A real-life version of Succession is playing out in Canada...

A real-life version of Succession is playing out in Canada...

Succession is a fictional TV series on HBO about a dysfunctional family fighting over control of their global media conglomerate as their powerful father's health deteriorates.

A similar situation is unfolding in the real world... There's a feud within the Rogers family – of Rogers Communications (RCI) – over the control of its $24 billion empire.

It began last year when the existing CEO of Rogers Communications orchestrated a takeover bid of Shaw Communications (SJR), another major telecom operator in Canada.

Edward Rogers, son of the company's deceased founder Ted Rogers, has been trying his hand at boardroom intrigue to gain control of the company ever since.

A recent inside scoop from Bloomberg Businessweek highlights how far he has taken the company in his direction.

It has led to an intense legal battle with Edward Rogers on the one side and his mother and two sisters on the other.

The young Rogers has now brought in a new board of directors that could threaten the tie-up between Canada's two biggest telecom players.

It would also threaten his father's ultimate vision for the goliath of a company he had built... making for a drama pulled right from the pages of an HBO script...

Outside of the drama, Edward Rogers may be on the right side of the courtroom...

Outside of the drama, Edward Rogers may be on the right side of the courtroom...

Lost in the family feuding, the story seems to miss a major point about the whole takeover bid. Edward Rogers might be right to oppose the deal.

He contends that the company's existing CEO hasn't been doing a great job.

In Succession, shareholders are often portrayed as just a bothersome group who have no real seat at the table.

In reality, investors are the ones who watch to see how the firm performs and serve as the ultimate judge of that performance.

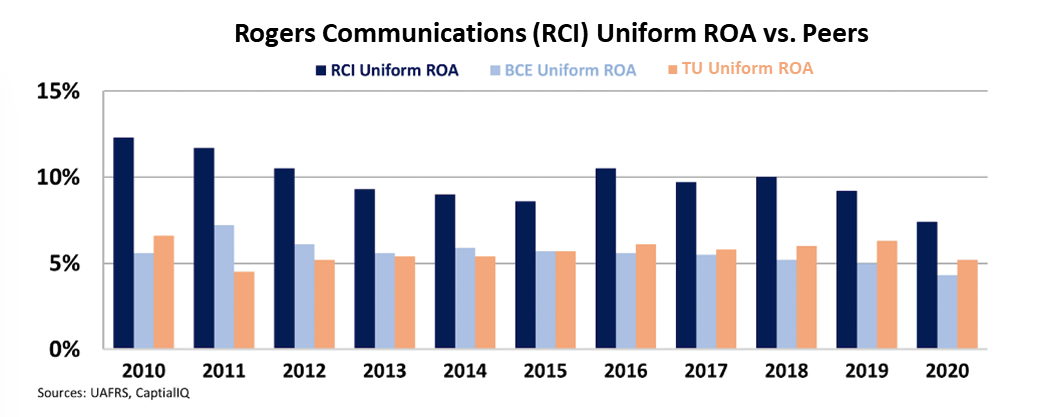

Rogers Communications has consistently realized better Uniform return on assets ("ROA") than its peers.

In fact, it's often looked much like U.S. communication giant Comcast (CMCSA) with its robust double-digits returns.

That is... until recently.

Over the past few years, Rogers Communications' Uniform ROA has been fading closer and closer to the more stayed returns of other Canadian firms like BCE (BCE) and TELUS (TU).

As you can see below, Uniform ROA at Rogers Communications has steadily fallen from 11% in 2016 to around 7% in 2020.

This downward trend in Rogers Communications' profitability might be what's weighing on the mind of Edward Rogers as he thinks about management performance.

It could lead him to question whether making a blockbuster acquisition is the right move for the company.

One might also guess that the founder's son believes he can piece together a plan that might turn Rogers Communications around and get it back on its former upward path.

How this whole Succession-style drama plays out in court is still an open question.

But if Edward Rogers thinks he can make his father's company start looking like Comcast again, it's worth listening to him, with or without the Shaw acquisition...

Regards,

Joel Litman

November 30, 2021

P.S. No matter what stories or shows dominate headlines, in Altimetry's Hidden Alpha, we use our proprietary analysis to find large-cap opportunities from the market's mispricing...

In our most recent issue of Hidden Alpha, we found one of the world's biggest pharmaceutical companies. This company's transformation is ushering in higher growth that is largely unnoticed by most investors.

You can learn more about Hidden Alpha – and how to gain instant access to our latest recommendation – by clicking right here.

A real-life version of Succession is playing out in Canada...

A real-life version of Succession is playing out in Canada...