It's your final opportunity to explore the 'Challenger Deep' with us...

It's your final opportunity to explore the 'Challenger Deep' with us...

In 1960, a deep-diving submarine made the first manned journey to explore the depths of the Challenger Deep – the deepest section of the world's oceans, at the bottom of the Mariana Trench. Explorers had been plotting the sea floor for the past century using submarines, but this was the latest mission of its kind.

To send two men into the pitch blackness and crushing pressure of Challenger Deep required overcoming significant engineering challenges. Most normal submarines would be crushed. However, this challenge paid off for the explorers Jacques Piccard and Don Walsh, who answered the question of whether life could exist in such hostile conditions.

Upon spotting a strange, but very living fish, the men shook hands at negative 35,000 feet to celebrate their discovery.

In the investing world, a similar Challenger Deep exists that few people will venture to. Due to the difficulty required to master such depths, it even turns off most institutional investors from the possible discoveries.

Limitations in Wall Street research, a lack of liquidity, and regulatory issues about how much a fund can invest in a microcap company mean institutional investors stay at arm's length from the smallest stocks in the market.

This means these names remain hidden for most investors... except for the select few researchers who attempt to make the next great discovery for massive gains in the space.

So we've made it our mission to make this type of research available to individual investors like you. It's just too massive of an opportunity to pass up... and we don't want you to miss out.

We specifically created our Microcap Confidential service to highlight the undiscovered microcap stocks primed for huge upside. We've also identified the players in the space that could be practicing fraud – the stocks that are primed to blow up unsuspecting investors' portfolios.

If you've waited on taking advantage of this brand-new research, don't delay any longer... our special charter offer closes tonight at midnight.

It's the last day you can get access to this research for half off its normal price, as one of our charter subscribers.

We put together a video discussing the power of identifying microcaps that have significant upside when we utilize all the tools we have in our framework that you read about here in Altimetry Daily Authority, including:

- Uniform Accounting

- Credit analysis

- Management compensation and communication analysis

- Deep fundamental research

In the video, we share our favorite stock to buy in the microcap world right now. We also tell you about one company that's aggressively and regularly promoting itself in the news and through press releases to try to take advantage of speculators in the midst of the coronavirus pandemic. It's essential that you do not buy this stock.

Click here to learn more... and take your first step in the microcap world.

Alternatively, you can click here to go straight to the order form if you don't want to watch the video.

But don't delay. We don't want you to miss out on this opportunity... and today is the last day to take advantage.

There's a constant push and pull in the decision of sourcing...

There's a constant push and pull in the decision of sourcing...

When a company is looking for a supplier, an internal debate often occurs on where to find the perfect tool. On the surface, this seems like an issue that would be easily solved: Simply find the best product at the cheapest price. However, it rarely works out that way...

Those who are doing the sourcing are often looking for the cheapest product or best possible deal. We see this especially in larger companies that have longstanding legacy platforms or relationships... The sourcing team will look for a known quality.

Meanwhile, those in the company who are using the tool will be more willing to overlook price to have the newest features or functionality. They can see the cost savings inherent in a more adaptable platform.

Many companies are having this battle over business messaging platforms with the need to collaborate remotely.

Some IT departments are likely to push for Microsoft Teams as the collaboration platform of the company, as they already have longstanding relationships with Microsoft (MSFT) through the company's Office suite. Microsoft would certainly prefer they do so...

However, many users view Microsoft Teams as clunky, and would rather use a slimmer platform such as those from Slack Technologies (WORK) or Zoom Video Communications (ZM). These are the upstart competitors who compete with Microsoft for different parts of the remote collaboration ecosystem.

This isn't a new issue, either... IT and sales staff drew battle lines over Salesforce (CRM) versus Oracle (ORCL) and other legacy platforms for the adoption of customer relationship management platforms over the past two decades.

As the world of big data and artificial intelligence ("AI") tools has surged over the past few years, the scope of this back-and-forth between suppliers and stakeholders inside companies has grown.

When managing information, modern firms need to be able to sort through huge amounts of data to drill into trends and insights.

Two broad solutions have emerged in this market: off-the-shelf software and customized solutions for an individual firm. Alteryx (AYX) is currently leading the charge on providing tailor-made analysis solutions for corporate customers.

However, for an IT staff to support pursuing a solution from Alteryx, it would need to trust that Alteryx will still be around in a few years to support the platform... and that it won't be saddled with a platform that has no support when they encounter issues.

