Despite the rise in subscriptions, ad spending can't be stopped...

Despite the rise in subscriptions, ad spending can't be stopped...

Over the past few years, one of the most popular business models has been consumer subscriptions, with companies like streaming giant Netflix (NFLX) at the forefront.

Music services like Spotify (SPOT) and Apple (AAPL) Music – as well as news organizations – are transitioning away from monetization schemes like advertising and moving toward subscription models.

During the first weeks of the coronavirus pandemic, a rise in subscriptions and a fall in advertising spending had analysts proclaiming the end of traditional online ad placements.

While many things have been changed by the pandemic, ad spending wasn't one of them, at least permanently. As the New York Times explained recently, after companies put their finances in order in March and April last year, they began ramping up advertising spend well above pre-pandemic levels.

In the first quarter of 2021, Business Insider's ad revenue jumped 30% year over year. Bloomberg Media and Vice boasted 29% and 25% growth, respectively. Thanks to multiple high-profile interviews like the one with former president Donald Trump, Axios' ad revenue nearly doubled.

Management teams identified pandemic online shopping as a valuable market to tap into with advertising. Now, as the world reopens, travel and leisure companies looking to break back into the market are also following this line of spending.

As a result, industry experts expect digital advertising to grow 22% in 2021.

Unsurprisingly, the tech giants that dominate the advertising space are the biggest winners of this trend.

Roughly 87% of all of 2020's online advertising spending went directly into the pockets of Alphabet (GOOGL) or Facebook (FB).

But just focusing on the tech giants misses other big winners of this trend...

But just focusing on the tech giants misses other big winners of this trend...

The retail and manufacturing companies paying Google and Facebook for ad space also need someone to design their ads.

That means many of them turn to Omnicom (OMC).

It's one of the largest advertising holding companies. Omnicom oversees five major agency networks that directly manage more than 1,500 different ad agencies, all with specialties in different fields or advertising strategies.

Today, Omnicom is poised to benefit from this surge in ad space... which means investors are turning their eyes to this industry giant.

But before rushing into the stock, let's see what The Altimeter has to say...

But before rushing into the stock, let's see what The Altimeter has to say...

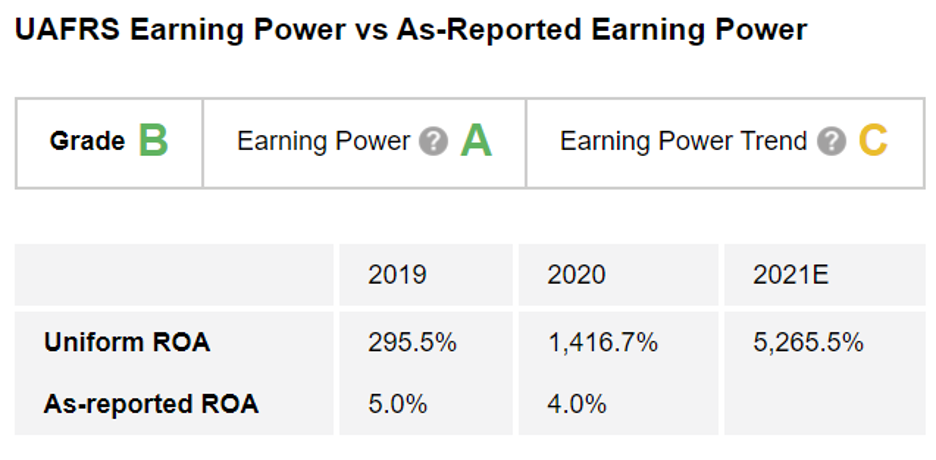

Using the power of Uniform Accounting – which removes the distortions in as-reported financial metrics – The Altimeter shows users easily digestible grades to rank stocks based on their real financials.

After we clean up the numbers, we can see that Omnicom's return on assets ("ROA") has been booming over the past few years thanks to its roll-up strategy.

But you wouldn't see it looking at the as-reported financials...

On a GAAP basis, Omnicom's ROA sat at 5% before the pandemic and fell to just 4%.

On the other hand, based on Uniform Accounting, the company's ROA actually jumped from 296% in 2019 to an eye-watering 1,416% last year!

Due to this strong profitability, Omnicom gets an "A" rating for Earning Power.

However, while its Uniform ROA is forecasted to climb to new heights, analysts are only expecting the company's Uniform earnings per share ("EPS") to reach 2019 levels. This means Omnicom gets a "C" for Earning Power Trend. Putting it all together, Omnicom earns an overall "B" for Performance.

Thanks to The Altimeter, we can see Omnicom's real performance numbers and understand that the company has generated massive ROAs.

These historical returns can put Omnicom in context... But they can't tell investors whether the stock is a buy.

These historical returns can put Omnicom in context... But they can't tell investors whether the stock is a buy.

For this, we need to turn to valuations. And once again, The Altimeter cuts through the accounting "noise" to show the real story of whether Omnicom is cheap or expensive.

Altimeter subscribers can click here to see how Omnicom is valued based on Uniform Accounting... and if the market has bought into this advertising trend already.

If you aren't an Altimeter subscriber yet, click here to find out how to gain access to the rest of the Uniform data for Omnicom... competitors like Interpublic Group of Companies (IPG)... digital ad giants Facebook and Alphabet... and the full grading for more than 4,000 other publicly traded companies.

Regards,

Rob Spivey

April 29, 2021

Despite the rise in subscriptions, ad spending can't be stopped...

Despite the rise in subscriptions, ad spending can't be stopped...