Amazon (AMZN) CEO Jeff Bezos' massive net worth has been steadily rising...

Amazon (AMZN) CEO Jeff Bezos' massive net worth has been steadily rising...

Anyone who would argue that Bezos isn't a great leader, business creator, or visionary just need look at his self-created net worth to come back to reality. If he can lose $40 billion in a divorce and still stay the world's wealthiest man, he has clearly been doing something right in his business endeavors.

One great place we look to understand management philosophy is in a CEO's own words. Here at Altimetry, one of the tools we use is our Earnings Call Forensics – we analyze management's earnings calls to see where management has stress or conviction about its strategies and outlook for the business. Our goal is to see into a CEO's real feelings.

But on an even more basic level, a great place to start is to read a CEO's letter to shareholders in the 10-K form each year.

Many people have talked about the wealth of insights that's Warren Buffett's note to shareholders in Berkshire Hathaway's (BRK-B) annual reports. And Bezos may be starting to build a similar following.

CB Insights recently built a list of key takeaways and insights from Bezos' past 23 annual letters to shareholders. It's worth reading not just for any Amazon shareholder, but also any business leader or investor in general. Below are some important themes over the years:

- 1997 – Bring on shareholders who align with your values

- 2001 – Measure your company by your free cash flow

- 2005 – Don't get fixated on short-term numbers

- 2008 – Work backwards from customer needs to know what to build next

- 2010 – Research and development (R&D) should pervade every department

- 2015 – Don't deliberate over easily reversible decisions

- 2018 – Wandering is an essential counterbalance to efficiency

- 2019 – In times of crisis, be aggressive and agile

We enjoyed thumbing through this read, and hope you do too.

Investors' favorite airliner, bar none, seems to be Southwest Airlines (LUV)...

Investors' favorite airliner, bar none, seems to be Southwest Airlines (LUV)...

In the business world, the operating strength of Southwest is well regarded. The company is featured in countless Harvard Business Review cases, and consultants use it as an example of a resilient, profitable business in a struggling industry.

Southwest has consistently bucked the trends of other airlines with its business model of low cost, no-frills flying. Through standardizing its Boeing (BA) 737 aircraft, Southwest has reduced costs compared to the legacy carriers. Experts have praised the company's business culture for driving continuous success. Some analysts speculate that a focus on individual fliers rather than business customers means that Southwest is exposed to less volatility.

This all means that Wall Street has viewed Southwest as a miracle stock that can avoid the traditional pitfalls of other airlines. However, Southwest is still affected by economic downturns...

From 2000 to 2002, Southwest saw its profit margin fall by a full 60% after the industry suffered from the fallout of the 9/11 attacks. In 2008, during the financial crisis, the company's operating profit fell by more than 50%.

So why does Wall Street love Southwest?

It's because the company has avoided bankruptcy over the past 40 years, unlike many of its other competitors.

The secret to Southwest's success is not its low-cost business model, or its culture. Rather, the company has avoided bankruptcy through smart management of its debt. In the cyclical airline business, Southwest has lived by one simple rule: Don't take on excess debt, and you can't go bankrupt.

This is a lesson that the legacy airlines have refused to learn. During the bull years, other carriers levered up their balance sheets, and would go under when the storm hit. On the other hand, Southwest would take a huge hit but keep on sailing. And that has translated into massive stock gains... Over the past 40 years, LUV shares are up more than 23,000% (including dividends).

In times like these, here at Altimetry we look for businesses like Southwest with smart capital structures. In highly cyclical industries, it's crucial that companies manage their debt safely. And one of these cyclical industries that has been hit hard in 2020 with the coronavirus shutting down discretionary spending is traditional retail.

In this economic environment, online retailers such as Amazon (AMZN) are profiting, and traditional brick-and-mortar retail has been left out. Of the large clothing outlets, we've had our eye on Ross Stores (ROST).

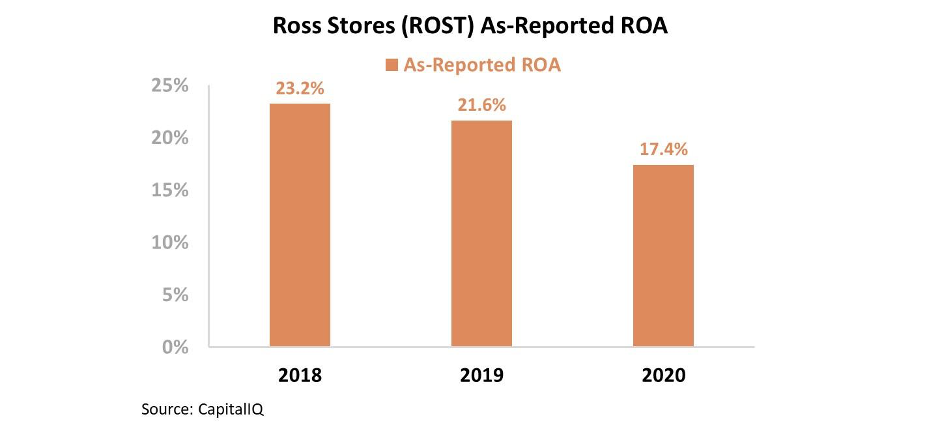

Ross is a discount retail outlet, and as the downturn occurred, it and many other retailers have seen their stocks plummet. However, some might think this is just an overdue reaction to issues Ross was already facing before the coronavirus pandemic. Over the past three years, the company's as-reported return on assets ("ROA") for has been trending lower, from 23% in 2018 to 17% in 2020.

