The quest to untangle 'Fedspeak' continues...

The quest to untangle 'Fedspeak' continues...

Investors and the financial media are trying to decipher how long Federal Reserve Chairman Jerome Powell and the rest of the Federal Open Market Committee will tolerate higher inflation.

Money managers and analysts want to know when the Fed will use its most powerful tool – interest rates. By raising interest rates, the Fed can rein in elevated prices that producers and consumers are facing.

Some call for the Fed to raise interest rates sooner to ensure higher prices don't become embedded into people's minds. Even the idea of inflation, if held by enough people, can start an inflationary spiral. It's what we saw in the U.S. during the Great Inflation of the 1970s.

Others are concerned the economy might get stuck in a period of stagflation, a situation where there is both high inflation and high unemployment, accompanied by slow growth. This presents challenges for policymakers because they may have to choose policies to deal with inflation (like raising interest rates) that only exacerbate growth issues and vice versa.

Stagflation worries stem from the potential that current supply chain issues may last longer more than expected. This could lead corporate management teams to refrain from investing, leading to continued price pressures.

Here at Altimetry, we have a more sophisticated way of gaining insights into the vague world of "Fedspeak," a term meant to describe the central bank's intentional ambiguity.

Thanks to our Earnings Call Forensics ("ECF") analysis, we can obtain a window into what Powell – and corporate management teams – are thinking.

Recently, we had the team review previous Fed meetings, and some signals from its July press conference were revealing. Powell was particularly confident that pricing surges in energy, lumber, and other inputs look transient.

On top of that, Powell was confident that current inflationary issues likely won't last longer than 12 months and that consumers shouldn't expect higher inflation going forward.

Like what we've been telling our readers, Powell was also confident that a supply shock is driving price pressures. It's not the sort of wage-price spiral dynamic that should be a concern for the economy and investors.

Inflation rates are central to market valuations...

Inflation rates are central to market valuations...

Insight into what Powell and other Fed officials are thinking about inflation is important. That's because inflation rates are central to understanding what valuations are warranted in the market.

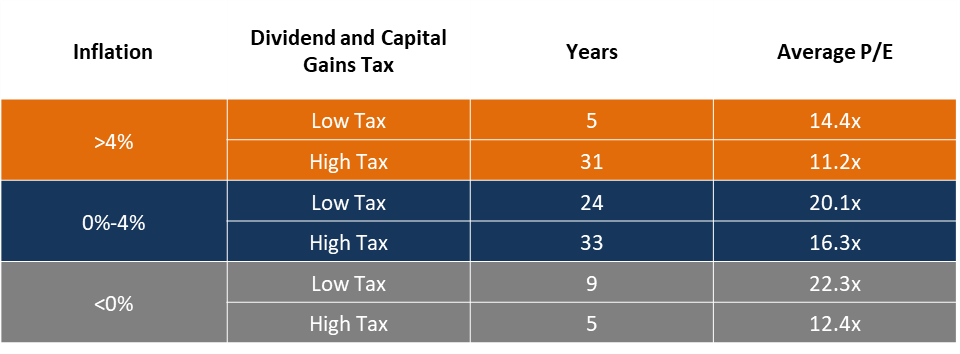

When inflation is higher, it generally means lower price-to-earnings (P/E) ratios for the market. Real returns are being eaten away by the rising costs of goods and services.

When inflation is above 4% for a sustained period, even in a low-tax environment like the one we're currently in now, market prices suffer. In this environment, investors are looking at a 14.4 times average P/E rather than 20.1 times when inflation is between 0% and 4%.

See the historical data for yourself below...

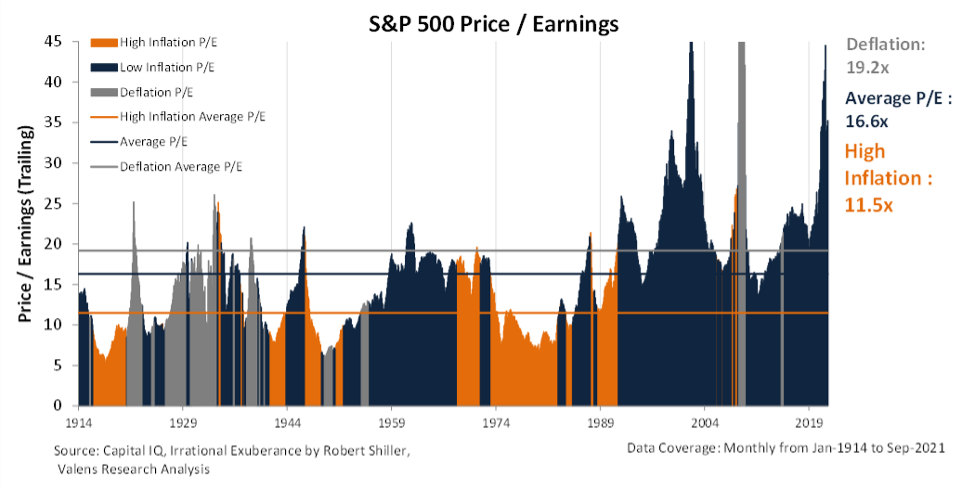

For a more tangible representation of how low P/E levels can impact your portfolio, take a look at the chart below. The orange represents times with high inflation over the past 100 years, when market valuations were pushed lower.

With Powell's recent signals, we can have confidence that we're not about to enter either an inflationary spiral or stagflation in the near term... That would lead to lower market valuations and slower earnings growth.

When current price pressures abate, the healthy credit environment and strength of corporate profitability in the U.S. can continue to support market valuations at the higher end of historical averages.

As we keep telling readers, given the current inflation dynamics, investors should allow the market noise to clear and continue to take advantage of opportunities to buy the dip.

And of course, if anything changes to upend the current economic environment, we'll alert Altimetry Daily Authority readers immediately.

Until then, we recommend taking advantage of attractive buying opportunities in stocks like the one we recently found in our Microcap Confidential newsletter...

Until then, we recommend taking advantage of attractive buying opportunities in stocks like the one we recently found in our Microcap Confidential newsletter...

It's a tiny company poised to disrupt the entire $200 billion cybersecurity industry. While we've seen massive returns in cybersecurity companies like Fortinet (FTNT), Okta (OKTA), Palo Alto Networks (PANW), and CrowdStrike (CRWD) in recent years, the company I'm pounding the table on hasn't joined the multibagger party... yet.

But for reasons I explain in a brand-new presentation, this tiny company is set to take off and could soar as much as 380% by December 31. Learn everything you need to know right here.

Regards,

Joel Litman

October 25, 2021

The quest to untangle 'Fedspeak' continues...

The quest to untangle 'Fedspeak' continues...