Dear reader,

In 1988, conglomerate RJR Nabisco was languishing at a low stock price of $40 per share after the recent merger of cigarette maker R.J. Reynolds Tobacco and cracker company Nabisco Brands. After growing management perks and buying back stock, CEO F. Ross Johnson was looking for a new play to buoy his company's struggling stock price.

Johnson met with Henry Kravis of investment firm KKR to discuss a leveraged buyout – where one business acquires a public company using cash flows of the target as collateral in order to raise the debt required.

However, Johnson decided he wanted to dictate his own terms... He teamed up with financial-services company Shearson Lehman Hutton, working against both KKR and his own board to buy out RJR Nabisco.

It sounds complicated, right?

That's because it was... The leveraged buyout of RJR Nabisco was the peak of late 1980s restructuring and corporate excess. As Johnson and Kravis raised each other's bids for control, Wall Street jostled to get in on a part of the action. When the dust settled, KKR became the new owner of RJR Nabisco, and Johnson rode his $50 million golden parachute into history.

In order to finance this debt-laden conglomerate, KKR was forced to downsize and streamline. By 1999, it had sold R.J. Reynolds off to other companies and stockholders. In 2000, it sold Nabisco to cigarette maker Philip Morris, leaving KKR with nothing left of the conglomerate it paid so dearly for.

Every few years, a director will come along with a blockbuster film capturing the greed and debauchery in corporate America. Whether it's Oliver Stone telling us "Greed is good" in Wall Street or Martin Scorsese sharing the story of Jordan Belfort in The Wolf of Wall Street, the public loves to root against the embodiment of unchecked capitalism on the silver screen.

However, none of these Hollywood blockbusters hold a candle to the true story of RJR Nabisco. As one of the largest leveraged buyouts in history, investigative journalists Bryan Burrough and John Helyar wrote an account of the fiasco known as Barbarians at the Gate.

Now, in 2019, after another series of mergers and divestitures, the current owner of Oreo, Chips Ahoy, Ritz, and all things Nabisco is a company called Mondelez (MDLZ). Spun off in 2012, Mondelez was the faster-growing and more profitable snack business of the grocery titan Kraft Foods.

