My family and I have spent most of the past six months in Istanbul...

My family and I have spent most of the past six months in Istanbul...

We're spending the holidays here, as it's halfway between our relatives in the U.S. and the Philippines. We were in the U.S. during the lockdowns, with no way to return to the Philippines.

As we found ourselves stuck bouncing around an America that was largely closed down, we wanted a safe way to find more space and freedom of movement while trapped during a pandemic.

So, in July, we decamped to one of the few places open to American travelers: Turkey. We were expecting Istanbul to be a shorter-term step... and yet, as I look at the calendar, it has already been half a year!

Istanbul has a long history... It was the capital city of three vast empires, two of which were related. The city is more than 2,000 years older than the U.S., first established in the seventh century B.C.

Once known as Byzantium, it was renamed Constantinople in 330 A.D. by the emperor Constantine and established as the seat of the Roman Empire.

After the fall of the Roman Empire in the West, it was the seat of the Byzantine Empire that emerged from its eastern half. Then, in 1453, the Ottoman Turks conquered the city and made it their capital... and it started to adapt its modern name of Istanbul.

Being in the city, it's inspiring to see so much ancient culture, from the Hagia Sophia architectural masterpiece to the Aqueduct of Valens... which I could even see from the window of one place we stayed. This aqueduct supplied water to much of the city – centuries before the type of modern plumbing we take for granted.

It's impressive to think about how the aqueduct was built using ancient construction methods...

It's impressive to think about how the aqueduct was built using ancient construction methods...

The Romans of course didn't have access to any kind of modern building equipment. If the aqueduct was built today, it would likely use modern cranes for the construction process.

Most large construction firms rely on only a handful of suppliers, such as Manitowoc (MTW), for these massive machines. Manitowoc produces a variety of different cranes for the construction space.

It's a dominant force in the industry... Through 2013, it had benefitted from surging demand throughout Asia and the Middle East. Due to the growth of the "Four Asian Tigers" – the economies of South Korea, Taiwan, Singapore, and Hong Kong – and large government spending projects, cities were springing up overnight.

Manitowoc consistently posted positive profitability during the surge. However, as demand slacked for these kinds of big projects after 2013, rating agencies and investors became spooked about dropping profits. Instead of paying attention to Manitowoc sustaining its market leadership through this drought in demand, they focused on the theoretical worst case.

Thanks to its industry-leading position and resiliency through the slowdown, Manitowoc's Uniform return on assets ("ROA") only went negative once since 2013. And yet, credit-ratings agency Moody's (MCO) gives the company a high-yield "B3" label. This implies a nearly 25% risk of bankruptcy during the next five years.

This risk seems vastly overblown...

This risk seems vastly overblown...

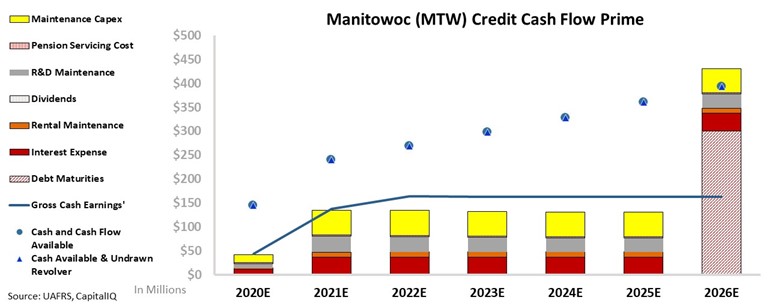

Through our Credit Cash Flow Prime ("CCFP") analysis, we can get an accurate sense of Manitowoc's true credit picture.

The chart below explains the company's credit risk. The stacked bars show obligations each year for the next seven years. We compare this to cash flow (blue line) and cash on hand at the beginning of each period (blue dots).

The bottom bars are the hardest for Manitowoc to "push off" and include costs such as debt maturities and interest expense. The higher bars are more flexible obligations, like maintenance capital expenditures ("capex") and share buybacks.

As you can see, Manitowoc's CCFP shows a significant cash balance and a long debt runway...

Manitowoc's cash flows are expected to exceed operating obligations in every year going forward. Additionally, the company's expected cash balance will exceed all obligations until a big debt headwall in 2026.

This gives Manitowoc a six-year runway to improve operations or refinance its debt. Therefore, we rate the name as a crossover "XO" rating.

This rating implies a less than 2% risk of default within the next five years – far less risky than the implied 25% default risk by rating agencies. The XO rating is also much more representative of economic reality when we look at Manitowoc's forecasted cash flows and obligations.

Ultimately, Uniform Accounting and the CCFP show Manitowoc's true credit risk. The company has a long runway before a cash shortfall in which it can refinance. Don't be fooled by the ratings agencies' overblown fears of default for this dominant crane manufacturer.

Regards,

Joel Litman

December 29, 2020

My family and I have spent most of the past six months in Istanbul...

My family and I have spent most of the past six months in Istanbul...