People are flying again in the U.S...

People are flying again in the U.S...

Anyone flying over the Thanksgiving holiday probably noticed something rare since the onset of the coronavirus pandemic: crowded airports.

During the early part of the pandemic in the U.S., the daily number of travelers screened by the Transportation Security Administration ("TSA") plummeted.

Security lines full of anxious passengers have been slowly inching back ever since – although with fits and starts.

TSA announced last week that 21 million travelers went through security over a 10-day period surrounding the Thanksgiving holiday. That's close to levels last seen in 2019.

TSA expects the travel trend to become stronger this holiday season now that volumes are flirting with pre-pandemic levels.

While scares around the omicron variant of the coronavirus might create some turbulence over the next few weeks, domestic travel and bookings remain strong, heading into the heart of the holidays.

Travelers are looking at alternatives to hotels...

Travelers are looking at alternatives to hotels...

Commercial airlines are ecstatic to see domestic travel trends pick up. However, this return in travel may not be enough to bring hotel demand back to pre-pandemic levels.

Consumers now think about hospitality differently.

Many more travelers are now open to a hotel alternative, which may be cheaper – such as rented homes.

Airbnb (ABNB), which provides a digital marketplace that connects hosts and vacationers, is the leader in this space.

Now a household name, the company has been around for more than a decade.

My wife and I have been using the platform since 2015, and there are many places we've traveled where we would have had a different experience had we stayed at a hotel.

Unlike a hotel, Airbnb's services allowed us to stay right near the heart of the place we wanted to be immersed in...

Millions of other users feel the same way... as the company saw nearly 80 million nights and experiences booked in its third quarter alone.

Given this booming demand, you might think Airbnb is raking in the profits.

A quick glance at The Altimeter – which shows users easily digestible grades to rank stocks on their real financials – suggests you'd be right.

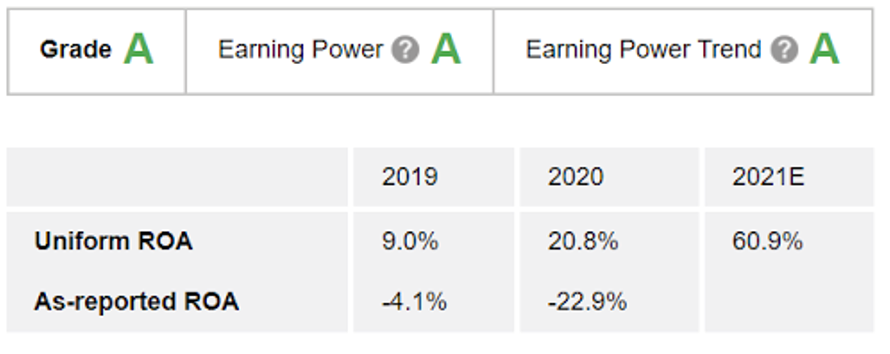

Despite as-reported metrics showing negative profitability, Uniform Accounting underscores the reality that Airbnb is a great business generating enviable returns for investors.

The Altimeter shows how the company generated a strong Uniform return on assets ("ROA") of 21% last year and is forecast to expand to more than 60% this year.

These results earn Airbnb an "A" grade for overall performance, driven by robust profitability and fundamental momentum.

The Altimeter data highlights how this hotel disruptor uses the current circumstances to its advantage and is poised for continued success.

Hunting for the next Airbnb...

Hunting for the next Airbnb...

Airbnb's successful strategy has meant tremendous wealth creation for its earliest investors.

Venture capital ("VC") funds like Greylock and General Catalyst had made 50 times and 100 times returns on their investments by building positions when the company was valued at $2.3 billion and $882 million, respectively.

Meanwhile, public investors who bought the stock after its initial public offering ("IPO") have only seen returns of around 25%.

That's because Airbnb waited to go public until it was already a megacap name. On its first trading day in December 2020, ABNB was valued at $85 billion.

While a 25% return in less than a year is impressive, it's not the sort of transformative type of return we're hunting for...

Here at Altimetry, we want to see the kind of return one would have gotten by investing in Nvidia (NVDA) when it was valued at around $230 million in January 1999.

Today, the semiconductor company is worth $716 billion, and public investors have realized substantial gains. If you had invested in Nvidia when it went first went public at $12 per share in 1999, your return on investment would be a whopping 75,104%. Nvidia has issued five stock splits since its initial public offering ("IPO"), including a 4-to-1 stock split last July, to keep its stock affordable.

For retail investors who bought Airbnb's stock on the first day it traded publicly to see substantial gains, the market would need to value the company at nearly $300 trillion...

The unfeasibility of massive returns from megacap names is why we spend so much time hunting for microcaps, public companies worth less than $1 billion.

We are looking for names like Nvidia that can turn 100 shares for $1,200 into more than a million dollars...

We're holding a special event on microcaps...

We're holding a special event on microcaps...

Tonight at 8:00 p.m. Eastern time, Joel Litman and I are holding an investment summit on our stock market outlook for 2022.

At the investment webinar, we'll let you in on every single one of our current favorite microcap stocks and tell you about our stock market insights for the new year.

Make sure to join us for this exclusive event tonight! You can register for it right here.

Regards,

Rob Spivey

December 16, 2021