Here at Altimetry, 'commodity' is a bit of a dirty word...

Here at Altimetry, 'commodity' is a bit of a dirty word...

It's due to the fact that throughout history, commodities have always proved to be difficult businesses.

Consider a few factors that are true about most, if not all commodities...

First, they're usually basic raw materials like agricultural crops or metals. For example, wheat, rubber, and avocados are all commodities.

Second, their prices can be volatile, and these prices can be heavily impacted by both supply and demand. To stick with the avocado example, demand is high right now... which is why they're so expensive. Should Mexico have a bad avocado season, we could expect prices to rise even higher.

For commodity producers or companies that rely heavily on commodities, the price volatility and potential for disruptions is a problem for which there isn't an answer.

For example, Dean Foods – the largest dairy company in the U.S. – recently filed for bankruptcy as a result of declining milk consumption and milk prices. These prices were at their lowest levels since 2002.

Companies that use a lot of commodities as input can expect to have volatile costs. During the Great Recession, many airlines struggled to keep up with fuel costs... but they benefited greatly in 2015 when oil prices plummeted.

Due to this price volatility, it's hard for these commodity-dependent companies to maintain high returns in the long run.

And because investors generally understand how tough it is to run a commodity-dependent business, these types of businesses rarely trade at premium valuations. Even when a company outperforms for a short period of time, investors know it's bound to reverse sooner or later.

One of the best examples of a commodity-dependent company is tire manufacturer Goodyear Tire & Rubber (GT). It makes a variety of tires for different types of vehicles and weather conditions, but all of its tires use rubber or synthetic rubber.

Over the past decade, Goodyear management has announced many cost-cutting initiatives in order to be less reliant on rubber prices. Unfortunately, none of these have worked out so far.

