The past two-plus years have been a wasteland for venture capital ('VC')...

The past two-plus years have been a wasteland for venture capital ('VC')...

And early-stage venture investments in particular have gotten hammered.

Investors just aren't interested in these speculative bets anymore. In 2023, early-stage venture companies only raised $103 billion... less than half of the $229 billion they raised in 2021, and about 40% less than they raised in 2022.

Last year was the lowest fundraising year since 2017. The last time we saw venture funding dry up this fast was in the midst of the global financial crisis.

When the economy is on thin ice, investors aren't willing to count on companies that could be years from making real cash returns.

However, their fear is likely hurting them... because if you hang on for the long haul, venture investments can pay off big time.

Value investors know the best time to invest is when nobody else wants to...

Value investors know the best time to invest is when nobody else wants to...

This advice is easy enough for people to remember... when it comes to profitable companies.

And we get their logic. As a value investor, you want to buy into enterprises that already have cash flows. It's a lot safer to bet on a company that has already started to prove itself.

However, times like these are ideal for considering venture-like investments... the speculative bets you might not have thought about before.

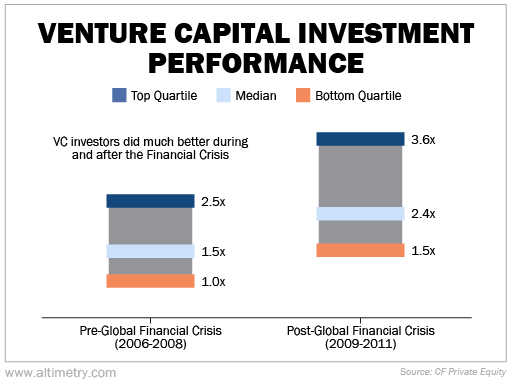

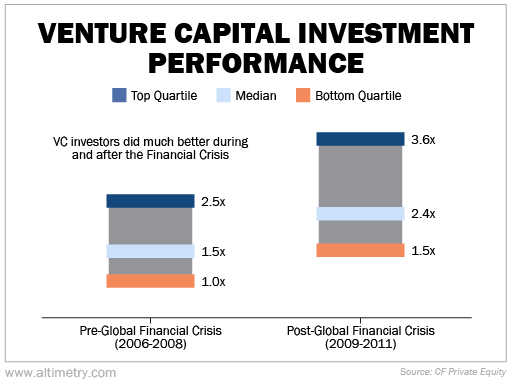

Take a look at the following chart. It shows the range of outcomes for VC investments, expressed in multiples.

A 1 times multiple means you made your money back... and 2 times means you doubled your investment.

As you can see, starting in 2009, VC investors saw significantly better returns than those who bought in before the crisis...

VC returned an average of 1.5 times its original investment in the three years leading up to the Great Recession. Those who bought in at the bottom booked an average return closer to 2.4 times.

If you're willing to be patient and you don't follow the crowd, you'll be rewarded.

Folks are worried venture capital is doomed...

Folks are worried venture capital is doomed...

VC-backed companies lost easy access to capital as the Federal Reserve hiked interest rates. This credit tightening led to around 3,200 startups failing last year, destroying more than $27 billion in venture funding.

And with that, venture funding has come to a screeching halt. That's not stopping startups from trying, though...

Just because investors are scared, it doesn't mean innovative startups aren't launching. This is the type of environment to be betting on those startups.

Regards,

Joel Litman

April 4, 2024

P.S. Even in the public markets, investors have shied away from companies that aren't yet making money... leaving some of those stocks worth less than the cash on their balance sheets.

While some of these businesses may burn through their cash with nothing to show for it... others will go on to be big winners. Our team dug through one specific, unloved sector to find the companies we think could be the next multibaggers.

Until midnight tonight, you can claim access to our very best invitation – which includes $8,899 in research and free bonuses at a fraction of the price. Click here before it goes offline.

The past two-plus years have been a wasteland for venture capital ('VC')...

The past two-plus years have been a wasteland for venture capital ('VC')...