When we first launched the Microcap Confidential newsletter 15 months ago, we marked four crucially important annual timeframes on our calendars...

When we first launched the Microcap Confidential newsletter 15 months ago, we marked four crucially important annual timeframes on our calendars...

No matter when the tiny companies we identified with massive upside reported their earnings – we knew these microcaps would be a big deal.

The reason is simple: The Russell 2000 rebalances in late June each year, and the S&P 600 SmallCap Index rebalances quarterly – just before the calendar quarters turn.

These days, when investing in microcaps, they should be marked for appointment viewing because they can send small stocks soaring higher.

Before a company joins one of these indexes, these microcap names have yet to appear on most institutional investors' radars.

They're usually too small, illiquid, and lack the public coverage that major funds look for when picking stocks. Some institutional investors may even think if a stock doesn't have an index's blessing, there isn't a need to pay attention to it.

But once microcap stocks break into an index, institutional investors investing in small-caps have to own them because they track small-cap indices.

Other mutual funds, hedge funds, and institutional investors are also paying attention. Many are restricted from owning stocks not included in major indexes, such as the Russell 2000 or the small-cap S&P products.

Once a company is added to an index, massive cash-endowed investors look to get an early jump with that stock...

Once a company is added to an index, massive cash-endowed investors look to get an early jump with that stock...

A similar lift occurs when a company leaps from the S&P 600 to the S&P MidCap 400 Index... And it certainly occurs when a company is added to the flagship large-cap S&P 500 Index.

We've also observed pops occurring when companies jump from the Russell 2000, which tracks the 2,000 smaller companies of the Russell 3000 Index, to the Russell 1000, which tracks the largest 1,000 remaining stocks. That pop, however, is less significant than crossing over into the big leagues.

Still, for microcaps, these events are akin to a previously unknown actor making it to the big screen for the first time and then being flooded with high-paying contracts by major studios afterward. So these pops for a microcap stock can mean a massive boost.

The flip side can also be true. Suppose a microcap stock joins an index and is put under a collective institutional investor and journalist microscope only to be discovered as a subpar firm. In that case, the stock price could sink like a stone in the ocean.

It's something we're always thinking about when analyzing our microcap ideas. After all, the companies we choose are inherently high-quality and underappreciated, so we tend to observe that these catalyst events can be very lucrative. We've seen our picks rocket higher as the market discovers their phenomenal growth opportunities.

A great example happened just over a month ago...

A great example happened just over a month ago...

When we launched Altimeter's Microcap Confidential over a year ago, one of our favorite ideas was BioLife Solutions (BLFS).

This tiny company makes the equipment and products needed for the safe transportation of biologics.

Many of these reagents, drugs, and other biomaterials need to be kept in ultracold temperatures to remain stable before they can be used for treatment. This is simple enough when the biologics stay put. But it becomes a logistical nightmare when these materials need to be transported.

The company's technology is so clever and robust that big competitors like Baxter (BAX) and Becton, Dickinson (BDX), which also sought to solve the transportation problem, have largely bailed out. BioLife is perceived as being so far ahead of the game that its dollars were better spent on other initiatives.

This industry was already poised to take off pre-pandemic due to the surging innovation around CAR-T-cell therapies for cancer and other forms of custom biological innovations.

But then, the ultimate catalyst occurred...

But then, the ultimate catalyst occurred...

Conveniently for BioLife, some of the COVID-19 vaccines need exactly this type of cold storage transportation. Unsurprisingly, the company's profitability took off.

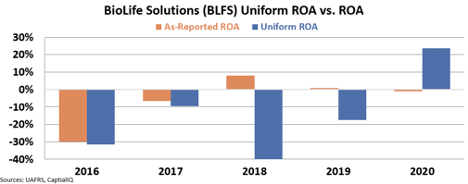

As we frequently point out with the companies we highlight, if you were looking at BioLife's as-reported metrics, you'd be totally in the dark about the true picture. Using Uniform Accounting data, we could see that in 2020 the company's profitability was forecast to be massively profitable, contrary to what as-reported metrics reflect.

Take a look at the difference between as-reported and Uniform return on assets ("ROA"):

After a tumultuous startup period, the company achieved a respectable level of profitability in 2020, with a 24% Uniform ROA. But on an as-reported basis, it was still in the red.

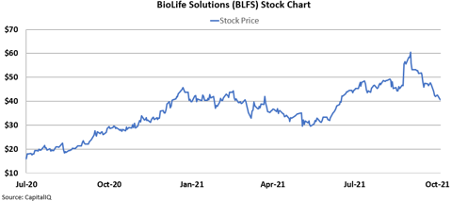

The stock easily doubled from our original recommendation at nearly $18 in July to more than $40 by December... And then the stock was down or sideways for eight months until August.

In late August, the stock leapfrogged from around $45 to $60, a 33% jump.

It wasn't because the company had announced a flashy new customer or reported blowout earnings. It was because the S&P SmallCap 600 had announced off-cycle that it was adding BLFS to the index, and it now appeared on big-money radars.

As the move wasn't fundamentals-driven, the stock has given those gains back. But that massive spike is the exact kind of move that can happen when a tiny company breaks onto an index.

Currently, we're up 115% on BLFS, and while we still think the company has compelling fundamentals, we are well above our buy-up-to price.

Another name in the Microcap Confidential portfolio is a screaming buy today...

Another name in the Microcap Confidential portfolio is a screaming buy today...

At Altimetry, our repeatable process, Uniform Accounting insights, and deep fundamental research has led us to select several microcaps that are primed to take off... And we even found one tiny tech company that could soar as much as 380% by the end of the year.

Airbnb (ABNB), Mastercard (MA), Morgan Stanley (MS), Experian (EXPN), PayPal (PYPL), and dozens of other major companies use this little-known cybersecurity company's services. And yet, this company receives virtually zero Wall Street coverage... which is a huge opportunity for investors who buy today.

I just put the finishing touches on a brand-new video presentation where I detail this company in full. You can watch it right here.

Regards,

Joel Litman

October 12, 2021

When we first launched the Microcap Confidential newsletter 15 months ago, we marked four crucially important annual timeframes on our calendars...

When we first launched the Microcap Confidential newsletter 15 months ago, we marked four crucially important annual timeframes on our calendars...