The latest avian flu outbreak has wiped out millions of egg-laying hens...

The latest avian flu outbreak has wiped out millions of egg-laying hens...

According to Expana, an institution that monitors egg prices, 15% of the nation's egg-laying hens have been culled in the past four months.

With far fewer hens to go around, supply is suddenly tight... and wholesale prices are soaring.

The price for a dozen eggs averaged $2.25 last fall. It now sits above $8 per dozen.

Said another way, we're experiencing a shocking 255% increase in egg prices.

As big as the supply glut is, it still shouldn't cause this much of a price shock. And some lawmakers and consumer advocates are casting the blame elsewhere...

Experts are taking a hard look at major egg producers like Cal-Maine Foods (CALM)...

Experts are taking a hard look at major egg producers like Cal-Maine Foods (CALM)...

Cal-Maine is the biggest egg producer in the U.S., with more than a 20% market share. To say it has been doing well lately is an understatement...

In the quarter ended November 2024, revenue was up 82% year over year. Net income shot more than 1,100% higher.

And that was before the latest bout of flu.

To put it simply, there's no reason eggs should be this expensive. The Guardian reports that direct avian-flu-related costs should have accounted for a 12% to 24% price hike. Instead, prices have tripled.

So when folks suggest major egg producers could be taking advantage of the crisis... we understand why.

With egg prices so elevated, Cal-Maine is set for another massive surge in earnings and revenue...

With egg prices so elevated, Cal-Maine is set for another massive surge in earnings and revenue...

But it's not going to last. And investors are well aware.

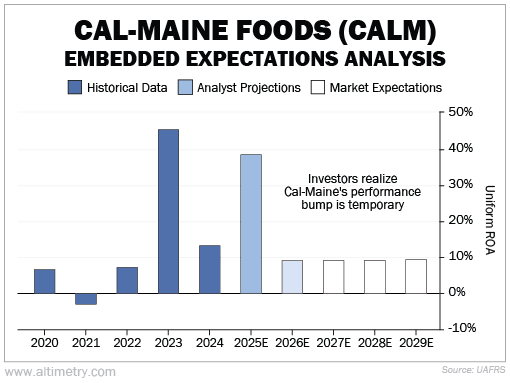

We can see this through our Embedded Expectations Analysis ("EEA") framework...

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Cal-Maine's Uniform return on assets ("ROA") mostly ranges from negative to positive single-digit levels. During the post-pandemic inflation spike in 2023, it soared to 45%... a 15-year record.

Take a look at the light blue bars. These show short-term Wall Street expectations, which tend to be pretty accurate.

As we endure another period of high egg prices, Uniform returns are expected to reach 38% this year.

But after that, investors (the white bars) expect Uniform ROA to fall back to 9%. That's more in line with the company's regular years...

As you can see, the market isn't convinced by Cal-Maine's recent strong numbers. We couldn't agree more.

Cal-Maine thrives when egg shortages drive prices up...

Cal-Maine thrives when egg shortages drive prices up...

But the market knows these price spikes are temporary. And so is the company's profitability.

There's no way anyone should be earning 40% returns on eggs. Prices will come back down sooner or later.

And folks who bought in during this blip will be left holding the bag.

Regards,

Joel Litman

March 21, 2025

The latest avian flu outbreak has wiped out millions of egg-laying hens...

The latest avian flu outbreak has wiped out millions of egg-laying hens...