One of the hottest investment themes of the past five years is to be 'better'...

One of the hottest investment themes of the past five years is to be 'better'...

Environmental, social, and governance ("ESG") investing has become a massive force in the investment industry in recent years.

This investment philosophy involves choosing companies that don't focus solely on profits, but also on all the different ways a business affects the world around it.

These companies seek to reward employees, protect the environment, and innovate to improve the world for future generations.

They generally try to positively contribute to social issues. For example, ESG companies tend to avoid addicting products such as tobacco or gambling.

ESG-focused companies also try to create strong alignment between management, employees, and the board of directors with long-term wealth creation.

Even though these companies aren't only focused on the bottom line, there's a good reason why even investors should pay attention to this trend.

Companies that deeply exemplify ESG initiatives tend to generate more sustainable returns. They're less likely to see their businesses disrupted due to unhappy workers or environmental issues.

The idea is one that resonates with us here at Altimetry. When I wrote the business strategy book Driven (the paperback version is available on Amazon) with my co-author Dr. Mark Frigo, the "top of the pyramid" of our Return Driven Strategy framework was: "Ethically Maximize Wealth."

The idea wasn't that being ethical will magically make you rich. It's that if you are unethical, you can't generate wealth in any lasting way. Even if you do everything else right in your business, things will eventually catch up to you.

In the same way, ESG initiatives don't let companies generate higher returns. They make sure companies don't do things to disrupt their long-term profitability.

As more investors start to prioritize ESG, the poor quality of ESG data is coming into focus...

As more investors start to prioritize ESG, the poor quality of ESG data is coming into focus...

As Bloomberg highlighted in a 2019 survey from asset management firm Natixis Investment Managers, roughly 19% of institutions and 18% of funds and asset allocators prioritized ESG integration in their investment approach.

Since then, these numbers have skyrocketed. The same ratios in the survey were 48% and 54% in 2021, respectively.

However, the same Bloomberg article highlighted the fact that ESG grading is anything but uniform.

Many different vendors that offer ESG ratings – like FTSE, Sustainalytics, and MSCI – have a low correlation between their rankings on any given metric (such as governance) and the ESG grading from other vendors.

That means that if you get an "A" from one vendor on good corporate governance, you could just as easily get an "F" from another vendor.

When no concrete arbiter exists, it's impossible to understand how valuable ESG investing really is.

There is still a great deal of grey area behind many of these rankings and their actual effect on company performance. While it's a popular theme, many in the industry still view the data behind it with skepticism.

Even though the data isn't perfect, it isn't stopping companies from making a lot of money off of it...

Even though the data isn't perfect, it isn't stopping companies from making a lot of money off of it...

MSCI (MSCI) is a prime example of this.

The company is one of the leading index creators as well as market data and analytics companies in the world. Additionally, it's one of the three leaders in the ESG grading realm.

You might think that would have allowed the company to make a lot of money over the years.

However, people who look at the as-reported metrics of MSCI would see the opposite.

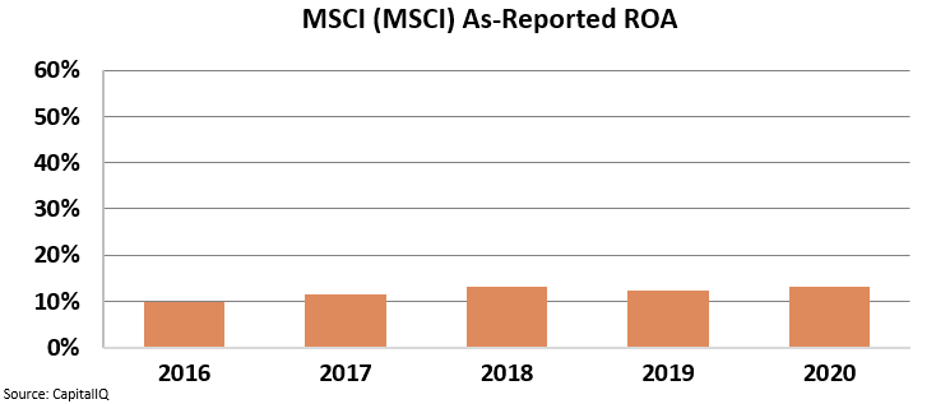

On an as-reported basis, the company's return-on-asset ("ROA") levels have sat around 10% since 2016.

These are modest returns at best for a company that it is supplying the fuel for the growth of new investment strategies.

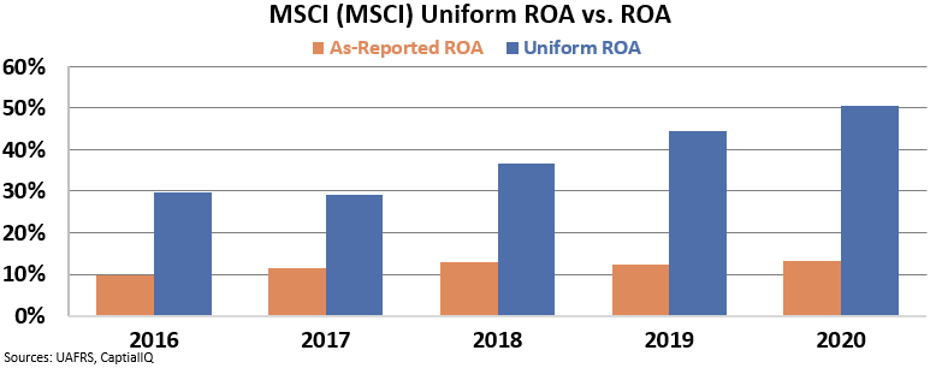

In reality, this is not an accurate picture of MSCI's true profitability. Just like how you can't trust all ESG ratings, you can't get the real story from as-reported accounting.

The company actually generates robust returns that are well above the U.S. corporate average of 12%.

Specifically, the company's ROA trend has been strongly positive, rising from 30% levels in 2016 to 51% levels in 2020.

As investors become more focused on data, demand for MSCI's ESG offerings, index creation, and other datasets are booming... And MSCI is minting money.

Regards,

Joel Litman

May 18, 2021

P.S. ESG investing is a big area of focus for our institutional investors, so we're investing a significant amount of effort to create a better way to do ESG analysis. We want to know if you're interested in a paid ESG newsletter at Altimetry. Let us know what you think at [email protected].

One of the hottest investment themes of the past five years is to be 'better'...

One of the hottest investment themes of the past five years is to be 'better'...