Folks are putting work-from-home culture to good use...

Folks are putting work-from-home culture to good use...

Corporations have been talking a great deal recently about how they want to help their workers live happier and healthier lives.

Some companies, like music-streaming service Spotify Technology (SPOT) and dating app Bumble (BMBL), have even implemented "wellness weeks." Once a year, they shut their doors to give all of their employees the chance to recharge.

This is a welcome treat for workers. But there might be an even better solution out there to improve employee health... and it has been right in front of these companies' noses the whole time.

If companies really care about the health of their workers, they should foster a work environment that promotes getting enough sleep.

Regular readers know I've written a lot about the merits of getting enough high-quality sleep... both for your health and your portfolio.

To that end, companies might want to think twice before pushing their employees to come back to the office.

This isn't just about people preferring work-from-home over being in-person. Research from the Federal Reserve Bank of New York shows that U.S. workers have reclaimed more than 60 million hours of commute time since remote work gained popularity.

We have to believe they're using some of that time to catch up on sleep.

People seem to have realized that they're sleeping more lately. Mattress sales were up 35% by the end of 2020. And for many mattress companies, business is still booming.

But that doesn't make them good investments as the world emerges from the pandemic...

But that doesn't make them good investments as the world emerges from the pandemic...

Take Tempur Sealy (TPX), for example. The company makes some of the best mattresses in the industry. Its memory-foam mattresses can cost several thousand dollars.

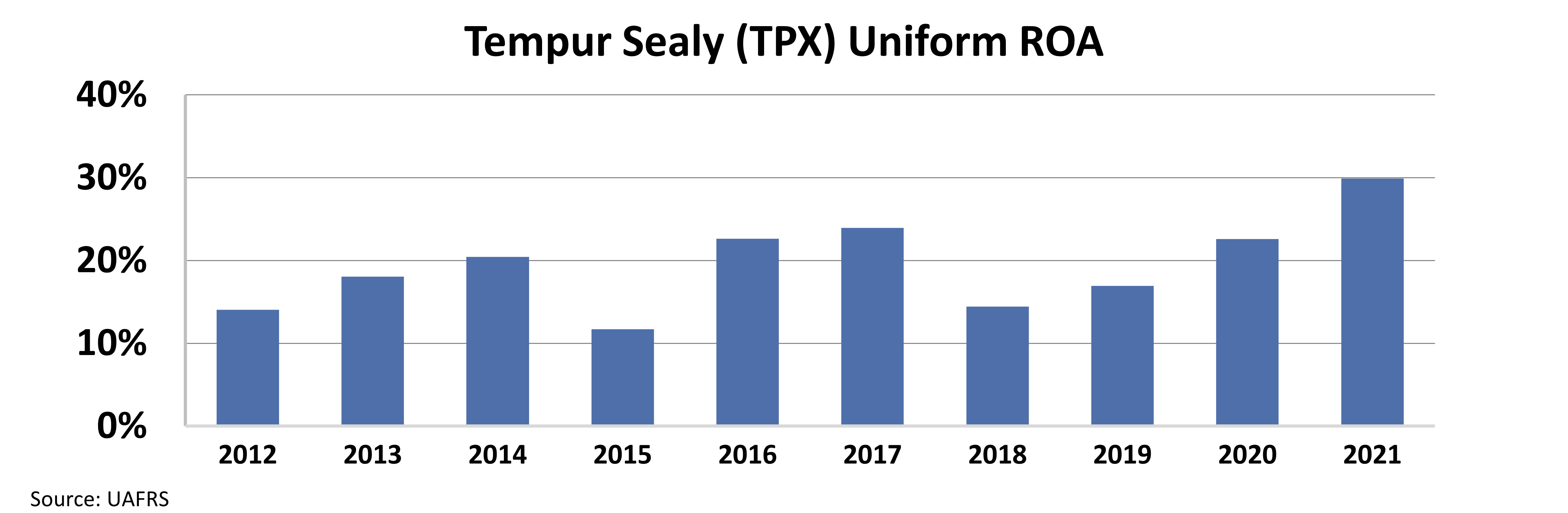

Tempur Sealy almost always generates healthy returns. Its Uniform return on assets ("ROA") has been 12% or higher for the past decade. That's right in line with the corporate average. That means Tempur Sealy has been average at worst for the past decade.

