The cement industry is one of the world's worst CO2 emitters...

The cement industry is one of the world's worst CO2 emitters...

Governments and businesses are becoming more and more worried about climate change.

Certain industries are always in the crosshairs of climate regulators. These include the big emitting industries like oil and gas, utilities, and metal producers.

But one industry in the spotlight now may be surprising to some: cement.

Cement is an essential ingredient in concrete that helps other materials bind together and hold in place.

More than 4 billion tons of cement produced worldwide each year account for roughly 8% of human carbon dioxide ("CO2") emissions, according to think tank Chatham House.

This is a massive number. It means the cement industry is only behind China and the U.S. as nations in terms of greenhouse gas emissions.

Even if entirely powered by clean energy, cement production would still emit large quantities of CO2...

Even if entirely powered by clean energy, cement production would still emit large quantities of CO2...

The issue is not just that the cement industry uses a lot of energy. What's really driving the emissions are the byproducts of cement production.

When a manufacturer makes cement, it must first go through a process called calcination. This process has two final outputs.

One is a solid material called clinker that looks like a rock. This material then gets milled or ground into a fine powder, making cement.

The more problematic byproduct of cement production is the large amount of CO2 that it emits.

No matter how it's broken out, the current way of making cement leads to harmful emissions.

This means the production process itself needs to be rethought to reduce cement production's ecological footprint.

Can carbon capture technologies save the day?

Can carbon capture technologies save the day?

One possible solution to the emissions problem of the cement industry is carbon capture.

Carbon capture is the idea of literally capturing CO2 before it enters the atmosphere and storing it or reusing it for certain applications.

This innovative technology can be used in the final steps of making and solidifying concrete.

Injecting CO2 at these later stages for curing has made concrete even stronger than just using water.

Carbon capture thus has two major potential benefits...

Stronger concrete could mean less of the material needs to be used in construction projects. In turn, less cement would need to be produced, and less energy would be consumed.

This would mean the CO2 emissions of the cement industry would start to decline.

One major cement company is trying to find out...

One major cement company is trying to find out...

HeidelbergCement (HEI.DE), a multibillion-euro materials company, is testing carbon capture at one of its plants in Belgium.

So far, the firm has seen significant success.

A study by the Low Emissions Intensity Lime and Cement ("LEILAC") consortium found the plant captured 100% of its emissions.

Interestingly, it looks like the company's success with carbon capture is showing up in the Uniform Accounting data too.

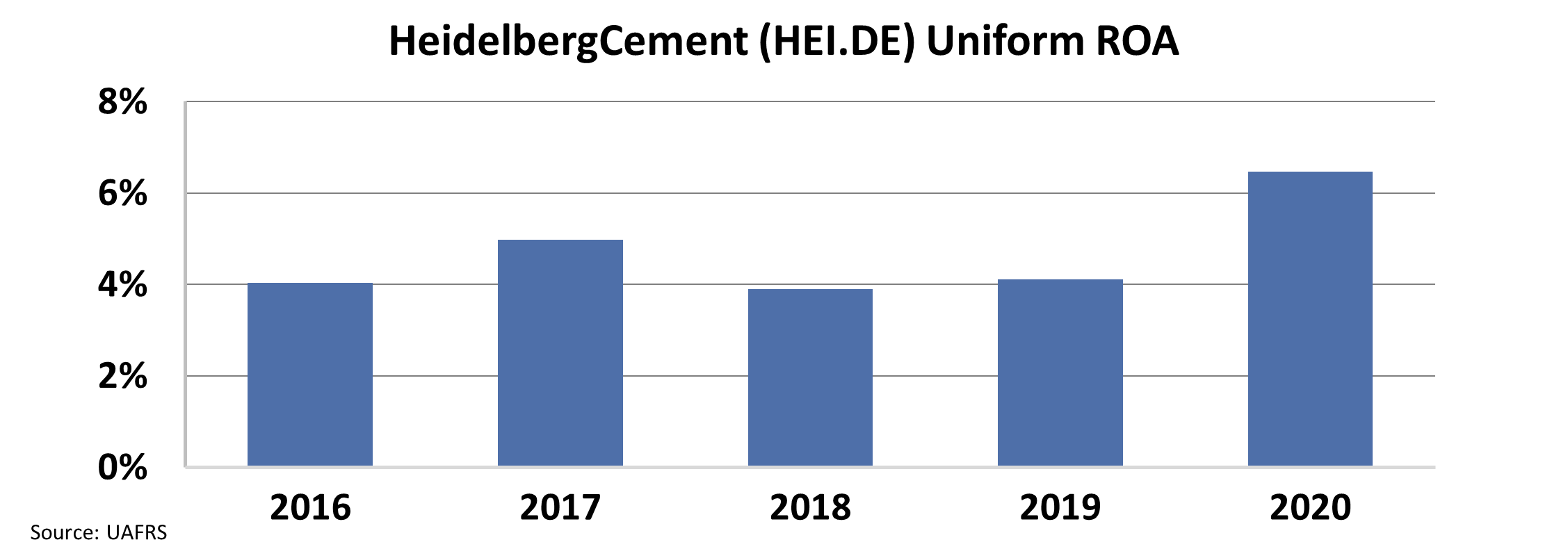

For years, the company saw an average Uniform return on assets ("ROA") of 3% to 4%, common for cement companies.

