The wave of virtual offerings is creating new risks...

The wave of virtual offerings is creating new risks...

It has been impressive to see the conversion of large parts of the U.S. economy to a work-from-home world. However, one of the big areas of concern has been issues with hacking and security in virtual-meeting services like Zoom Video Communications (ZM).

But working remotely hasn't been the only big move... "Telehealth" has also been an area of focus in the midst of the pandemic, with virtual health care services rising to help manage the stream of patients needing both acute and non-acute care.

But as with any online service – be it Zoom, Facebook (FB), or Teladoc Health (TDOC) – understanding how your information is being used and gathered is important.

While the revolution in telehealth is incredibly valuable in getting care to those who need it, these companies don't just make money by taking care of patients...

Rather, many of them also make money by using the data they gather from your checkups and the questionnaires that patients fill out to target ads to them in the future through Google, Facebook, and other platforms.

As with so much of the digital economy, just remember to be aware of the way the information you share on the Internet is used.

Some stocks have a lot of the same properties as bonds...

Some stocks have a lot of the same properties as bonds...

Most people know that the two major investment classes are stocks and bonds.

Bonds tend to offer more stability, less risk, and lower expected returns... while stocks offer higher expected returns in exchange for higher risk.

Certain hybrid instruments like convertible bonds and preferred equity fall somewhere in the middle, but those are less common for individuals to invest in.

But most people don't know that certain types of stocks act a lot more like bonds than typical equity investments...

Certain industries have been built in such a way that they have a lower risk-to-return profile, and thus have more stable cash flows.

One example is energy utilities. Without government intervention, these companies would basically be geographic monopolies... But in order to be fair to the consumer, the government has capped how much utilities are allowed to make in a given year.

Because there's such low competition and stable demand, utilities are fairly stable earners, and they're only allowed to keep so much of those earnings every year. Most of the excess is paid back to investors as dividends, which almost act like a coupon payment on a bond for these stable businesses.

Another example is a type of real estate company called a real estate investment trust ("REIT").

These businesses basically own and manage a portfolio of real estate, take equity investments to fund growth, and pay out their stable returns as dividends.

REITs have the added bonus of being a tax-advantaged asset class. In order to qualify as a REIT, companies need to distribute at least 90% of their taxable income as dividends to shareholders – making them exempt from taxation.

This is great for investors... Similar to utilities, it means REITs are forced to maintain a healthy dividend. It also avoids the issue most equity dividends face – double taxation.

Additionally, because REITs are allowed to grow their portfolios with the remainder of their capital and because the value of their assets appreciates over time, they act more like an inflation-hedged bond than a typical stock.

That said, one of the biggest risks for REITs is regarding the dividend. These stocks tend to perform poorly when investors think the company's dividend is coming under pressure.

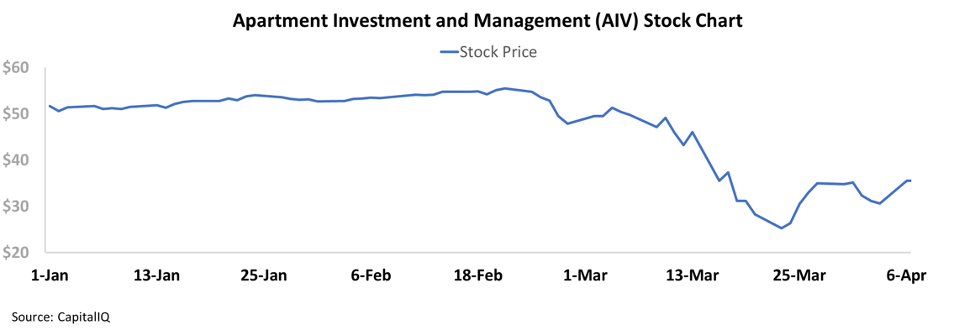

We've seen some REITs underperform over the past few months, but one of the worst has been Apartment Investment and Management (AIV), also known as "Aimco."

The company is one of the largest owners of apartment communities in the U.S., collectively owning upwards of 30,000 apartment units.

Considering all of the concerns about tenants making rent in the next few months, AIV shares have fallen roughly 35% from their highs in late February...

Yet despite recent stock troubles, Aimco's stats look compelling...

Because REITs are different than most other stocks, we don't typically look at our traditional valuation metrics.

Instead, we look at valuations compared to a REIT's funds from operations ("FFO") – which is like a modified net income specifically for the REIT industry – and its dividend yield.

