Roblox goes dark right before Halloween...

Roblox goes dark right before Halloween...

Roblox (RBLX), a popular gaming platform for kids, was knocked offline for a few days starting last week.

The digital outage, which began on October 28, caused a big panic among the platform's millions of young users. Suddenly many had lost their biggest pastime and had to scramble to find new activities to keep them busy.

Jokes quickly swirled on social media about how parents were shocked to see their kids playing outside with friends this Halloween instead of glued to their screens.

But it wasn't only kids who panicked when Roblox went dark. The platform allows users to program their own games and earn income from players, meaning many rely on Roblox to make a living.

When the platform shut down due to an unexpected outage, these developers quickly wondered when the issue would be resolved.

Fortunately, for both Roblox's users and developers, by the time kids got back from trick-or-treating Sunday afternoon, the platform was back online, and they could jump back into their favorite digital pastime.

The market sees Roblox as not just a gaming platform but as a new way to play online...

The market sees Roblox as not just a gaming platform but as a new way to play online...

What came as a big surprise to investors was that the Roblox outage didn't affect the gaming company's valuations or earnings estimates for the quarter.

This suggests that Roblox is a phenomenally resilient business. However, a closer look at the company through a Uniform Accounting lens highlights a different story.

It looks like the market doesn't seem to care about what happens to Roblox this year because it has such lofty expectations. The millions of kids hooked on the platform only seem to confirm this view.

For context, Uniform Accounting shows that Roblox is an unprofitable company. Last year the firm's Uniform return on assets ("ROA") was a staggering negative 43%.

Fast forward to 2021, and analysts are forecasting only a marginal improvement to negative 29% Uniform ROA. It's no wonder the market barely blinked an eye about the outage potentially hurting earnings... there are no earnings to hurt.

But what's even more staggering is how high Uniform ROA would need to reach for the company to be fairly valued.

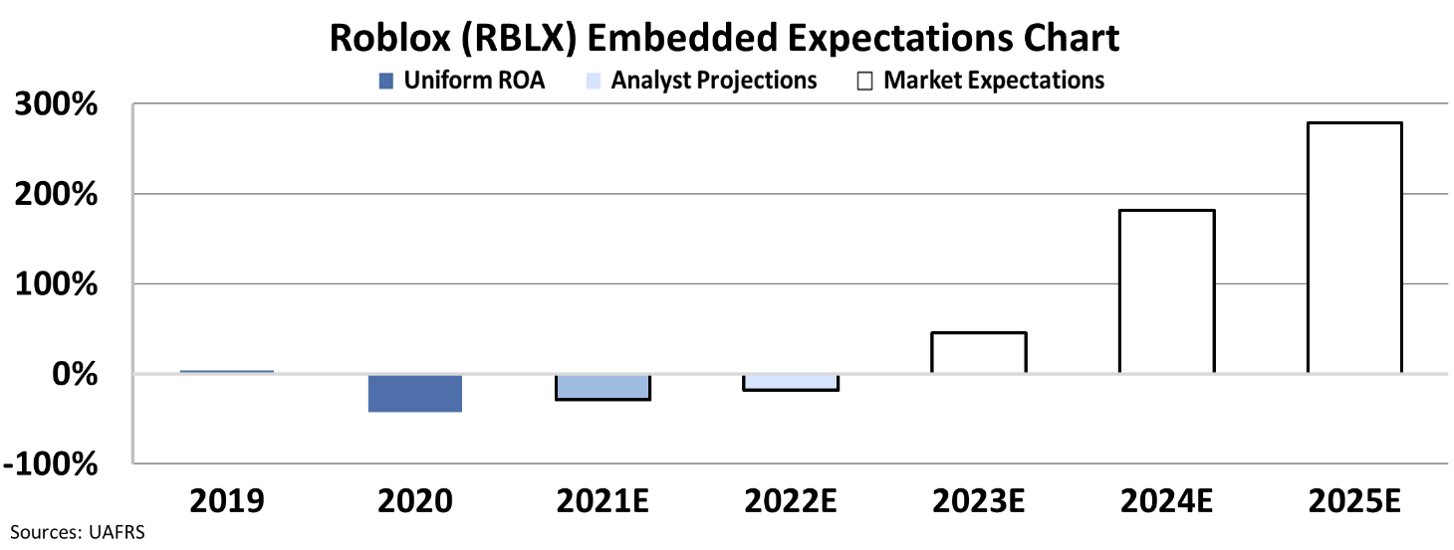

By utilizing our Embedded Expectations Analysis ("EEA") framework, we can see what Roblox would need to do to meet these soaring expectations.