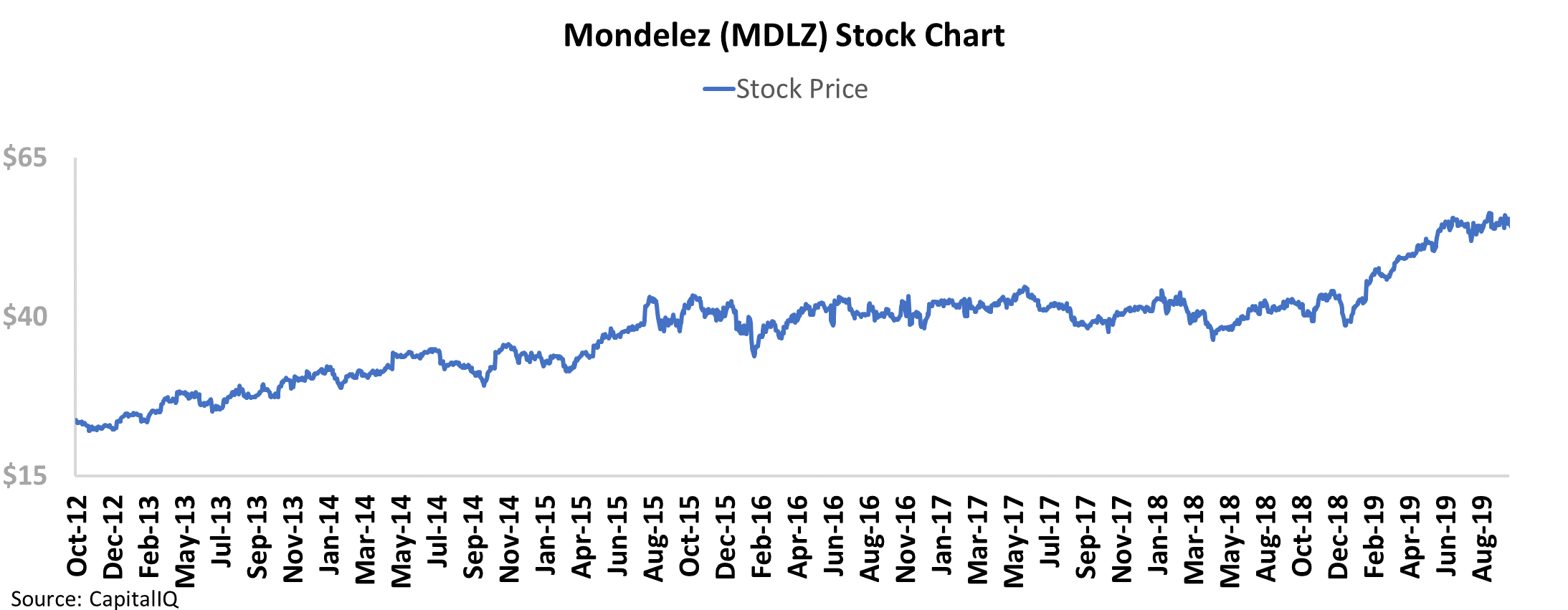

Since its spinoff, MDLZ shares have appreciated considerably, from an initial price near $27 to current values near $53.