Today, Aimco's dividend yield is 4.6%. Much like bond yields, REIT dividend yields are a good proxy for how much risk investors are pricing in.

At nearly 5%, Aimco is being priced like its dividend is unsustainable. However, using Uniform Accounting, we can look at the company's earnings compared to its obligations to see if that's actually the case...

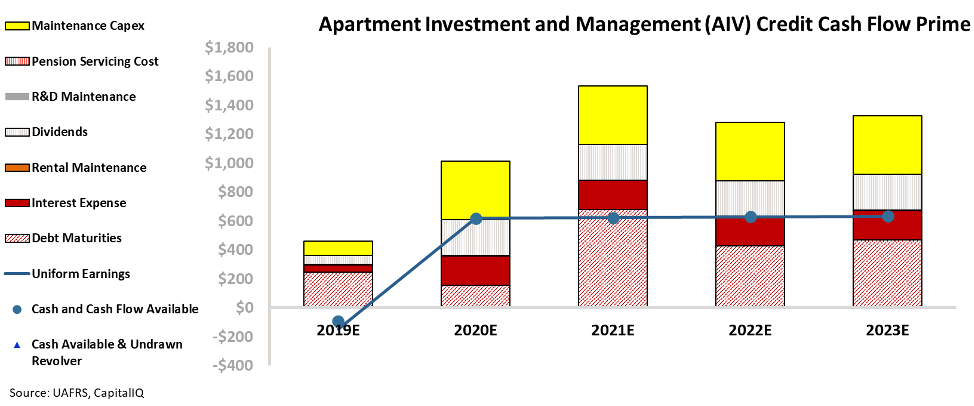

Our Credit Cash Flow Prime ("CCFP") analysis allows us to compare Aimco's Uniform adjusted earnings to its annual obligations – including items like interest expense, maintenance capital expenditures ("capex"), and annual debt maturities.

The blue line in the chart below is Aimco's Uniform gross earnings. The stacked bars are the obligations the company has each year in the future – everything from debt maturities to maintenance capex.

Looking at the base-case CCFP, we can see why investors may be concerned... Aimco's earnings are expected to fall short of its obligations in each of the next five years. Take a look...

At this rate, Aimco will likely only be able to service its dividends through 2020 at best, considering its continual interest expense and debt maturities.

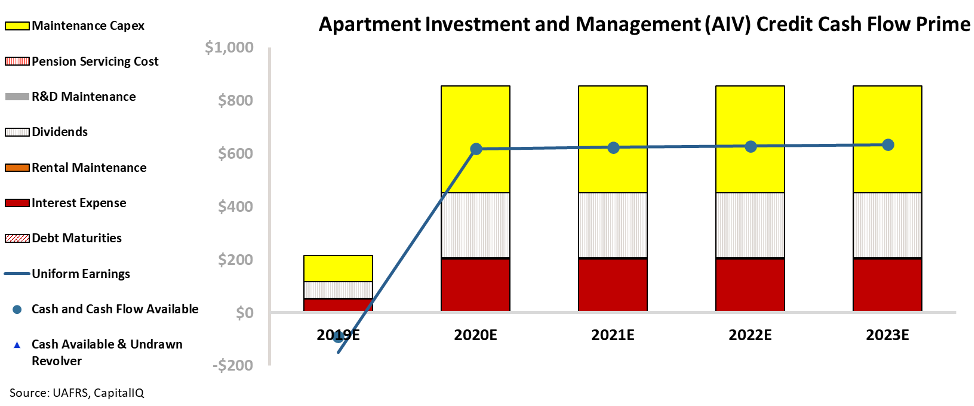

However, the company's credit profile might not be as bleak as it initially appears...

First, it's important to note that maintenance capex (the yellow bars) can likely be serviced by Aimco simply trading assets within its portfolio, and that this doesn't require significant earnings.

Additionally, as long as the company is able to refinance its current debt, its dividend has little fundamental risk.

Below, in the second version of the chart, we removed all debt maturities – assuming each one has been refinanced five years out. In this case, Aimco should be able to comfortably service its dividends for the next five years. In fact, the company may even be able to expand its dividend yield given its earnings buffer over obligations.

So long as credit markets don't completely freeze over, and Aimco can continue refinancing its debt to later dates, it appears investors have overreacted. It may be a great opportunity to consider this stock with stability that's more like a bond.

Regards,

Joel Litman

April 8, 2020

The wave of virtual offerings is creating new risks...

The wave of virtual offerings is creating new risks...