Investors are ecstatic that prices are falling...

Investors are ecstatic that prices are falling...

Inflation was one of the biggest headwinds facing the market last year. Prices soared for food, energy, cars, and everything in between.

Folks were paying a lot more for everyday goods and services... and the Federal Reserve stepped in with interest-rate hikes to cool things off.

The central bank raised rates by more than 4% in less than a year. That's a historically rapid pace in the battle against inflation.

Now, the economy seems to be calming down again. Some folks think it means the Fed is close to reversing course.

Those investors are getting ahead of themselves after only a few good months.

As we'll cover today, the Fed isn't ready to lower interest rates just yet...

That's because 2023 poses its own set of challenges... and the central bank is being cautious. It's looking at an entirely different metric before it takes its foot off the gas pedal.

The Fed's rate-hike campaign is starting to work...

The Fed's rate-hike campaign is starting to work...

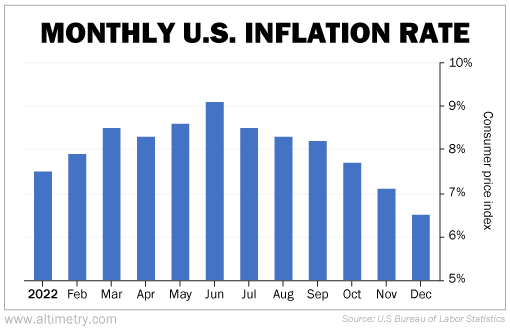

We can see this reflected in the consumer price index ("CPI"), which tracks the change in prices of consumer goods.

The CPI peaked at 9.1% last June... and it has been falling ever since. The CPI dropped to 7.7% in October and 7.1% in November. In December, it was 6.5%. So it went down even faster than in prior months.

Take a look...

Investors are becoming more optimistic about the future. They hope that if inflation continues to decrease faster than expected, the Fed will ease up on rate hikes.

However, the Fed has its own inflation metric to consider...

However, the Fed has its own inflation metric to consider...

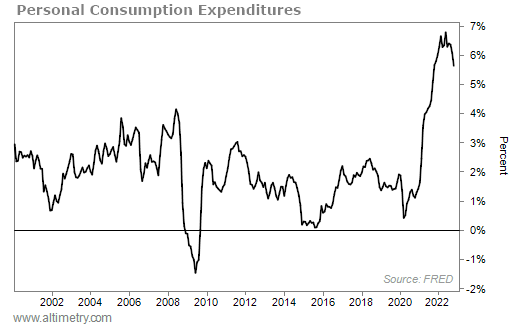

Each month, the central bank releases data for what's called personal consumption expenditures ("PCE"). The PCE is one of its preferred inflation metrics.

The U.S. Bureau of Labor Statistics calculates the CPI based on consumer data. The Fed calculates the PCE using the data it collects from businesses. It's usually more accurate than the CPI... at least from the Fed's perspective.

Like the CPI, recent PCE data from the Fed has shown that inflation is stabilizing. It peaked at more than 6% in the middle of 2022. By November, it had dropped to 5.5%.

Check it out...

The dip in the PCE number is a positive development. However, the Fed is providing a clear message...

The central bank recognizes that the economy is heading in the right direction... However, it doesn't think the economy is improving fast enough.

The Fed tries to keep the PCE around 2%. And it doesn't think that we're going to reach those levels anytime soon.

During a December meeting, policymakers actually increased their inflation forecast for 2023. They now expect inflation at 3.1%, up from their previous 2.8% estimate.

This is largely because unemployment rates are still historically low. When few people are looking for jobs, it can create a bidding war... which leads to higher prices. The technical term for that is "wage-price spiral."

So the Fed isn't just keeping an eye on where inflation is headed...

So the Fed isn't just keeping an eye on where inflation is headed...

It's also tracking the labor market.

In December, the unemployment rate came in at just 3.5%. That matches the level in 1969, before the 1970s and the "lost decade" of inflation.

Low unemployment persists despite multiple rounds of layoffs from big companies. And there may still be tough times ahead...

The Fed wants to weaken the labor market and increase unemployment. That means it's not going to pull back on rate hikes anytime soon. During last month's meeting, the Fed implied that rates could surpass 5% this year unless unemployment rises.

When it does give way, that will push us into a downturn.

The Fed is basically committed to a modest recession. And it's going to facilitate that within the economy... just not right now. With employment levels so high, a recession isn't likely until at least the second half of this year.

With another rate hike or two on the horizon, we expect continued rocky roads for the time being... not the strong bounce analysts are hoping for.

So although the market is rallying to start off 2023, investors need to tread cautiously and temper their expectations.

Regards,

Joel Litman

January 30, 2023

Investors are ecstatic that prices are falling...

Investors are ecstatic that prices are falling...