This year, momentum isn't in our favor...

This year, momentum isn't in our favor...

The Federal Reserve isn't budging on interest rates. Instead of easing credit availability, it's holding strong at its tightest policy rates in some time.

At last week's Federal Open Market Committee meeting, the central bank held the target federal-funds rate at 5.25% to 5.5%... still at its peak since the early months of 2001.

With rates so high, individuals and businesses aren't as willing to borrow. And those who need to borrow aren't looking so good. That's why banks are getting nervous and are making it harder to access credit.

There are still two months left in the year. And with rates remaining at 20-year highs and lending standards tightening, it's only going to get harder for businesses to stay afloat.

Today, we'll examine another worrying sign for the U.S. economy.

The latest bankruptcy data wasn't pretty, to say the least...

The latest bankruptcy data wasn't pretty, to say the least...

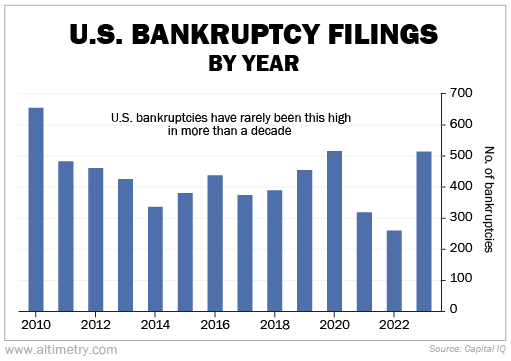

According to S&P Global Market Intelligence, corporate bankruptcies are running at a rate we haven't seen since 2020. And the numbers have only been higher one other time in the past 13 years.

Take a look...

Said another way, today's bankruptcy numbers look a lot like they did after periods of intense economic turmoil... during the pandemic in 2020 and the aftermath of the Great Recession in 2010.

When bankruptcies were this high through September 2010 and 2020, the Fed stepped in to soften the blow. It recognized the pain that credit issues were inflicting on the economy... introducing stimulus and bank-lending programs and cutting interest rates to near 0%.

Of course, some companies still went bankrupt toward the end of both years. But the Fed's assistance helped...

In 2010, the fourth quarter accounted for just 21% of the year's bankruptcies. And in 2020, the recovery was even stronger – only 19% of bankruptcies occurred between October and December.

In other words, the economy was improving in both cases.

Don't expect the same outcome today.

The Fed isn't backing down...

The Fed isn't backing down...

Employment numbers continue to crush expectations... signaling that the economy isn't slowing down as fast as the Fed would like.

Likewise, inflation is still above 3%. So while bankruptcies are on the rise, the Fed doesn't think its job is finished.

With credit tightening, it will be harder for businesses and consumers to get loans. Higher interest rates make it expensive for businesses to borrow money.

They might struggle to pay for things they need, like stock or wages. This setup is going to put even more pressure on corporate America heading into the new year.

This year looks a lot like 2010 and 2020... for now. But it's on track to get worse.

We wouldn't be surprised if more than 25% of the year's bankruptcies come in the final quarter. Be prepared for a sell-off as the market panics.

Regards,

Rob Spivey

November 6, 2023

This year, momentum isn't in our favor...

This year, momentum isn't in our favor...