Nobody wants to invest in China...

Nobody wants to invest in China...

Not even Chinese investors.

For decades, the Chinese economy has been a magnet for foreign investment. It has recorded net inflows every year since at least 1990. But this could be the year that breaks the streak.

Investors poured about $10 billion into Chinese companies in the first quarter. With the exception of one quarterly net outflow last year, that's the slowest quarterly investment since 2003.

And last quarter, investors pulled $15 billion from China... the biggest outflow the country has ever faced.

At the same time, Chinese investors are looking elsewhere. They bought $71 billion in foreign investments in the same quarter, up 80% year over year.

In short, investors are worried about China's economy... for good reason.

When investors don't trust the numbers, they don't want to invest...

When investors don't trust the numbers, they don't want to invest...

And it's getting way harder to trust the numbers coming out of China.

Back in February, we mentioned Russian President Vladamir Putin taking a jab at China's leader, Xi Jinping. Putin stated that his government recorded $10 billion less in trade between the two countries than Xi had previously claimed.

So how did China's trade figures end up being $10 billion higher than its closest ally's measurement of the same exchange?

China's own allies don't seem to trust its numbers... and neither does the International Monetary Fund ("IMF").

China has two measures for its trade surplus. One comes from its State Administration of Foreign Exchange ("SAFE"). The other is based on customs data in and out of the country.

Between 2003 and 2022, these numbers were almost always in the same ballpark. They'd occasionally differ by a few billion dollars.

But since then, the gap has widened considerably. In the most recent quarter, the two agencies reported a difference of $87 billion... And that spurred the IMF to write a report highlighting the gap.

When people can't trust the numbers, they can't invest in good conscience. Even mega-bank JPMorgan Chase (JPM), which used to be extremely bullish on Chinese stocks, has scrapped its recommendation after consistent misses on growth targets.

Not to mention, China's economy is nothing special...

Not to mention, China's economy is nothing special...

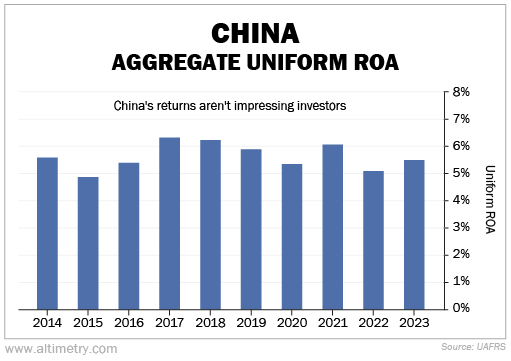

Just look at the following chart, which measures aggregate Uniform return on assets ("ROA") for all major Chinese companies.

Since 2019, China's corporate average Uniform ROA has been between 5% and 6%. That's around the country's cost of capital. Take a look...

By investing in China, you're investing to break even. Investors have far better alternatives... like the U.S., which is more than twice as profitable. Our corporate average Uniform ROA is 12%.

This could be the first year in modern history that investors sell out of China. Nobody seems to trust the country. Or maybe they're realizing they can turn to better markets.

Either way, don't be the odd one out.

Regards,

Rob Spivey

September 12, 2024

Nobody wants to invest in China...

Nobody wants to invest in China...