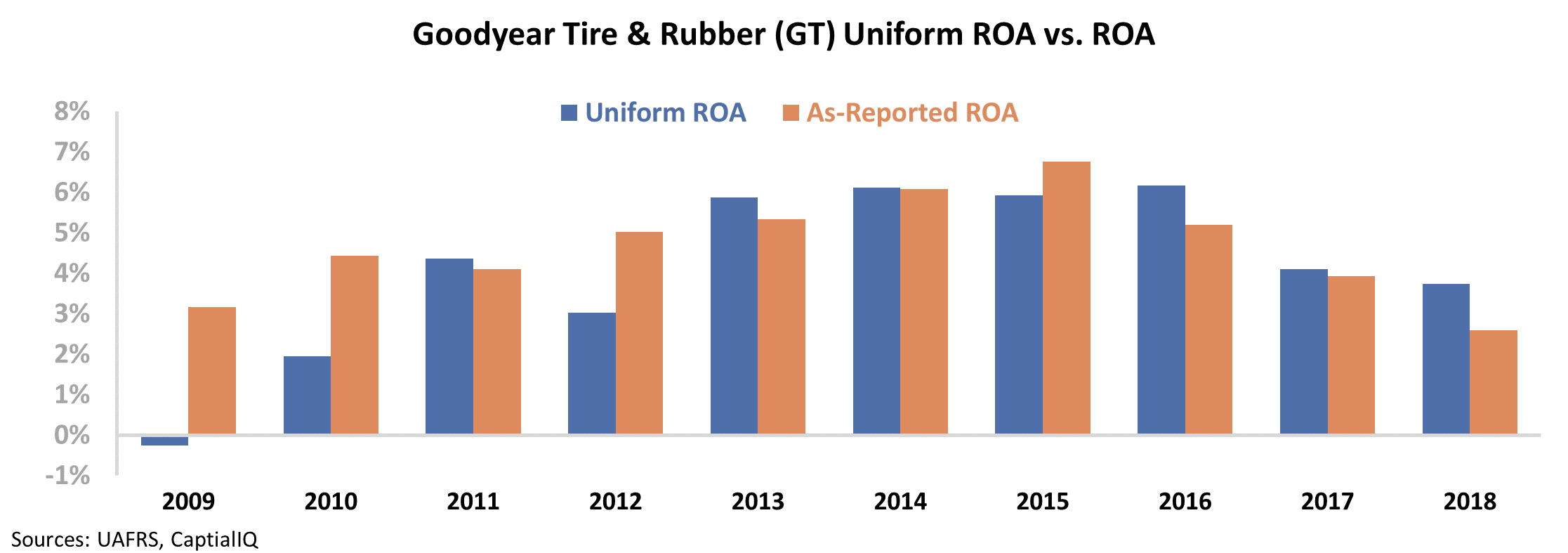

Long-term corporate averages for returns on assets ("ROA") are around 6%, and the current corporate average is closer to 12%. Whether you're looking at as-reported ROA or Uniform ROA, Goodyear has barely made a profit over the past 10 years. With declining returns over the past three years, the company is a below-average business.

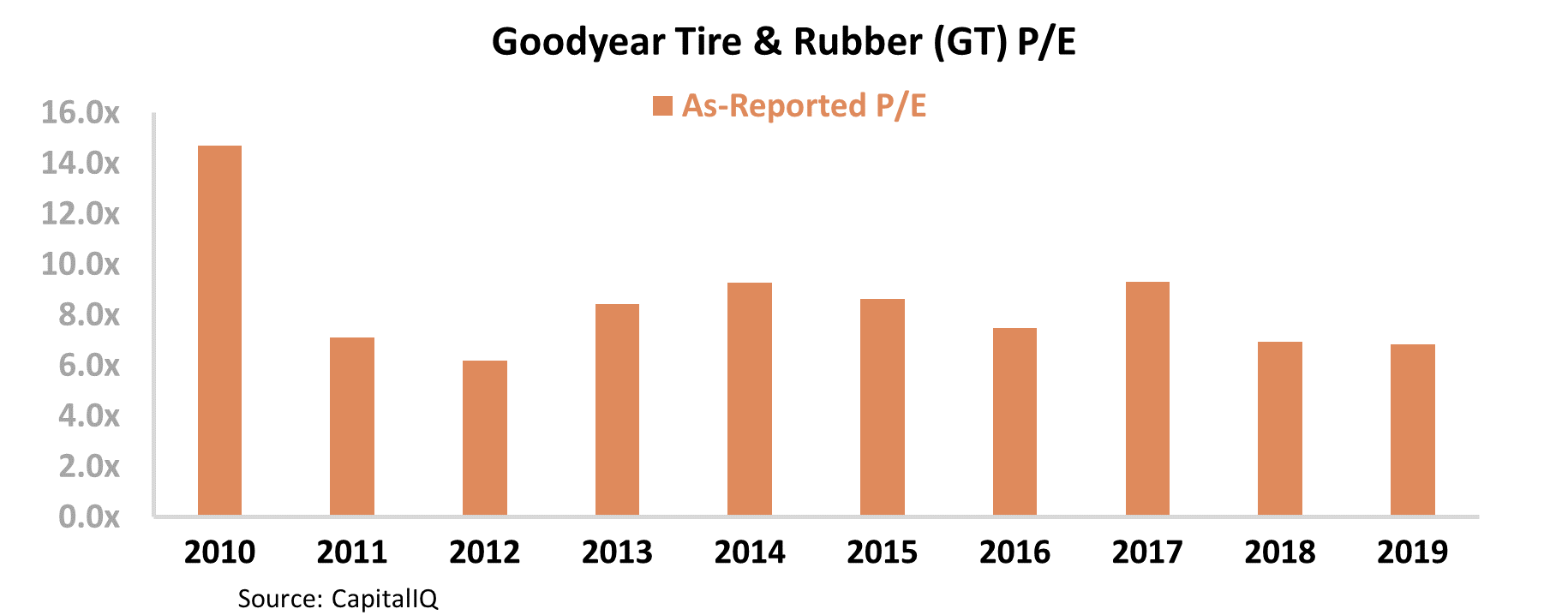

And it appears that investors recognize Goodyear for what it is. On an as-reported basis, the company's valuations have remained low for the past decade. When looking at Goodyear's price-to-earnings (P/E) ratio, this metric has consistently been below average. Compared with corporate average P/E ratios that are closer to 20, Goodyear's P/E ratio has fallen from a high of 15 in 2010 to a range of 6 times to 9 times since then. This indicates that investors have consistently valued Goodyear at a discount.