It's all too easy for Wall Street to write off Ross as a struggling retailer. Considering how many of its competitors – such as JC Penney (JCP), Sears, and Neiman Marcus, to name a few – have been brought down, could Ross be next?

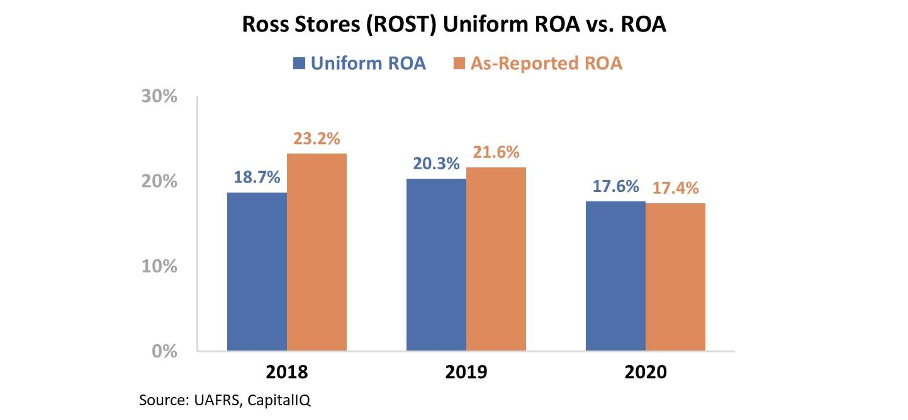

This view is colored by the distortions inherent in GAAP accounting. By adjusting operating leases and stock option expenses, we can see what Ross' true operating performance looks like.

In fact, rather than decreasing over time, Ross' Uniform ROA has held relatively steady over the past three years – holding between 18% and 20%. The company is maintaining strong returns.

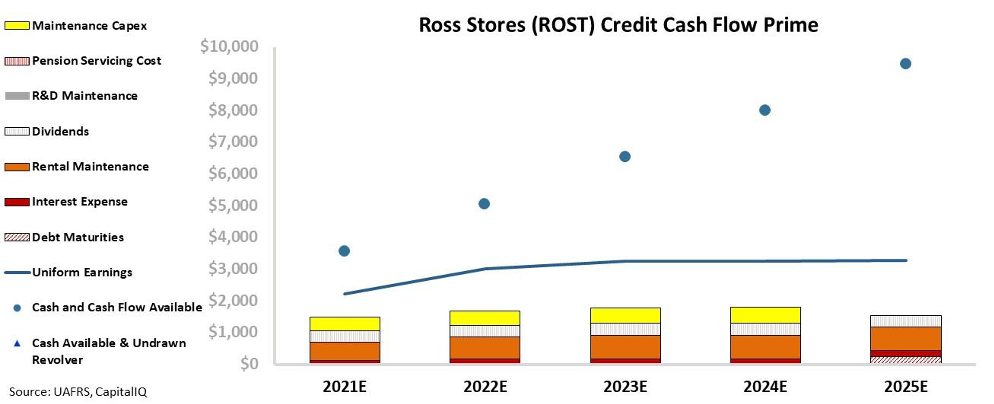

Furthermore, by looking at Ross' real, Uniform earnings compared to its annual financial obligations, we can get a better sense of how strong the company's capital structure really is through our "Credit Cash Flow Prime" analysis. And thanks to its Southwest-like capital structure, Ross might not be brought to bankruptcy by this economic downturn.

When looking at Ross' Uniform earnings, we can see that the company's cash flows alone can comfortably service all its outstanding obligations – including items like debt maturities, interest payments, and dividend payments. Take a look...

As you can see, Ross is a smart player in a struggling industry. By minimizing its debt during the bull market, the company can take on responsible debt now, during a downturn, and not have to worry about being over-levered. Rather than a legacy airline, Ross is positioned like a Southwest.

And once the market realizes the underlying strength of Ross Stores' balance sheet, upside is possible for this misunderstood firm.

Regards,

Joel Litman

May 7, 2020

Amazon (AMZN) CEO Jeff Bezos' massive net worth has been steadily rising...

Amazon (AMZN) CEO Jeff Bezos' massive net worth has been steadily rising...