The 'diet queen' transformed herself from an overweight housewife to a business professional...

The 'diet queen' transformed herself from an overweight housewife to a business professional...

You may not know the name Jean Nidetch. Yet you've almost certainly heard of her company, Weight Watchers... now known as WW International (WW).

Discouraged by so many fad diets and false promises, Nidetch founded Weight Watchers in 1963 to offer a medically backed support system for overweight folks.

Since then, it has become one of the most popular weight-loss programs in the world... and boasts one of the highest Uniform return on assets ("ROA") numbers we've ever had in our database. It's easily in the top 1% most profitable companies.

On the surface, Weight Watchers sounds like a great investment. It makes money by helping people make healthier choices. And with more than 40% of Americans qualifying as obese, many folks would agree that's something we desperately need.

And yet, as I'll discuss today, that alone doesn't mean Weight Watchers has a ton of upside potential. When investing for the long term, businesses that cater to wants tend to outperform those focused on needs.

Coffee-chain Starbucks (SBUX) is practically the polar opposite of Weight Watchers...

Coffee-chain Starbucks (SBUX) is practically the polar opposite of Weight Watchers...

I like to say that Starbucks isn't really a coffee shop. It's a candy store.

A venti caramel macchiato contains up to 42 grams of sugar. That's way more than a Snickers bar, which contains 28 grams.

A venti Iced Chai Tea Latte can have as much as 62 grams of sugar... nearly the same as a 20 oz bottle of Coca-Cola, which has 65 grams.

And if you thought that was bad, don't order a venti white chocolate mocha with whipped cream. It can contain up to 76 grams of sugar. That's 19 teaspoons in your morning coffee.

Starbucks' food business is no better. It has undergone a massive expansion over the years, selling everything from a berry trio parfait (25 grams of sugar) to chocolate chip cookies (31 grams each) and iced lemon pound cake (39 grams per slice).

There's no doubt in my mind that for many folks, the company's sugary food and drink offerings have contributed to unhealthy eating habits. Yet believe it or not, I'm not telling you this to pin the world's dietary woes on the Starbucks menu...

Starbucks isn't actually to blame here. This is a choice the consumer makes.

Weight Watchers has identified a critical need. Many of its customers need to get their weight under control for health reasons. They need a system that will help them keep the weight off in the long term.

On the other hand, Starbucks has found something folks want. Sugar is addictive. When we choose to spoil ourselves with Starbucks delicacies instead of meeting our body's needs, Weight Watchers will always come second.

As investors, we have to realize that wants are often a bigger market than needs...

As investors, we have to realize that wants are often a bigger market than needs...

Folks will spend more on treats and luxuries, especially when times are good. That means over time, companies that constantly adapt to what people want will have a chance to grow their market size.

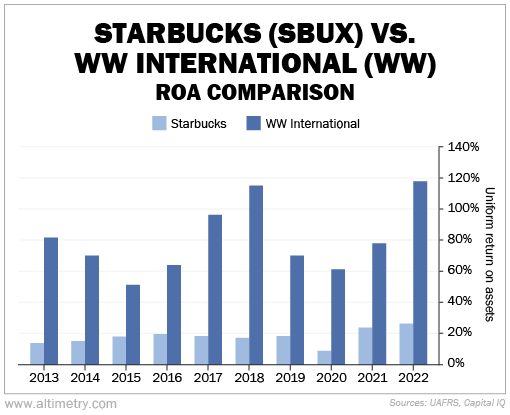

It might not be immediately obvious that Starbucks is a better business. Take a look at the following chart, which shows both companies' Uniform ROAs over the past decade.

Starbucks is a solid performer. Its Uniform ROA rose from 14% in 2013 to 22% last year.

On the other hand, excluding the pandemic year in 2020, WW International's Uniform ROA has been above 60% for a decade. That's five times the 12% corporate average...

Both Starbucks and WW International look like strong businesses based on Uniform ROA. However, WW looks much better between the two.

The issue is, Weight Watchers is always going to be a niche business. It has a limited target market of people who want to go on a diet.

Starbucks keeps finding ways to sell products that everybody wants. It has been expanding its food and drink menu for years. It offers not only coffee, but tea and even hot chocolate. Almost everyone can find something they want to order.

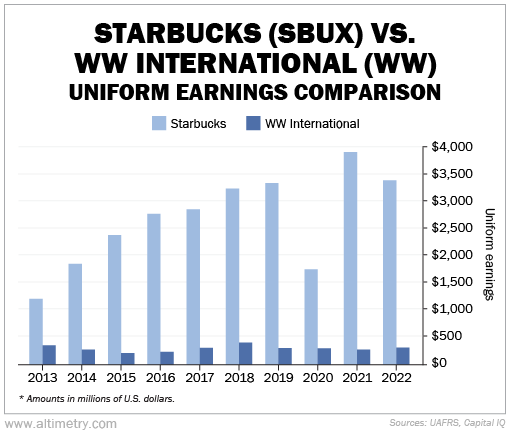

The contrast between a business of needs and a business of wants is clear through Uniform Earnings. This is the absolute closest we can get to the company's real cash earnings. Using this metric, Starbucks far outpaces WW International.

Check it out...

While WW is profitable, its earnings aren't growing. They've held steady at less than $300 million per year.

Meanwhile, Starbucks has grown earnings almost every single year. They went from a little more than a billion dollars in 2013 to well over $3 billion last year.

The reason is simple... The total addressable market for diet plans doesn't have the same growth prospects as the kinds of treats Starbucks offers.

Even though WW is a much older company, it's still worth less than a billion dollars. Meanwhile, Starbucks' market cap sits at more than $100 billion today.

And if you'd invested in both at the start of 2013, you'd be sitting on an 81% loss in WW International today. Shares of Starbucks are up 255% in the same time frame.

Be sure to check out growth potential before diving into any investment...

Be sure to check out growth potential before diving into any investment...

It's not always enough to look at how "good" a business is. You should also consider how big a business can be.

Weight Watchers looks like a fantastic business on the surface. Its problem is that it can't keep growing earnings because it hasn't grown its addressable market. Starbucks, on the other hand, keeps finding ways to bring more customers in.

When considering a new investment, take some time to think about both customer wants and needs. If a customer needs something, it's a start. However, if they don't want it, that company will be hard-pressed to grow.

Wishing you love, joy, and peace,

Joel

August 25, 2023

The 'diet queen' transformed herself from an overweight housewife to a business professional...

The 'diet queen' transformed herself from an overweight housewife to a business professional...