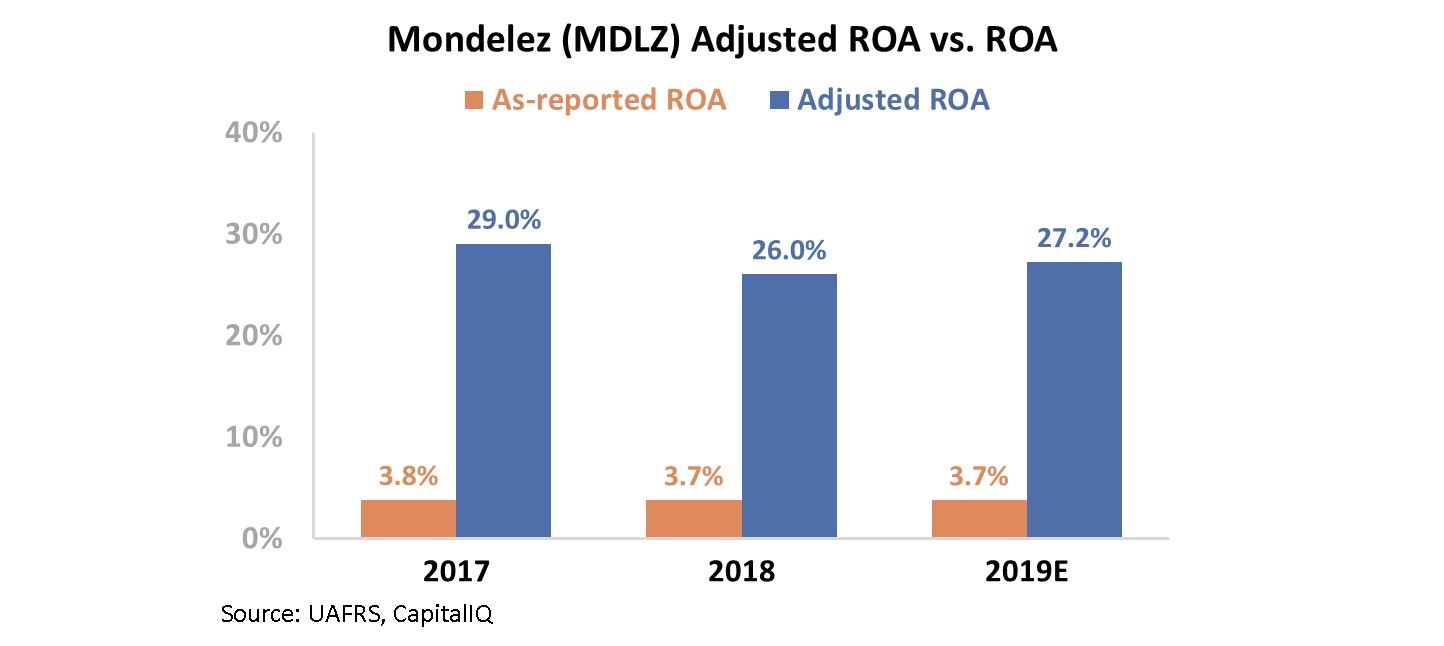

However, to many investors, this steady rise is puzzling. In the business of crackers and cookies, cost rules supreme... and margins are razor-thin. This is reflected in Mondelez's as-reported return on assets ("ROA"), which has been below cost-of-capital levels over the last few years.

With bad data clouding their judgement, these investors have missed the competitive moats Mondelez has created. With such beloved brands, the company is able to charge a premium with the brand loyalty it has built. This is why Mondelez's Uniform ROA of 26% in 2018 is significantly above its as-reported ROA. Take a look...

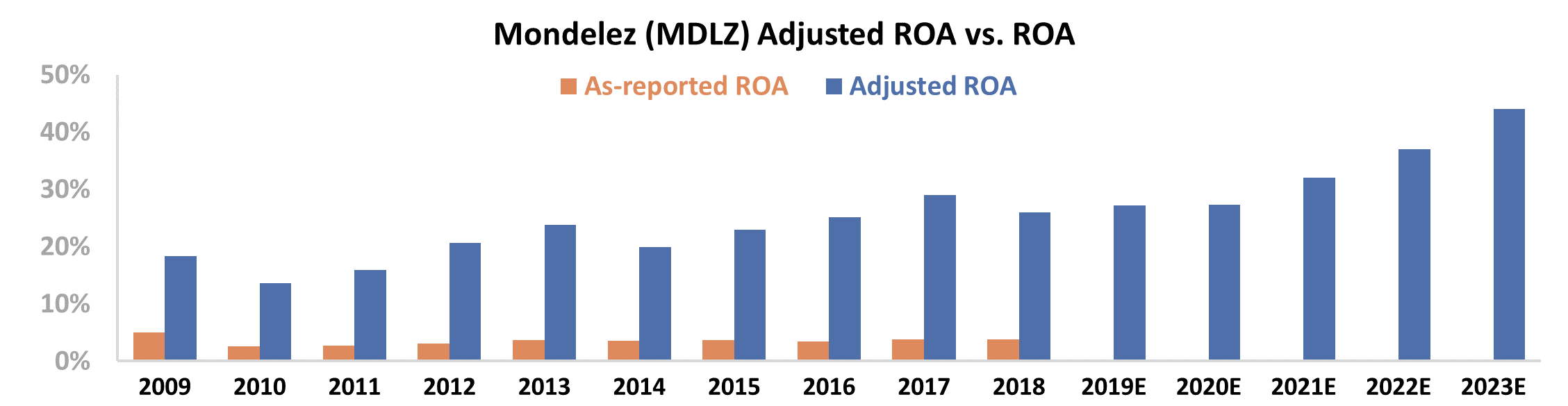

However, a great company does not always mean the stock is a buy. Understanding what the market expectations are for the business is the first step any stock picker must learn before making a trade. By looking at the performance valuation, we can see that the market's expectations for Mondelez are steep.

Historically, Mondelez has reported a Uniform ROA between 14% and 29%. However, market expectations are for its Uniform ROA to climb all the way to 44%... more than 50% higher than peak profitability.

As MDLZ shares have risen steadily due to the company's strong business practices, the market has baked a record performance into the stock price. While the Nabisco brands have finally found their way to a good business, they have not found themselves an attractively priced equity.

Regards,

Joel Litman

October 29, 2019