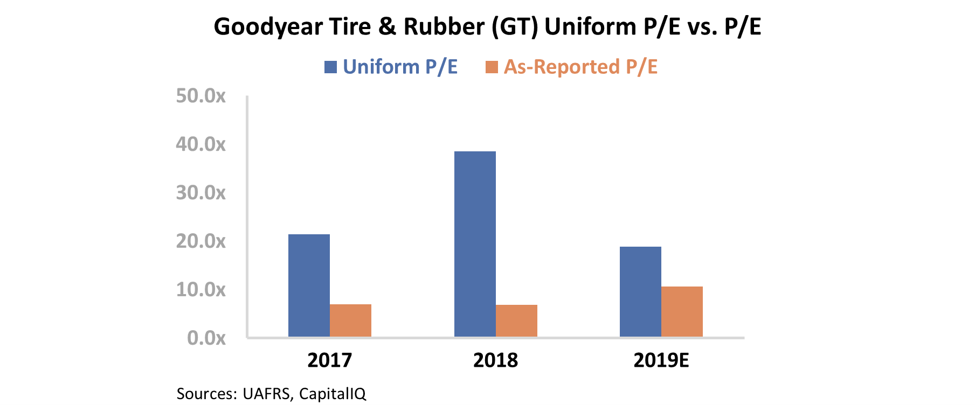

However, Uniform Accounting shows something different...

Once we adjust for misleading accounting practices present in as-reported financial metrics – like the treatment of operating leases, depreciation expense, and one-time special items – we can see that investors may have bought into management's cost-cutting story.

Even in the past three years, Goodyear has traded at least in line with market-average P/E ratios, and has traded as high as 38.5 times earnings in 2018. Take a look...

Given Goodyear's weak, declining returns in recent years and its high valuations, this appears to be a risky mix.

While it looks like investors are in tune with the traditional wisdom on exercising caution with commodity businesses, Goodyear's high Uniform P/E ratio reveals that these investors may have been more swayed by management's story than we originally thought.

I took a trip into economic history over Presidents' Day weekend...

I took a trip into economic history over Presidents' Day weekend...

My wife and I spent last weekend skiing in New Hampshire.

As a history buff – specifically economic history – one New Hampshire resort has always been on my bucket list to visit. It isn't just a great ski destination... It was the location of a dramatic piece of financial history.

The post-World War II economic order was agreed upon and established in Bretton Woods, New Hampshire at the Mount Washington Hotel.

Everything from the International Monetary Fund ("IMF"), World Bank, and the International Bank for Reconstruction and Development ("IBRD"), to the post-war currency exchange rate mechanisms were created at a conference here in 1944.

In the midst of World War II, nations from across the world gathered to agree on how to create a post-war order that would provide economic stability to help the world avoid falling back into chaos.

The room where the agreement establishing the IMF was created is now a mini-museum at Bretton Woods. You can see photos of key members of the different delegations, as well as the list of all the countries involved. Here's the plaque on the door...

The Mount Washington Hotel is a nice small trip into history, and it's a good reason to consider Bretton Woods if you're looking for a trip in the Northeast. The skiing is pretty good too...

Regards,

Rob Spivey

February 20, 2020

Here at Altimetry, 'commodity' is a bit of a dirty word...

Here at Altimetry, 'commodity' is a bit of a dirty word...