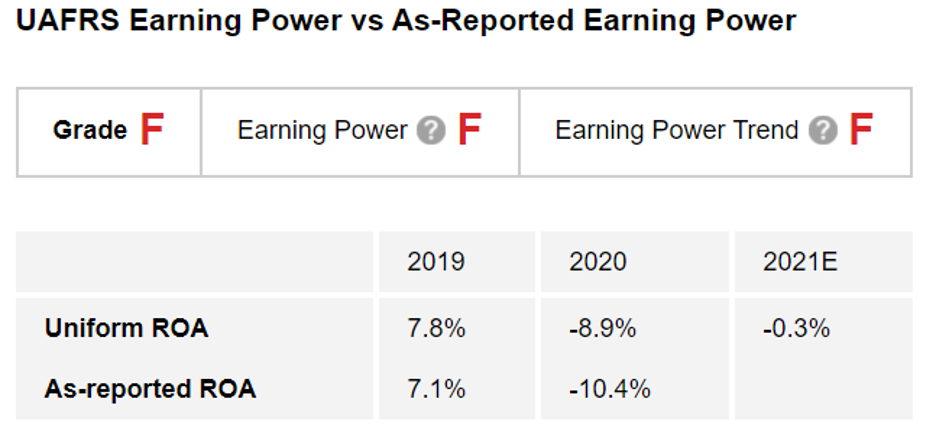

After making adjustments though Uniform Accounting, we can see that Southwest's return on assets ("ROA") has completely cratered to a negative 9% in 2020 due to the pandemic. The cost-cutting measures Southwest has implemented can only go so far.

This dismal return means that the company earns an "F" grade for its Earning Power in The Altimeter. Furthermore, the sharp drop in profitability means that Southwest also earns an "F" grade for its Earning Power Trend.

This weak performance isn't a one-off issue, either. Even before the pandemic, Southwest's returns were still consistently below the corporate average of around 11%. This means that in the best of times, Southwest would only earn a grade of "C" from The Altimeter. That's hardly business school material.

Airlines are tough businesses to operate, with expensive overhead and cutthroat competitive pressures. While Southwest has minimized its costs and fought to win customer loyalty, it hasn't been enough to change the underlying nature of the industry.

And yet, valuations don't appear to recognize this reality...

And yet, valuations don't appear to recognize this reality...

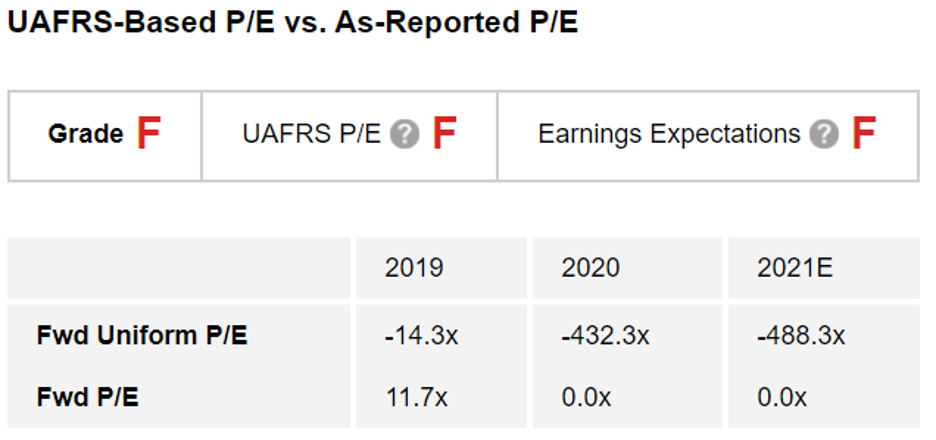

We can also use The Altimeter to see Southwest's real price-to-earnings (P/E) ratio... as well as market expectations for the company's earnings growth going forward.

As you can see below, Southwest sports a Uniform P/E ratio of negative 488. Even with the company's negative earnings, the market is still paying for significant earnings growth – as the "F" grade in market expectations for earnings growth indicates.

While Southwest may see a short-term bounce, the market is already pricing in this below-average company to have a best-case scenario rebound.

No matter what the case studies say, Southwest looks like a stock to avoid...

No matter what the case studies say, Southwest looks like a stock to avoid...

Through the power of Uniform Accounting, we're not only able to identify Southwest as a ticking time bomb... Using The Altimeter, you can also learn how the other airlines grade out. You can see what other traps could be lurking in your own portfolio, waiting to implode... and which stocks could be poised for big upside ahead.

Don't be caught with stocks that could torpedo your portfolio's returns. Find out how to gain instant access to The Altimeter – and the database of thousands of U.S.-listed companies – right here.

Regards,

Rob Spivey

February 25, 2021

Now that the dust is beginning to settle from 2020, airlines are measuring the damage from the coronavirus pandemic...

Now that the dust is beginning to settle from 2020, airlines are measuring the damage from the coronavirus pandemic...