These investment giants' merger seemed promising back in 2017...

These investment giants' merger seemed promising back in 2017...

Denver-based Janus Capital and London-based Henderson joined forces to grow their assets under management... and compete with passive investing.

They wanted to cut costs, expand their global reach, and improve performance in tough market cycles. Yet things didn't go as expected...

The first cracks appeared with the collapse of active asset management itself – the hands-on approach to investing. This was Janus and Henderson's bread and butter.

Active funds have lost more than $1.5 trillion over the past decade. On the flip side, passive funds have gained more than $2 trillion.

The main issue is that active asset management costs more to run. And fund managers must deliver stronger results to justify the higher price tag.

Not every company can do that... Janus, for example, has had trouble attracting big assets.

The other problem was Janus and Henderson simply weren't compatible. The staff lived and worked thousands of miles apart. Most of them didn't even know each other, let alone know how to collaborate across a seven-hour time difference.

All told, this deal was a failure. Shares of the combined Janus Henderson (JHG) were down more than 50% in the first three years after the merger.

Janus Henderson's management is now trying to right the ship... and yet, as you'll see, the market isn't convinced it can turn things around.

To get the job done, a new CEO took the helm in June 2022...

To get the job done, a new CEO took the helm in June 2022...

As soon as he stepped into office, Ali Dibadj put together a diverse 40-person team. Their task was to come up with a recovery strategy.

After months of discussion, the team narrowed down a handful of goals. They focused on Janus Henderson's strengths, including active exchange-traded funds ("ETFs") and alternative assets. They also redirected sales efforts to more productive business lines.

Janus Henderson has already announced two acquisitions this year – Tabula Investment Management, a Europe-based ETF provider... and NBK Capital Partners, a private investment subsidiary of the National Bank of Kuwait.

And while Janus Henderson is still suffering overall outflows today, the areas Dibadj is focusing on are starting to gain some traction.

The company has had three straight quarters of inflows from wealth manager clients. Its new ETF business continues to grow, too.

And it's planning many more acquisitions for the right price.

Despite management's efforts, the market doesn't appreciate Janus Henderson yet...

Despite management's efforts, the market doesn't appreciate Janus Henderson yet...

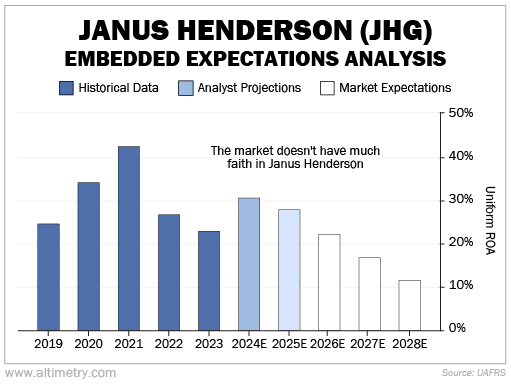

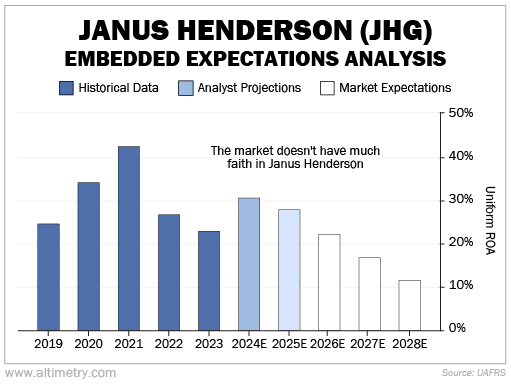

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Janus Henderson's Uniform return on assets ("ROA") has plummeted in the past two years, from 42% in 2021 to 23% in 2023.

Wall Street analysts haven't given up hope. They expect Uniform ROA to top 30% by the end of 2024... with a slight dip to 28% by 2025.

However, investors don't think this downturn is a blip. They're acting like Uniform ROA will sink to 12% by 2028... right at the corporate average.

Take a look...

Investors don't believe Janus Henderson can turn things around anytime soon. They're waiting for profitability to hit its lowest level since the merger.

We think they're far too bearish.

This asset manager may not be a hopeless case after all...

This asset manager may not be a hopeless case after all...

We can't deny that Janus Henderson is bleeding profit. That's why the market expects more pain for the next five years or so.

However, Dibadj seems to be serious about a turnaround effort. Janus Henderson has identified its problems. And it seems to be slowing down the bleeding at the very least.

If the company regains momentum, it has lots of room to impress the market... And low expectations could boost Janus Henderson's upside potential even more.

Regards,

Joel Litman

July 31, 2024

These investment giants' merger seemed promising back in 2017...

These investment giants' merger seemed promising back in 2017...