How can more debt be good?

How can more debt be good?

The Federal Reserve has thrown markets into a bit of a frenzy over the last several months.

As the economy has improved and no longer needs cheap loans, the Fed has indicated it will begin raising rates. While the market initially reacted poorly to the news, this is a sign the economy has a large amount of room to run.

It may finally be time for an uptick in investor sentiment with the release of recent results.

As macroeconomic data came in last month, along with banks reporting earnings, the Fed and banks are reporting on an incredibly bullish signal.

The bullish signal? Loans are growing.

After nearly two years of increased liquidity in the market, the largest banks in the nation showed more than 3% year-over-year growth.

While 3% isn't an eye-popping number, it is the first sign of acceleration in the loan market after borrowers had lowered their aggregate debts during the liquidity rush in 2020.

Implications of loan growth?

Implications of loan growth?

Increased debt is an incredibly bullish indicator, as it is a sign to investors that the economy is starting to pick up again.

For those thinking about the super leveraged balance sheets of firms in the mid-2000s before the Great Recession, it may be concerning to hear about increasing debt levels.

But the context of debt in 2007 and 2022 is completely different. Aggregate debt levels can measure this.

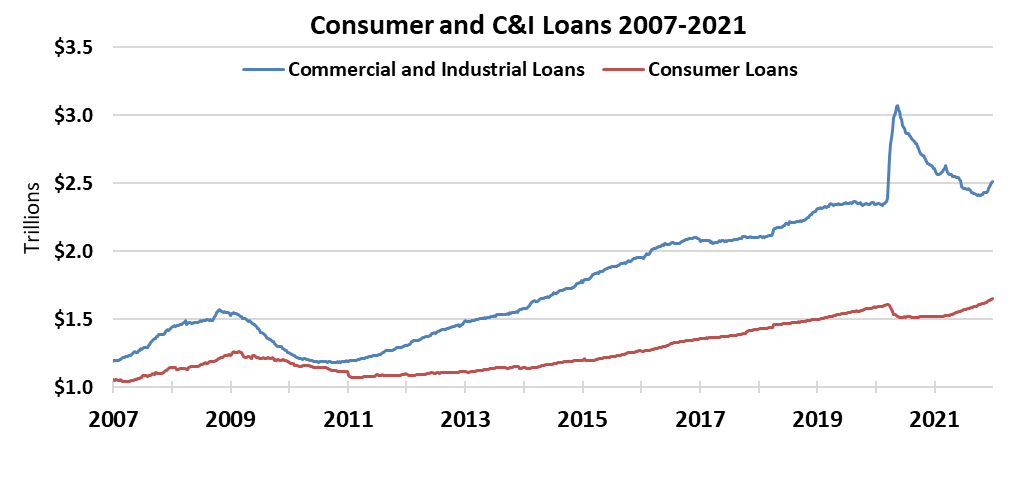

To explain why it serves as a bullish sign, a long-run chart of loan growth can visualize historical trends.

The chart below shows total consumer loans against commercial and industrial (C&I) loans. Looking at the C&I loans, you can see that the inflection in loan growth shows a different trend than 2020.

In 2020, C&I loan growth was caused by a sudden panic for companies to ensure they had enough liquidity as the economy slowed down overnight.

Meanwhile, the steadier inflection we're seeing today is a sign that businesses are starting to borrow to fuel growth.

The inflection consistently lines up with when a bull market gains traction because the economy takes off with it.

From looking at past cycles, there was a short-term spike in C&I loan growth in the middle of the crisis, driven primarily by a rush of liquidity.

The trend continues, as just like in previous cycles, there is a lull as borrowers digest their debts.

Banks during this time must also be patient as they work through their bad loans.

After this brief lull, borrowing starts to pick up again as companies look to invest in growth.

This investment in growth becomes a big catalyst for the economy, accelerating and bringing the market higher with it.

Does this data impact the Fed's actions?

Does this data impact the Fed's actions?

Much ink has been spilled about the high inflation rates that the economy has seen in recent times.

As the primary authority on managing these inflation levels, the Fed may be pursuing higher interest rates because they're looking at this same data.

They may be starting to get comfortable enough about the economy's health to start to fight inflation aggressively.

With the demand for loan growth back, interest rates do not need to be as low.

Rather, they're seeing tangible recovery.

Management teams will be in a growth phase...

Management teams will be in a growth phase...

As borrowers begin investing in the economy again, the economy is getting back on its own two feet.

And that acceleration is a reason to get bullish... and management confidence will kick off an epic capex cycle.

This coming capex boom has the potential to be a major tailwind for companies across all industries. This means capex in the sense of hardware, but also the software that powers that hardware, and many of those companies are Software as a Service ("SaaS") platforms.

That's why, in our recent backtest, we found that 96% of the time that a company transitioned to a SaaS model, the stock was up... with an average gain of 759%.

In this time-sensitive presentation, I walk you through the SaaS business model and show you how to get the name of the next big winner.

Watch it right here.

Regards,

Joel Litman

February 14, 2022

How can more debt be good?

How can more debt be good?