Take a look...

We can see that the pandemic was great for business. Uniform ROA rose to 23% in 2020, nearly matching Tempur Sealy's 10-year high. And 2021 blew that out of the water.

That sounds like a great thing for investors. But it's important to factor in valuations. You see, Tempur Sealy stock is up more than 380% from its pandemic low.

Investors understood that mattress sales were surging... and they bought in.

Investors understood that mattress sales were surging... and they bought in.

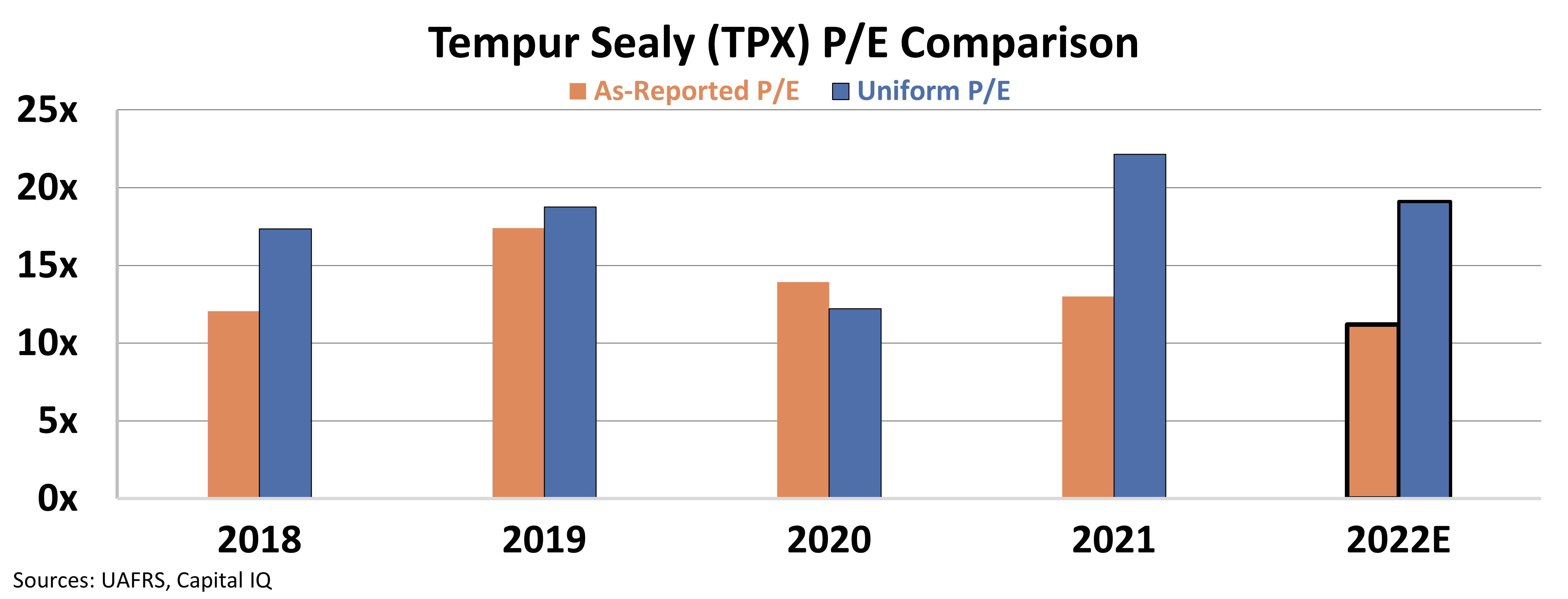

That's why the company's Uniform price-to-earnings (P/E) ratio has soared recently. The P/E ratio compares a company's share price to the earnings it's generating.

Check it out...

Tempur Sealy currently trades at a 19 times Uniform P/E ratio. That's not quite as high as last year... But it's still right around market averages.

If you had bought the stock back in 2020, when the company's Uniform P/E ratio was just 12 times, you could have gotten a lot of upside. That's not the case anymore. The stock already reflects the company's record earnings in 2021.

The market has recognized the strength of Tempur Sealy's business. This was a great opportunity at the height of the pandemic... But these days, there's not much room for it to run.

Regards,

Joel Litman

November 9, 2022

Folks are putting work-from-home culture to good use...

Folks are putting work-from-home culture to good use...