Stock valuations are typically determined using a discounted cash flow ("DCF") model, which makes assumptions about the future and produces the "intrinsic value" of the stock.

But here at Altimetry, we know models with garbage-in assumptions based on distorted GAAP metrics only come out as garbage. Therefore, with our Embedded Expectations Framework, we use the current stock price to determine what returns the market expects.

In the chart below, the dark blue bars represent Roblox's historical corporate performance levels in terms of ROA. The light blue bars are Wall Street analysts' expectations for the next two years. Finally, the white bars are the market's expectations for how the company's ROA will shift over the next five years.

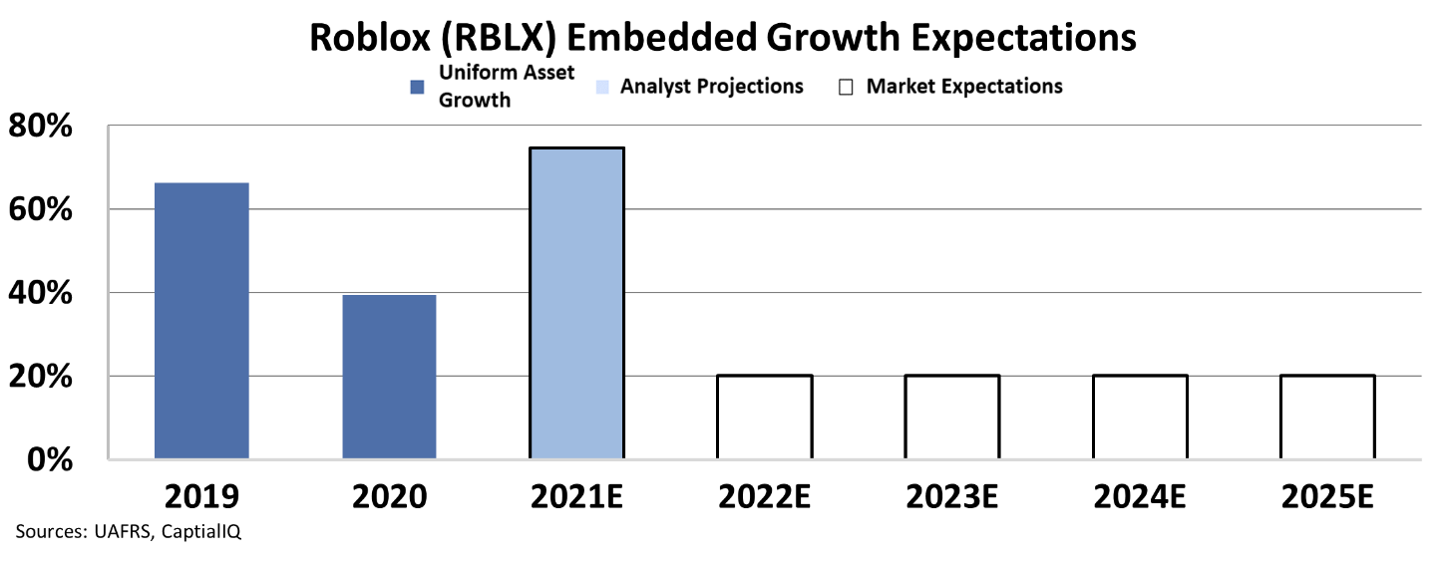

With analysts expecting topline growth of 20% a year going forward, we can model out 20% asset growth into the future. This means Roblox would need to see Uniform ROA reach a staggering 284% to be fairly valued at current prices.

In comparison, Activision Blizzard (ATVI), one of the biggest and best-in-class gaming firms with properties like Call of Duty and Candy Crush, has a Uniform ROA of only 40%.

This suggests investors expect Roblox to transform the gaming industry in ways few companies in a few industries have before.

Roblox's sky-high valuations relative to its gaming peers underscores how this story has to execute perfectly to look fairly valued at today's prices.

Even though Roblox is back online, our Embedded Expectations framework highlights the real fundamentals for this company...

While it may be 'game over' for Roblox, we use Uniform accounting to identify winners...

While it may be 'game over' for Roblox, we use Uniform accounting to identify winners...

In fact, in our Microcap Confidential service, we just identified a microcap stock we think could turn into a multibagger...

I shared my thesis about this tech stock – including the name and ticker symbol – in a presentation at our sister company Stansberry Research's annual conference in Las Vegas in late October.

And for a limited time, you can watch my presentation – no e-mail address or credit card required – right here.

Regards,

Joel Litman

November 9, 2021

Roblox goes dark right before Halloween...

Roblox goes dark right before Halloween...