Then in 2020, returns jumped significantly higher. Uniform ROA rose to 7% and put HeidelbergCement among the top-performing companies in its industry.

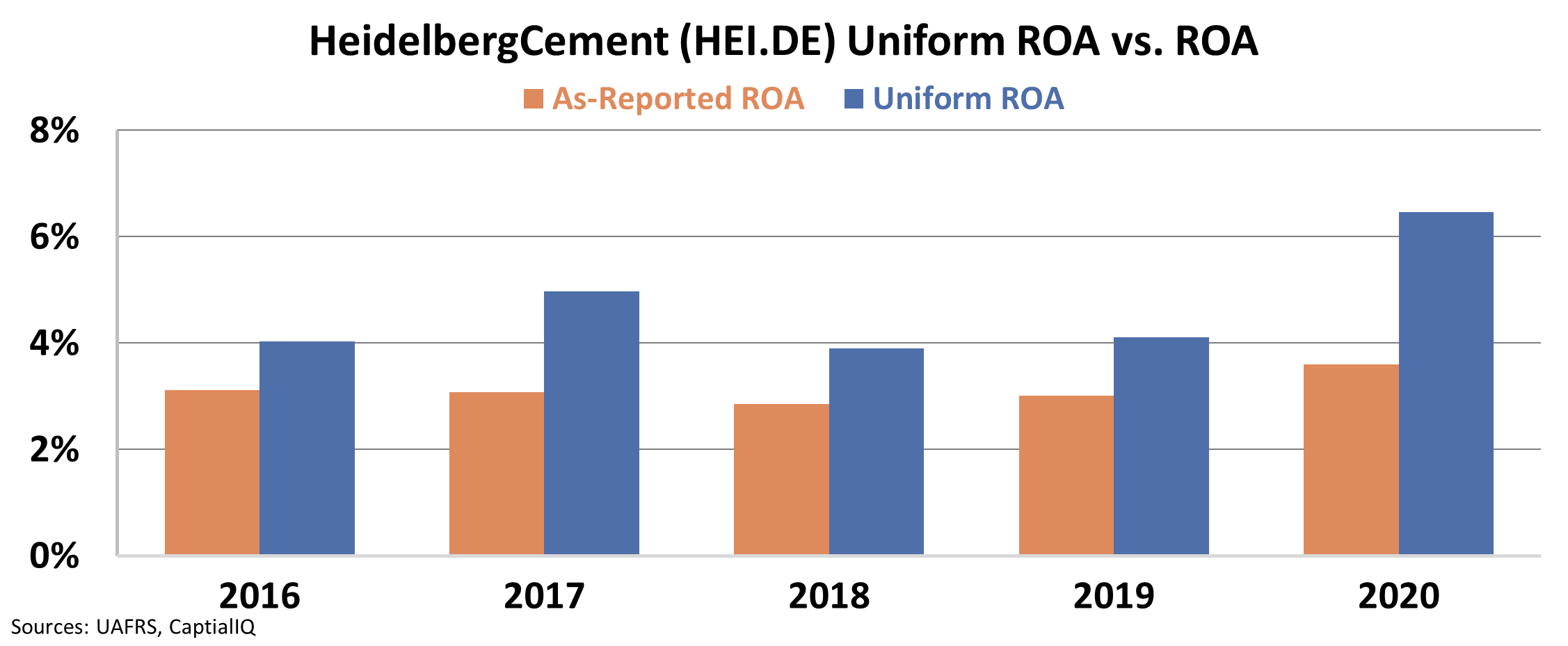

But looking at as-reported metrics, investors don't see a jump in profitability.

The chart below shows the contrast. As-reported ROA barely budged from 3% in 2019 to 4% in 2020 while Uniform ROA nearly doubled.

Perhaps trying to innovate to clean up its climate profile could be boosting profits at HeidelbergCement, despite what the as-reported numbers suggest.

Does this mean HeidelbergCement stock is a buy?

Does this mean HeidelbergCement stock is a buy?

While HeidelbergCement is doing something better for the environment, its bottom line isn't seeing the recognition from as-reported accounting. That means investors may be slower to realize the power of carbon capture...

Of course, we don't just buy companies based on performance alone. We also need to consider valuations as well...

Here at Altimetry, we use the power of Uniform accounting to identify different types of companies with hidden upside for our Altimetry High Alpha service.

Our latest stock recommendation – which supports modernizing industrial infrastructure – stands to gain 75% upside from where it is today. In fact, the average return among the more than 20 open recommendations in the High Alpha portfolio is nearly 40%, and three of these picks have yielded triple-digit gains...

To learn how you can gain instant access to all of High Alpha's recommendations, including our most recent pick – click right here.

Regards,

Rob Spivey

December 1, 2021

The cement industry is one of the world's worst CO2 emitters...

The cement industry is one of the world's worst CO2 emitters...