Peloton's days of glory appear to be over...

Peloton's days of glory appear to be over...

Peloton Interactive (PTON) was the next big thing at the start of the pandemic. Its virtual classes provided a sense of community as everyone was stuck inside, and it made a killing off customers willing to drop $2,000 on a bike and exercise routine.

But for the past year, Peloton has been in free fall. Its stock has dropped from more than $150 per share in January 2021 to slightly more than $30 today.

Investors grew pessimistic about Peloton's ability to attract new subscribers and retain current ones. Also concerning were the increasing competitive pressures from legacy bike competitors and new workouts of the scene, like rowers, mirrors, treadmills, and ellipticals. Safety concerns regarding Peloton's Tread+ treadmill didn't help its sentiment either.

But last Monday, that free fall changed, at least momentarily.

Rumors came out that Amazon (AMZN), Nike (NKE), and other big names might be targeting the firm as a potential acquisition target. As a result, Peloton's stock jumped 20%.

Peloton had some wild growth, but things are slowing down...

Peloton had some wild growth, but things are slowing down...

As Peloton is now at a $10 billion market cap, it is much more digestible for larger firms looking to grow their fitness portfolio to consider purchasing it now than when it was at $50 billion roughly a year ago.

But being cheaper isn't enough to make a company an attractive acquisition candidate. We also need to understand what the market is pricing Peloton to do now that it's sitting at around $10 billion in market cap.

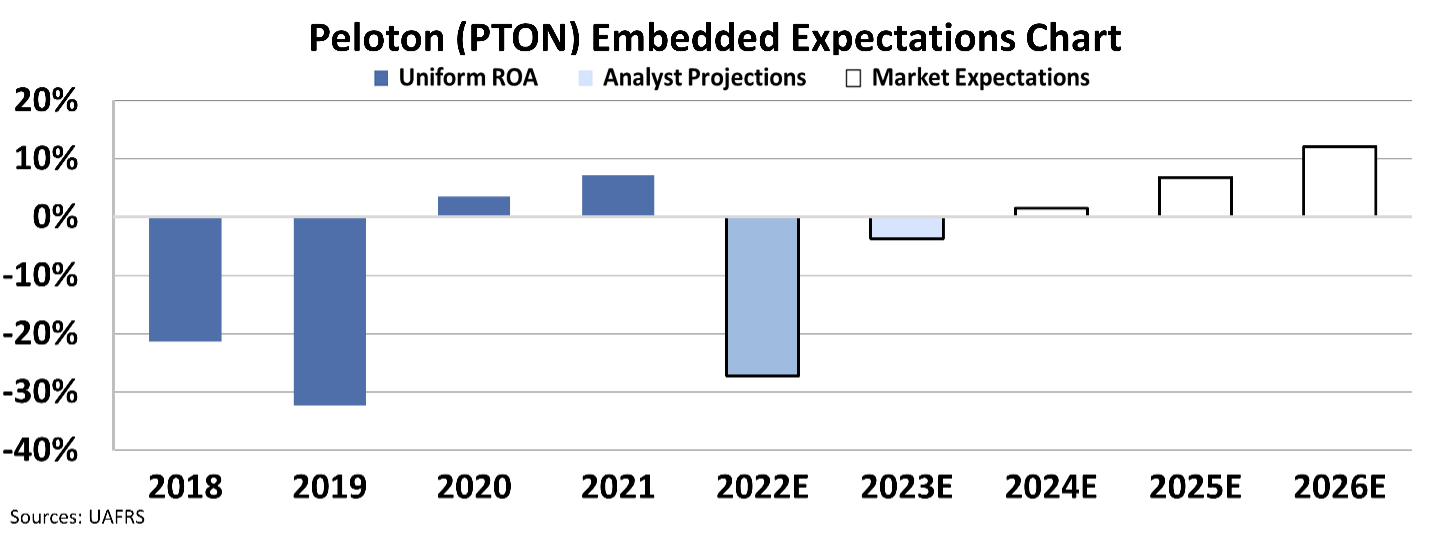

By utilizing our Embedded Expectations Analysis ("EEA") framework, we can see what investors expect these companies to do at the current stock price.

Stock valuations are typically determined using a discounted cash flow ("DCF") model, which makes assumptions about the future and produces the "intrinsic value" of the stock.

Here at Altimetry, we know models with garbage-in assumptions based on distorted GAAP metrics only come out as garbage. Therefore, we use the current stock price with our Embedded Expectations Analysis to determine what returns the market expects.

So, the answer to what the market expects will happen is... not much.

For the past three years, Peloton has grown its assets rapidly, with more than 100% growth in two of the last three years.

This year shows signs of slowing down, with assets forecast to grow by only 32%. Topline growth is expected to fall to just 15%.

If we assume this is what the market is pricing in, we can also see how high returns would need to get to justify current valuations.

To justify current valuations, Peloton would only need to see its returns on assets ("ROA") to get to 12%. But 2022 ROA is supposed to be negative 27%. Last year, at the height of the brand's popularity, its returns reached 7%.

Will Amazon or Nike step up and make the purchase?

Will Amazon or Nike step up and make the purchase?

It might be a bad year for Peloton, primarily because it overinvested in excessive growth during the pandemic. But it's not unreasonable for profitability to return as it works through that overinvestment.

For context, Peloton's competitor Nautilus (NLS), a workout equipment company, has had a Uniform ROA above those 12% levels in seven of the past eight years.

So maybe it wouldn't be such a bad idea for Amazon or Nike to scoop up Peloton (its brand and subscribers) while it's "cheap." Amazon could address Peloton's struggling supply chain and bundle subscriptions with Amazon Prime. Or Nike could use its dominance in activewear to complement Peloton's products.

These companies can build off what Peloton already started as the first Software as a Service ("SaaS") fitness company to create more monetization opportunities. Thanks to Uniform Accounting here at Altimetry, we can quickly see exactly how a stock price translates to future performance...

The SaaS companies that represent a real opportunity...

The SaaS companies that represent a real opportunity...

Instead of gambling on risky stocks like Peloton, we at Altimetry focus on high-quality businesses that the market hasn't noticed...

We recently put together a presentation on one of those opportunities... a little-known SaaS company whose stock could easily rise 10x from today's levels.

You can watch it here.

Regards,

Joel Litman

February 15, 2022

Peloton's days of glory appear to be over...

Peloton's days of glory appear to be over...