Management teams know their businesses better than anyone...

Management teams know their businesses better than anyone...

This is why one tool in every smart investor's "tool kit" is checking whether executives are trading their companies' stock. With their innate knowledge of operations, management's trading patterns can be insightful.

Late last month, Bloomberg examined stock activity by management. Executives of companies in the S&P 500 Index have recently been unloading shares at a rapid pace over the past month.

Led by Microsoft (MSFT) and Corning (GLW), insiders sold nearly $1 billion worth of shares in one week. Furthermore, the number has been trending higher over the past month.

This is a marked change from the beginning of the coronavirus pandemic. In mid-March, insider buying hit a nine-year high as stock prices were crashing. While investors everywhere were worried about the pandemic, executives who understood their companies' performance and knew the world wasn't ending voted with their wallets. They used the opportunity to buy more of their companies' stock at cheap valuations.

Now that the S&P 500 is up 50% from its trough, those executives appear to be locking in their profits.

Insider buying and selling is an important data point to follow, and it allows us to understand management sentiment better. However, while Bloomberg may be sounding the alarm, this one metric shouldn't be used by itself...

All data points are important...

All data points are important...

However, as we discussed in the September 28 Altimetry Daily Authority, it's important to look at various indicators as a mosaic. While looking at one data point has the ability to provide insights into the macroeconomic picture, an investor can't be confident until multiple metrics reaffirm the same theory.

A great example of this in action is management intent.

Investors love looking at insider buying and selling. The recent spike in selling could be concerning... But this is just a single metric, so we have to look at it in context.

It's true that insider selling is elevated. However, this may be due to the stock market appreciation in recent months. Executives tend to subscribe more to value investing than growth investing.

When prices dip and they don't have reason to be concerned about their business operations, they buy. As stock prices rise in a short period of time, valuations rise as well... so some management teams may sell.

Since valuations don't look as attractive as they did six months ago, management members may be deciding to unload shares.

However, just because management teams are selling shares doesn't mean they think their company's stock is overvalued or about to collapse.

There are countless reasons why management teams sell stock... and a primary one is for liquidity.

Some executives may be interested in buying a new house – following the trends of the "At-Home Revolution" to move out of the city. Others may need to put their kids through college now that the academic season has started again... or perhaps they want to diversify out of their company's stock.

Another reason is uncertainty in the short term. With the election looming and unresolved questions regarding the pandemic and a stimulus package, executives may just be concerned about the following months.

And that all assumes the data from Bloomberg are correct...

In reality, even if insider selling rises, then selling alone isn't a concern if other insiders are also actively buying. This says in aggregate that management teams aren't getting concerned.

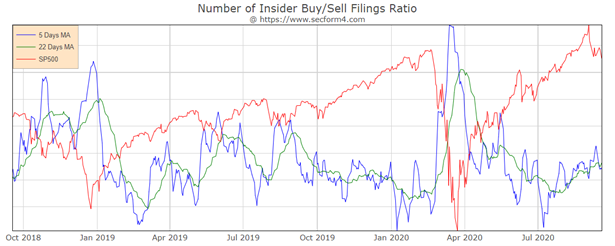

And that's exactly what the bigger picture shows right now. When looking at the buy/sell ratio of U.S. corporate management teams, this metric isn't low at all. In fact, outside of big market sell-offs like December 2018 or March of this year, insider buying to selling is currently at average levels.

Take a look at the chart below from SecForm4.com... Contrary to the Bloomberg article, management teams aren't running for the hills.

Looking at buying versus selling is relevant because there are countless explanations as to why an executive may sell out of their company... but there's only one reason they will buy on the open market: they think the stock will go up. To figure out exactly why executives may be buying or selling, we can use our Earnings Call Forensics ("ECF") technology.

As we said in the August 24 Daily Authority when discussing the U.S. Federal Reserve, this can help us get unique insight into sentiment. Alongside anchoring market trends, the ECF allows us to gain a clearer picture of management outlook.

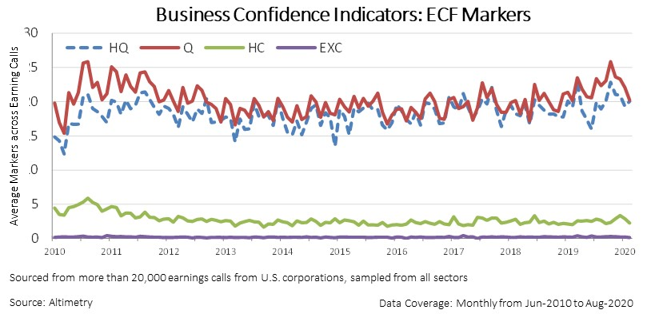

Our ECF data show us when management teams are "highly questionable," "questionable," "highly confident," and "excited."

Highly questionable ("HQ") markers signal management may be holding back significantly on communicating what they're really thinking about a subject, while questionable ("Q") markers indicate a lower degree of management withholding their true feelings. Highly confident ("HC") markers signal if executives have conviction in what they're talking about. Excited ("EXC") markers, which are exceedingly rare, highlight literal giddiness from management on a subject.

As you can see in the chart below, highly questionable and questionable markers have decreased in recent months. After significant uncertainty in the first few months of the year, management teams started showing less concern about the visibility in their outlook for their businesses.

Unsurprisingly, as that happened, management teams initially also became more confident about opportunities for investment – as seen by the rise in HC markers. But subsequently, even as management teams remain less concerned about surprises, they're also becoming less confident about investing in growth.

So, even for those insiders who are selling, if they aren't selling for personal reasons, it appears that the reason is less because they are worried about their companies' outlook... and more because they're less bullish about growth.

Understanding management sentiment is essential when trying to map out the future of a business. After all, these are the people driving a company's stock through their strategies and execution. Their optimism or pessimism about their business and plan can provide us with clues as to how a company may perform in the future, which is essential to an investor's mosaic.

While Bloomberg may be concerned about insider selling, in the context of both buying and selling – and where management sentiment is heading – we see that there's much less cause for concern that this is a sign the market will roll over.

Regards,

Joel Litman

October 12, 2020

Management teams know their businesses better than anyone...

Management teams know their businesses better than anyone...