Credit is typically a sleepy place...

Credit is typically a sleepy place...

Unlike the stock market, credit markets don't typically see a lot of dramatic shifts.

Changes tend to occur slowly and over extended periods. To add to the lack of excitement, most equity investors mistakenly think changes in the credit market don't impact them.

But we can see that the U.S. credit markets have significantly changed over the past 40 years by taking a long-term view.

For some context, credit ratings are graded on a letter system. The nomenclature for the safest credits for Standard & Poor's (S&P) and Fitch Ratings are rated AAA, and Moody's uses Aaa to indicate the same ranking.

These credits are considered the gold standard, as rating agencies think they have a slim 0.09% chance of defaulting over the next five years.

Therefore, this rating implies that less than one in every 1,000 names with this rating should default in the next five years.

How trustworthy are these ratings?

How trustworthy are these ratings?

When it comes to using these ratings in practice, most people don't even give them much credence. Often, people don't even know the credit ratings of the companies they are investing in.

Rather, they probably think about the mortgage-backed securities fiasco of the Great Recession. During this crisis, these so-called AAA securities defaulted at rates much higher than one in every 1,000.

Although credit-rating agencies dropped the ball on mortgage-backed securities, these firms tend to have a higher batting average with corporate credit ratings, as this is where they spend most of their time.

This higher visibility is why the trend in AAA companies over the past 40 years is so telling.

It tells us that corporate credit has steadily become riskier over the past four decades.

In 1980, 60 companies boasted AAA ratings.

By 2011, after this pool of companies suffered business issues, leveraged buyouts, and just increased comfort with higher leverage with lower interest rates, only four AAA companies remained: ADP (ADP), Johnson & Johnson (JNJ), Microsoft (MSFT), and Exxon Mobil (XOM).

By 2016, this number dropped further to just Microsoft and Johnson & Johnson. Exxon Mobil overinvested and overleveraged during the shale boom, and ADP took on increased leverage.

If trends in leverage keep up, like Johnson & Johnson ballooning its debt from $18 billion in 2016 to $33 billion in 2021, the list of AAA ratings could continue to drop.

With the rate of AAA companies being downgraded, it looked as though we were on pace for zero AAA names...

Signs of an improving credit trend?

Signs of an improving credit trend?

Yet, as investors began to worry about these trends, a glimmer of hope appeared.

Late last year, the news came in that Apple (AAPL) has an improved credit rating.

Even with its mountainous debt load of $125 billion, it has sufficient cash flows and cash on hand, enough so that Moody's upgraded Apple to Aaa.

S&P still has them at an AA+. But with the company's healthy cash flows, liquidity, and large size, it is likely just a matter of time before it is upgraded as well.

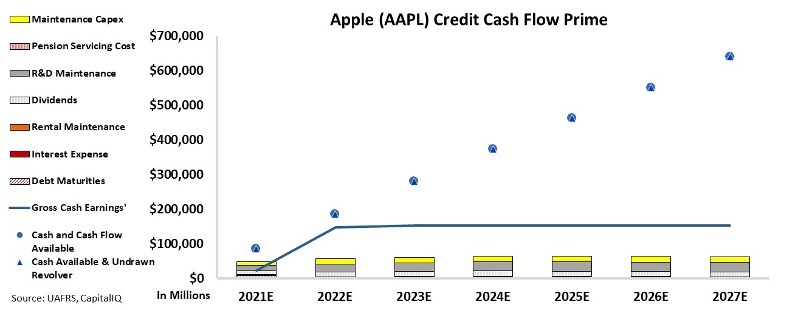

To better understand why Apple is rated so well, we can look at our Credit Cash Flow Prime ("CCFP"). In the below chart, the stacked bars represent the firm's obligations each year for the next five years. These obligations are then compared with the firm's cash flow (blue line), as well as the cash on hand at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

Apple has a huge amount of cash on its balance sheet, which is enough to cover all its obligations every year over the next seven years.

Furthermore, it has cash flows that are approximately double its obligations each year.

This strong financial position is also why we give it an IG1 rating, equivalent to an AAA rating.

It isn't a rating we take lightly, by the way, as we don't bestow the other two S&P companies with an AAA rating.

We have, however, found a handful of other companies globally that have earned this rating.

With rates finally starting to widen to levels that might eventually make bonds compelling again, we are thinking about launching a bond newsletter.

If you're interested in a bond market product, please share your thoughts with us right here.

Regards,

Joel Litman

February 23, 2022

Credit is typically a sleepy place...

Credit is typically a sleepy place...