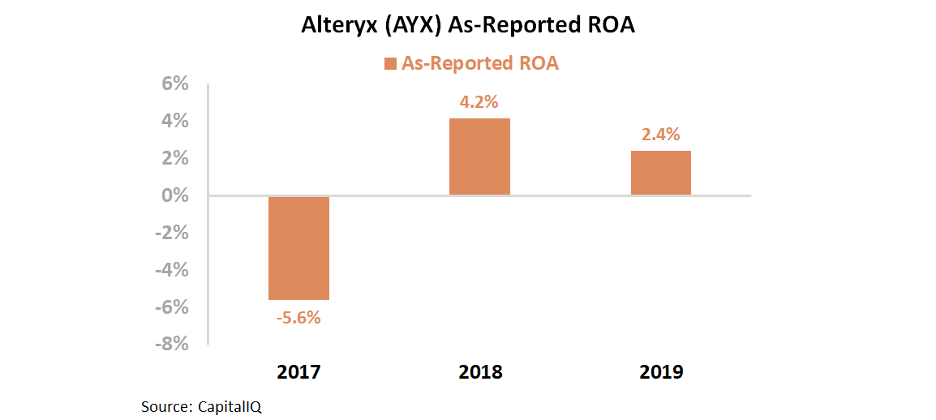

Looking at Alteryx's as-reported return on assets ("ROA"), this fear isn't unwarranted. As you can see below, Alteryx's as-reported ROA is below cost-of-capital levels. It was negative in 2017... and since flipping positive, it has never broken even 5% levels. That's weak profitability for such a theoretically innovative firm.

Potential customers and investors may be turned off from such paltry returns considering that Alteryx is currently the largest company in the custom data solutions space. If Alteryx is losing the sourcing battle, IT departments might consider simply going with a cheaper, off-the-shelf solution instead.

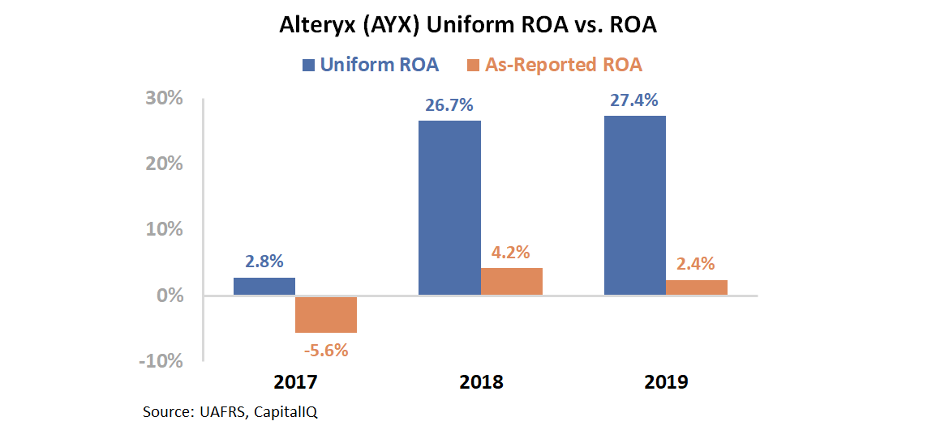

And yet, Alteryx's true performance is fogged by as-reported accounting distortions. Due to GAAP treatment around excess cash and R&D spend among other distortions, Alteryx's asset base has been seriously misstated.

Once we are able to look at Alteryx's real performance, a much stronger picture emerges. Rather than seeing near-zero ROAs, the company has been hugely profitable. From 2017 to 2019, Alteryx's Uniform ROA has risen from 3% to 27%. Take a look...

By removing the veil of as-reported accounting, we can see a strong future for the firm. Rather than nearing the edge of bankruptcy, Alteryx has been winning its battle in the custom-built analytics space.

As the market becomes aware of Alteryx's recent success, investors and customers will feel more comfortable buying into a firm with such a strong operating performance.

Similar to Salesforce and Zoom, Alteryx is winning the battle against the tech goliaths... but you wouldn't be able to see it without Uniform Accounting.

Regards,

Rob Spivey

July 24, 2020

It's your final opportunity to explore the 'Challenger Deep' with us...

It's your final opportunity to explore the 'Challenger Deep' with us...