It's a bloodbath for Meta, and it's not just thanks to the metaverse...

It's a bloodbath for Meta, and it's not just thanks to the metaverse...

Last week could not have been fun for Mark Zuckerberg and his C-suite as they conducted their first-ever earnings call under the name Meta Platforms (FB). After reporting, the social media giant saw around $210 billion of its market cap obliterated and shares fell a whopping 25%.

Investors have now begun picking through the pieces and trying to figure out what went wrong. While many are looking at how Meta has currently spent $10 billion on the metaverse with little to show for it, the real cause of this collapse is much deeper.

Thanks to weakness in its core social media business, Meta was slammed by investors, with little to do with the metaverse.

Facebook users have stagnated for the first time, with daily active users ("DAUs") dropping in the U.S. and Canada. This is partly thanks to competition from the social media platform TikTok, which Zuckerberg admitted is winning in the short-form video posting world.

Furthermore, the company has taken a huge hit in its advertising business, which makes up more than 99% of its revenue. Thanks to Apple's (AAPL) new opt-out privacy settings on its devices, users can turn off Facebook's tracking. This tracking allows Facebook to tailor its ads to specific users and directly cost more than $10 billion in lost revenue.

To understand where the wheel fell off, we can turn to Uniform Accounting and why we had been recommending investors buy Meta for eight years... up until October 2021.

Until recently, we urged our subscribers to buy Meta...

Until recently, we urged our subscribers to buy Meta...

In 2013, we urged our institutional clients to buy shares of Meta, as the market was missing how profitable Facebook's advertising engine was. That's why we launched our investor product Hidden Alpha covering large-cap companies, and it was among the first names we recommended there as well.

We let Meta run 76% in its first 18 months in Hidden Alpha before recommending readers sell half as regulatory scrutiny seemed to be picking up for big tech. As it turns out, when we suggested readers sell half, Meta's stock was within 10% of its all-time high and more than 34% higher than it is today.

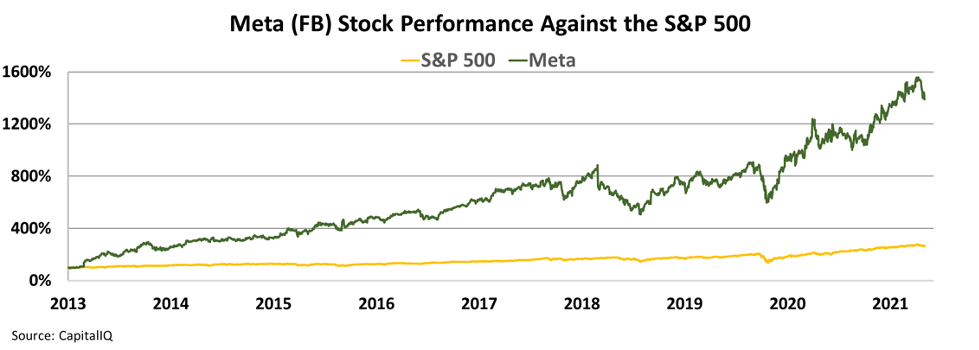

From May 2013 until October 2021, when we told our readers to sell completely, the stock rose 1,380%, well above the returns of the S&P 500 Index over the same period.

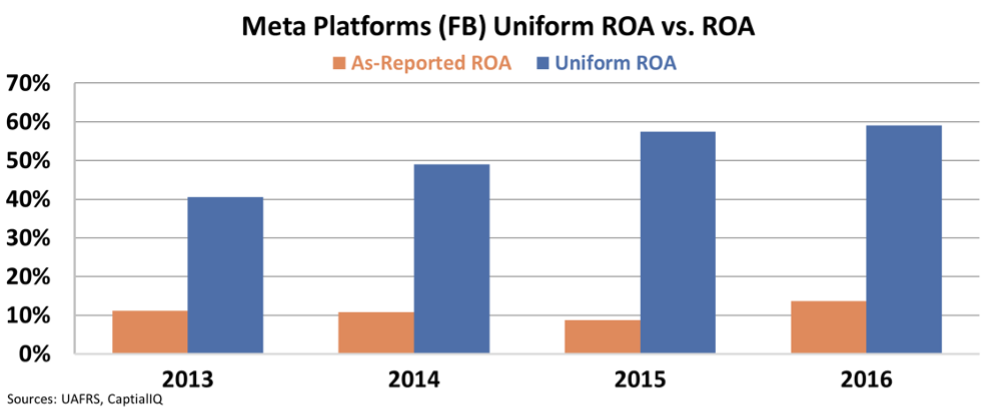

We were able to spot the magnitude of this opportunity thanks to Uniform Accounting. While GAAP metrics made Meta look like a company with flat, average returns after its rocky initial public offering ("IPO"), Meta was able to improve its already sizable returns consistently.

Furthermore, as the market kept revising its expectations in surprise, Meta was already blowing past these expectations to set new returns. This consistently drove the stock price higher, which is why we maintained it on our buy list for so long.

However, in the past year, expectations for Meta were finally catching up with its stellar performance... just as the engine was slowing down.

In our report to our Hidden Alpha readers in October, we urged everyone to sell the rest of their positions... for exactly the reasons that caused the stock to fall last week. Here's what we said...

The bad news keeps on piling up for social media titan Facebook (Nasdaq: FB), and in ways that concern us about its ability to maintain growth in its dominant platforms. At this point, we're recommending readers close out their Facebook positions completely.

Over the past month, the company highlighted how Apple's iOS updates have negatively impacted customers' ability to spend on targeted ads on Facebook and its other platforms.

The market was not only behind on the story of Meta improving its business, but it was behind on how that business would be eroded.

Thanks to our access to the real performance of Meta, we knew when to walk away...

Thanks to our meticulous research, we know there are far better places to put your money than in Meta...

Thanks to our meticulous research, we know there are far better places to put your money than in Meta...

We recently did a back test of 75 tech companies at Altimetry to see if a certain theme delivered results. And we found that a certain niche is quietly delivering 87% gains per year... enough to turn $10,000 into more than $122,000 in just five years.

In our testing, we discovered a little-known company off Wall Street's radar... one we expect to take off as soon as tomorrow.

Joel explains everything you need to know about this incredible opportunity in his time-sensitive video presentation.

Watch it right here.

Regards,

Rob Spivey

February 8, 2022

It's a bloodbath for Meta, and it's not just thanks to the metaverse...

It's a bloodbath for Meta, and it's not just thanks to the metaverse...