Why is everyone sick this fall without COVID-19?

Why is everyone sick this fall without COVID-19?

With the return of kids to school and employees back in the office, there is an unprecedented wave of regular common colds and other petty sicknesses.

After all, we've been social distancing for more than a year and a half, away from all of our sneezing friends, crowded subway systems, and seldom-cleaned staircase hand railings.

I'm no doctor, but it makes intuitive sense that we've lost some of our natural immunity. Our immune systems are sort of like an athlete who hasn't practiced for a year... which could make this a worse-than-normal cold and flu season.

Psychologically though, it feels even worse than a run-of-the-mill head cold... especially with everyone on heightened alert because of the new mutations and variants of the coronavirus.

Turning the common cold into an investable theme...

Turning the common cold into an investable theme...

One powerful way to alleviate fears that a common cold isn't COVID-19 is through testing.

We've heard much about the two types of tests: PCR and rapid tests.

In the U.S., the PCR test is still the dominant style, but it has shortcomings in turnaround time. Even the best PCR testing regimes take 12 to 18 hours to return results to the patient. Additionally, patients need to schedule PCR tests in advance, often leading to 48-to-72-hour total turnaround times.

As its name suggests, the rapid test can turn a sample into a result in less than 30 minutes. But with far higher manufacturing and administration costs, tests are in short supply.

But another type of test has become more popular in the U.S. and has already become widely used in the rest of the developed world. That's the at-home administered rapid test.

That way, when someone wants to come and visit, you can quickly put to rest any COVID-19 concerns.

Abbott Laboratories (ABT) currently sells the most popular option, the BinaxNOW two-pack, for around $23.99. While the test is still pricier than the free options available through CVS Pharmacy (CVS) or services like Google's (GOOGL) Project Baseline, you can skip the headache of trying to schedule a test in advance.

Families have taken to their local pharmacies to stock their medicine cabinets with testing kits for later use, triggering a surge in demand. And that demand is being driven further by a holiday season that's being overrun by the common cold.

That demand is setting Abbott up to be a big winner. With the recent news of the omicron variant of the coronavirus blowing through South Africa and jumping across the Atlantic, demand has another catalyst to drive home-testing sales higher.

Let's take a look at The Altimeter to see just how big of a winner Abbott could be...

Let's take a look at The Altimeter to see just how big of a winner Abbott could be...

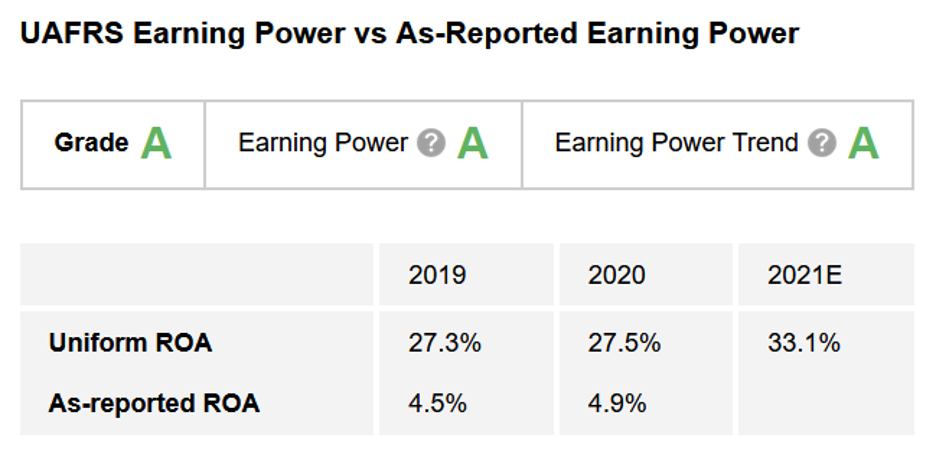

On an as-reported basis, Abbott's return on assets ("ROA") last year was just 5%, roughly in line with its cost of capital. On the surface, that doesn't bode well for the company.

But lackluster productivity is only a symptom of antiquated GAAP rules that distort the usefulness of financial metrics like ROA. In the case of Abbott, GAAP rules for mergers and acquisitions have made the asset base appear much larger than it is, bringing ROA down.

The Altimeter automatically looks at more than 130 adjustments to deliver accounting metrics that represent real economic productivity. This allows investors to make apples-to-apples comparisons between companies.

The Altimeter shows that Abbott's Uniform ROA is 28%, significantly higher than the 5% most investors would see. Moreover, analysts forecast Abbott's Uniform ROA to expand to 33% going forward, driven by its COVID-19 testing regime.

That earns the company an "A" grade for both Earning Power and Earning Power Trend, and importantly, an overall "A" grade for performance. Take a look at Abbott's Altimeter scorecard:

In effect, Abbott has transformed your common cold into a profit center. While pharmaceutical companies selling over-the-counter remedies have been doing this for years, Abbott seized a unique opportunity to offer a new type of relief with the pandemic.

These are the inflection points that investors need to be looking out for to generate real alpha. But before making the jump, they need to make sure the company is reasonably priced.

Click here to see The Altimeter's valuations grade for Abbott Laboratories.

As subscribers to Altimetry's Hidden Alpha newsletter are aware, we just recommended a big health care stock in another area of the industry primed for disruption... cancer treatment.

Our latest recommendation stands to nearly double its stock price from where it stands today. In fact, the average return among the more than 25 open recommendations in the Hidden Alpha portfolio is 35%... and several of these stock picks have triple-digit gains.

Plus, as a bonus, you'll also get complimentary access to Timetable Investor. Our Timetable Investor readers receive first access to our thoughts on the markets and the economy as a whole. These are market ideas and insights you won't find anywhere else...

Learn how you can get a year of Hidden Alpha for 75% off the normal price – by clicking here.

Regards,

Rob Spivey

December 2, 2021

Why is everyone sick this fall without COVID-19?

Why is everyone sick this fall without COVID-19?