Being there for all of Starbucks' (SBUX) major moments...

Being there for all of Starbucks' (SBUX) major moments...

The entrepreneurial coffee legend has been a consistent figure at Starbucks throughout its history. Schultz has been there for Starbucks' big moments, from shifting the first store location to an espresso bar in the 1980s to building its success as a massive coffee empire.

While he is the person we most associate with Starbucks, he has been more of a rotating presence since his initial days with the company. He ran the company until 2000 but then stepped back from the day-to-day operations by becoming the chairman.

When the company struggled to execute as it rolled out food and consumer package goods ("CPG") solutions, he rode back to save them in 2008.

He was critical in closing underperforming stores and installing his former leadership team. Furthermore, he pushed for a return to the "Starbucks experience," which had become commoditized with flavor-locked bags for coffee rather than freshly ground and brewed offerings.

Schultz was at the helm through technological changes, loyalty programs, and the rise of mobile payments in the last decade.

Once Starbucks was back on stable footing, he stepped back to become chairman, allowing a new CEO to step in. He then fully stepped down in 2018 from all leadership roles at the company.

What is the reason for his return?

What is the reason for his return?

Even as Starbucks has executed well in the pandemic, recent events have seen him step back into the picture.

Growing pressure for the unionization of its workers, as they complain about more challenging conditions, has paved the way for his return.

In the past, Schultz has been known as an outspoken leader on many social issues. He has backed up his thoughts at Starbucks with generous health care, college tuition, and stock plan options for all employees.

Starbucks was the first U.S. company to offer comprehensive health care coverage and equity in stock to all its part-time staff.

With his prior actions and statements in mind, no one would be faulted for assuming his return would be heralded as a triumph for employees.

However, based on his current actions, his return appears to impede the company from becoming more union-friendly.

How would unionization impact the business?

How would unionization impact the business?

His return may be heralded by a desire to protect his investment. This is because he knows that Starbucks' valuations would change dramatically if unionization were to occur.

Schultz owned around $2.3 billion in stock as recently as 2018 and may own more today. We can't confirm his holdings as he hasn't needed to disclose his ownership since he stepped down, as he owns less than 5% of the company and hasn't been on the board as an insider.

Unionization could lead to higher wages and, therefore, lower profitability. Unlike some of its competitors, roughly half of Starbucks locations are directly owned by the company instead of being franchised.

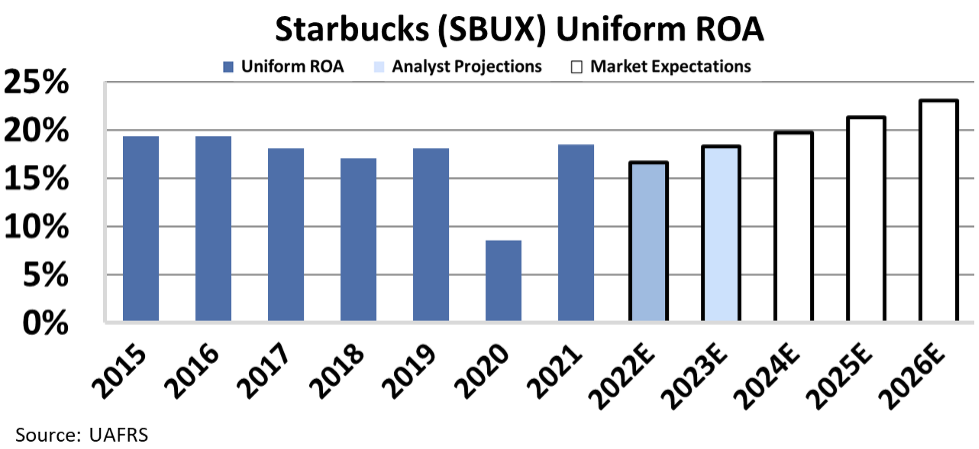

In the chart below, the dark blue bars represent historical returns, and meanwhile, the light blue bars are Wall Street analysts' expectations for the next two years. Finally, the white bars are the market's expectations for how Starbucks' return on assets ("ROA") will shift over the next five years.

While the company has had an impressive and steady 17% to 19% ROA since 2015, excluding the coronavirus pandemic year of 2020, the market is pricing Starbucks to see returns rise even higher, up to 23% going forward.

If labor costs go up, Uniform ROA is likely to go down, not up. This means market expectations would shift aggressively, sending the stock price plummeting.

If ROA were normalized at 15% levels, the stock could lose upward of 45% of its current market valuation.

With that in mind, Schultz might have very specific reasons for rushing back into the fire.

Regards,

Joel Litman

March 29, 2022

Being there for all of Starbucks' (SBUX) major moments...

Being there for all of Starbucks' (SBUX) major moments...