Real estate investors can breathe a sigh of relief... for now.

Real estate investors can breathe a sigh of relief... for now.

The University of California ("UC") system announced earlier this month that it's putting $4 billion into the Blackstone Real Estate Income Trust ("BREIT").

Regular readers recall that we discussed BREIT just last month. The fund, which is owned by investment-management company Blackstone (BX), lets high-net-worth individuals buy into commercial real estate.

BREIT has been under pressure lately. It limited investors to withdrawing 5% of their holdings per quarter at the start of December. That's a sign that liquidity could become an issue soon.

The UC system's investment will provide the fund with that much-needed liquidity. And it acts as a show of faith to stymie investor worry.

It should offset some of the fund's losses from increasingly large redemption waves.

All the same, even with outside help, BREIT could be a bellwether for a deep shock to the real estate market.

Today, I'll explain why the fund could be an even bigger indicator than we thought... and what it means for you as an investor.

Residential real estate isn't as recession-proof as people think...

Residential real estate isn't as recession-proof as people think...

Most folks agree that office real estate is in trouble. Occupancy rates never recovered fully from the pandemic. And companies are getting comfortable with flexible work setups.

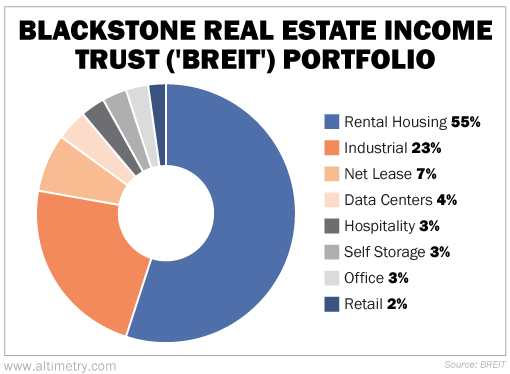

BREIT has barely any exposure to office real estate. Its portfolio is just 3% office real estate and 2% retail. The majority (55%) comes from multifamily rental housing.

Take a look...

It's good that BREIT isn't so exposed to office real estate. And yet, it's still facing a big sell-off.

In December, we chalked this up to a mix of rising interest rates and bad game theory. We said rising interest rates could scare people out of real estate altogether.

Plus, investors have a bad habit of selling their winners.

BREIT is full of the "winners" of the real estate market. It's largely multifamily homes, which have more stable demand.

Office real estate investment trusts ("REITs") have had serious difficulty with tenants thanks to the pandemic. Multifamily homes have fared much better. Residential real estate returned 58% in 2021 (the most recent data available).

However, the tide could finally be turning. Interest rates are way up. They're high enough that private-equity firms might not be able to buy up real estate indefinitely.

Private equity has been the biggest buyer of homes since the Great Recession. These investors bought 24% of all single-family houses sold nationwide in 2021... up from between 15% and 16% annually going back to 2012, according to CoreLogic.

This year, rents might actually fall for the first time in years. A looming recession could put pressure on how much folks can pay. And multifamily-home inventory is coming online in droves.

That's a horrible combination for private-equity real estate investors...

That's a horrible combination for private-equity real estate investors...

Their cash flows could start slowing down just as refinancing gets more expensive.

The primary rationale behind these purchases is that rents always rise. This familiar reasoning was on full display in a slightly different form before the 2008 financial crisis hit... when people suggested that housing prices would never fall.

We all know how that turned out. The average home price dropped 13% during the Great Recession.

If rents do start to drop soon, it could set off a huge reversal. Some of these private real estate funds may need to liquidate portions of their portfolios to generate liquidity.

The last time the housing market collapsed, private equity stepped in as the buyer. It remains to be seen who could fill that role this time around.

In fact, private equity could be the biggest seller.

That could cause a cascade effect. It could get much worse for residential REITs, homebuilders, and other parts of the housing market.

Banks would fare better under stricter post-Great Recession controls. Meanwhile, real estate assets could fall dramatically in value.

If you have exposure to the real estate sector, don't rest easy. Keep an eye out for any news about private-equity firms becoming real estate sellers.

If that happens, you might want to take a hard look at your portfolio. This sector could turn sour fast.

Regards,

Joel Litman

January 26, 2023

Real estate investors can breathe a sigh of relief... for now.

Real estate investors can breathe a sigh of relief... for now.