What happens to the market when taxes increase?

What happens to the market when taxes increase?

A few weeks back, I was guest-lecturing an advanced MBA-level accounting course at DePaul University.

Many of my students were asking a relevant question: What happens to the market when taxes increase?

There's been a lot of buzz in the financial press around how any potential spending bill in Washington, D.C., will be paid for, hence the onslaught of tax questions.

The answer I gave them was pretty straightforward... When a government wants to reduce an activity – smoking tobacco or drinking alcohol, for example – it can raise taxes on that activity.

Higher taxes raise the cost of the action and reduce the number of people who want to perform it. In other words, if you increase taxes, you decrease economic activity. So a government that wants to decrease investing activity can simply raise taxes on investments.

Say taxes on capital gains double from 25% to 50%. Imagine the impact of this increase on $1 of dividends for a stock that trades at $40 per share.

When you think about how much you're paying when you buy an item, you think in terms of net pay, not gross pay.

The same goes for investing. You want to know what your after-tax return is, not what you get before Uncle Sam takes his cut.

Going back to our example, if dividend taxes rise from 25% to 50%, $1 of dividends that used to yield $0.75 in income now earns only $0.50.

The after-tax earnings effectively fell by a third. For investors valuing how much the stock is worth, this changes their thinking. Now, they'll only be willing to pay two-thirds of the prior price, meaning the $40 stock would only be worth $27.

It's possible taxes could go up over the next year if social spending programs in D.C. become law...

It's possible taxes could go up over the next year if social spending programs in D.C. become law...

If taxes do go up, it's likely to be a headwind for the market.

It won't be as dramatic as in the example I just discussed. We're not actually looking at capital gains and dividend taxes jumping from 25% to 50%.

At worst, we're talking about investment taxes rising from current 20% levels to 29%. This increase would certainly hurt the market as a one-time reset, but it wouldn't be enough to cause the broad market to fall 33%.

Using the same math, it means the market would be worth 11% less after the tax hike than before.

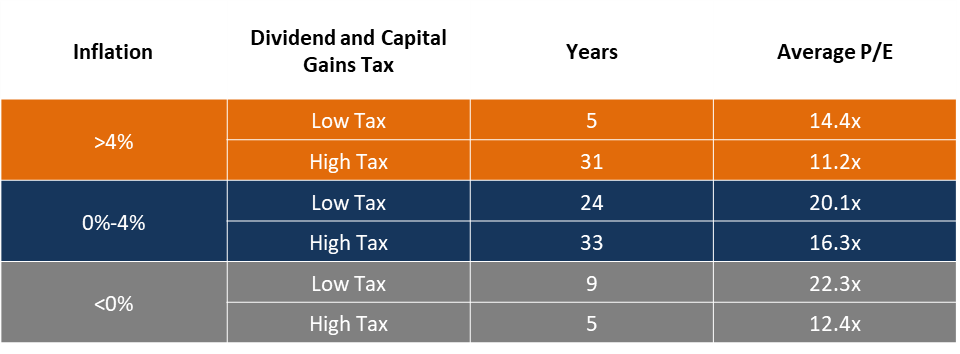

Taxes directly affect price-to-earnings (P/E) ratios, much like inflation does, as we discussed last week. Like inflation, higher taxes mean higher discount rates – the rate investors use to translate a dollar of "future" money into today's value.

That's why in a high tax environment, even when inflation is muted between 0% and 4%, investors are looking at a 16 times average P/E ratio, rather than 20 times when taxes are low.

Take a look at the historical data...

One important piece of advice, as any good financial advisor will tell you, is that just because taxes might go up soon, you shouldn't go and change your investment strategy.

We want to wait until we actually see the data, because the real tax plan that makes it through a divided Congress may be much different from what the headlines suggest.

Here's the big takeaway: Beware of rising capital gains and dividend taxes, but don't overreact to them.

Little risk of mass defaults and strong corporate profitability supports high market valuations. This means that bailing out of the market now could mean leaving further gains on the table.

As we keep telling readers in Altimetry Daily Authority, let the market "noise" clear and continue to take advantage of opportunities to buy the dip... And of course, if anything changes to upend the tax environment, you'll be the first to know.

If you want to learn more about what really drives both the economy and stock market over the long run, I'd urge you to subscribe to our Hidden Alpha newsletter, where you'll get access to not only our favorite large-cap stock ideas, but also The Timetable Investor, which helps users understand how to navigate macroeconomic topics such as inflation dynamics and tax rate regimes. For a special offer on a year of Hidden Alpha, click here.

Regards,

Joel Litman

November 1, 2021

What happens to the market when taxes increase?

What happens to the market when taxes increase?