The legal gray area is nothing new for Elon Musk...

The legal gray area is nothing new for Elon Musk...

Over the years, the CEO of electric-vehicle innovator Tesla (TSLA) has found himself at the center of all kinds of lawsuits.

He has been served for tweeting that he had secured funding to take Tesla private... an alleged Dogecoin pyramid scheme plot... claims over deceptive advertising for Tesla's autopilot and full self-driving features... and more.

But fortunately for Musk, one of the earliest lawsuits of the bunch officially went his way this month.

After years of appeals and decisions, the Delaware Supreme Court upheld Tesla's $2.6 billion SolarCity acquisition in 2016.

If you haven't been following closely, SolarCity sold solar panels and other equipment to residential, commercial, and industrial customers. It had a history of losing money before Tesla scooped it up.

Here's the kicker... Musk was SolarCity's largest stakeholder back in 2016. (As it happens, the company was founded by his cousins.) He knew it needed saving.

That's why shareholders were angry. Some thought Tesla overpaid to bail out the business – and Musk's investment.

The Delaware Supreme Court's ruling means that Musk and Tesla don't owe investors any money for a perceived overpay. Today, we'll look a little closer at the SolarCity deal to see if the judge was right to throw the case out.

SolarCity was a pioneer in the world of home solar... and that wasn't great for business.

SolarCity was a pioneer in the world of home solar... and that wasn't great for business.

When it was still its own company, SolarCity focused heavily on door-to-door sales of leased systems. Customers would pay no upfront costs, and they agreed to purchase the power generated by those panels from the company for 20 years.

It was a new concept at the time. This model helped SolarCity become the largest residential solar installer. But it never figured out how to make money...

By 2016, the company was in a pickle. It needed financing to keep growing, but its mounting losses were scaring a lot of investors away.

Musk had injected $10 million into SolarCity. So he stood to lose a lot of money if it went under. By the time he bought the business for $2.6 billion, plenty of investors had had enough.

They thought Musk overpaid for SolarCity to give it the liquidity it needed to keep growing... thereby saving his investment. They argued that Musk coerced Tesla into buying a bankrupt firm.

To some extent, Tesla investors had reason to be angry...

To some extent, Tesla investors had reason to be angry...

SolarCity was hemorrhaging money like crazy.

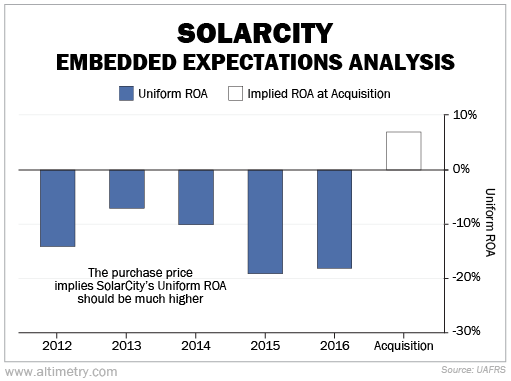

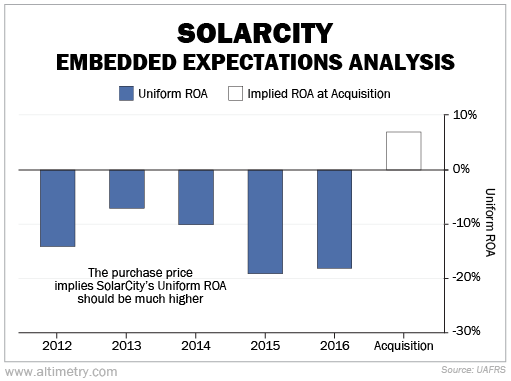

For the five years before SolarCity got acquired, its Uniform return on assets ("ROA") was consistently negative. It lost at least 10% in four of the five years.

We can see how the deal stacks up through our Embedded Expectations Analysis ("EEA") framework.

We'll start with Tesla's $2.6 billion purchase price for SolarCity. From there, we can calculate the future cash flows SolarCity needs to justify that purchase price.

In short, our EEA tells us how well SolarCity's business has to perform in the future to be worth what Tesla paid for it.

Even though SolarCity consistently lost money, the purchase price implied that its Uniform ROA would rise to 7% after the acquisition. Take a look...

This is why Tesla shareholders were upset. It seemed like the company seriously overpaid for a business that was on the verge of insolvency. To be worth what Tesla paid for it, SolarCity would have to flip its entire business around.

But here's where it gets tricky... There's another way of looking at this acquisition.

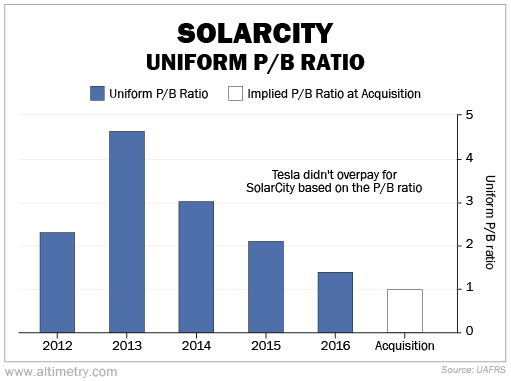

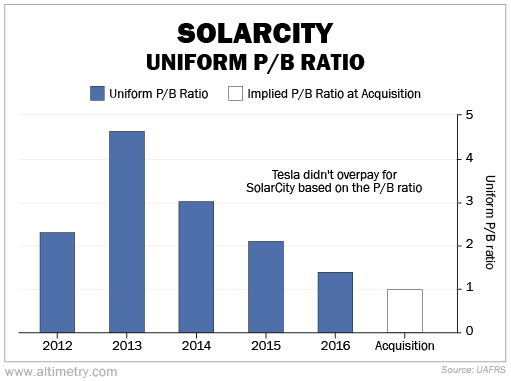

Rather than looking at cash flows, we can also use the purchase price relative to SolarCity's assets. This is called a price-to-book (P/B) ratio.

In the five years before the acquisition, the company was valued as high as 4.5 times its assets. As it kept losing money, its valuation fell. And to Musk's credit, Tesla bought SolarCity when it was trading at a five-year-low valuation... with a 1 times P/B ratio.

Said another way, Tesla bought SolarCity's assets for what they were worth. Take a look...

That's not the "overpay" Tesla investors were hoping for... and it's likely the reason the judge ruled in Musk's favor.

The truth is, both sides are 'right' here...

The truth is, both sides are 'right' here...

Tesla technically didn't overpay, since it bought SolarCity's assets at face value.

But practically speaking, if a company was losing 10% per year and faced actual insolvency risk, it probably should have traded for even less than the value of its assets.

The judge had a leg to stand on. However, looking at SolarCity's returns... we're not surprised some investors think Musk used Tesla to bail himself out.

This is yet another reason to always watch out for corporate governance. It's vitally important to make sure that management has shareholders' best interests at heart.

Just remember, when you consider investing in any of Musk's businesses – or any he's thinking about working with – Musk isn't aligned with you. Be careful betting with or against his companies.

Regards,

Rob Spivey

June 27, 2023

The legal gray area is nothing new for Elon Musk...

The legal gray area is nothing new for Elon Musk...