Kroger (KR) is on the verge of becoming the biggest grocery chain in the country...

Kroger (KR) is on the verge of becoming the biggest grocery chain in the country...

The company just announced that it's acquiring Albertsons (ACI), the fifth-largest U.S. chain, for $25 billion. (Kroger currently ranks fourth.)

The purchase means it will control not only Kroger and Albertsons stores, but also Safeway, Shaw's, and Ralphs.

But Kroger is already preparing to face a lot of backlash – and plenty of speedbumps.

Management doesn't think the deal will close until at least 2024 because it requires so much regulatory approval. And Kroger will probably have to sell parts of the business to avoid being considered a monopoly in the eyes of regulators.

Kroger said this merger would deliver $500 million in cost savings, which it would pass on directly to consumers. That sounds like good news, considering a trip to the grocery store costs an average of 13% more than it did last year.

In reality, mom-and-pop stores might be forced to raise prices to compete. The best way to keep prices low is healthy competition. So while the deal might help Kroger compete with companies bigger than it, like Walmart (WMT) and Amazon (AMZN), it will also crush competition below it.

It's hard enough for local grocery stores as-is. Grocery stores are notoriously fickle. Food waste and pricing pressures make it tough to earn a good margin.

This merger could make the grocery industry so concentrated that it wipes out the small players. And as we said, that's assuming the post-merger Kroger gets to keep all its stores in the first place.

Kroger likely wants the deal to go through because Albertsons is a better business...

Kroger likely wants the deal to go through because Albertsons is a better business...

Kroger's Uniform return on assets ("ROA") is just 6% today. That's right around cost of capital... and about half of the corporate average.

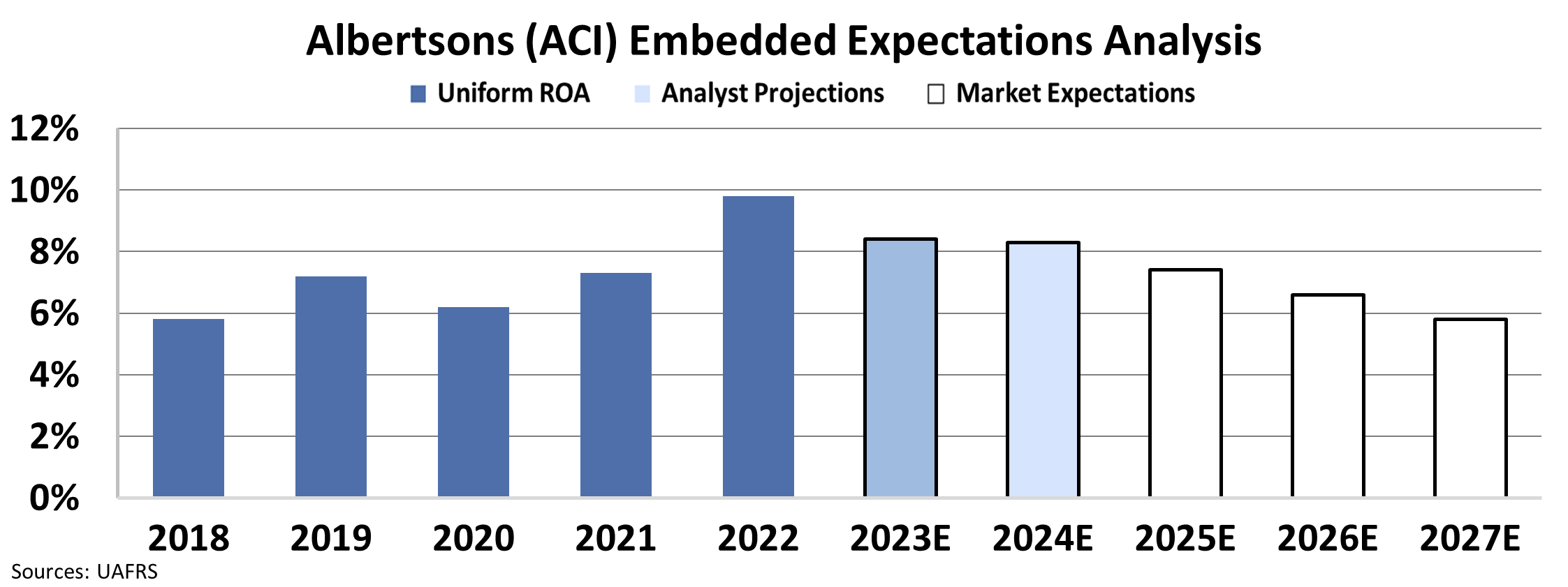

Albertsons' Uniform ROA has been between 6% and 10% over the past five years. It sits at 8% today.

But the deal might not be the boost the company was hoping for.

If regulators force Kroger to sell too much of the business, it could defeat the purpose. This seems increasingly likely, especially in areas where it has a big presence. That will make it harder to generate strong returns.

The market seems to get the picture...

We can see this using our Embedded Expectations Analysis ("EEA") framework... which uses Uniform Accounting to show us exactly what the market expects from a company based on its current stock price.

In the following chart, the dark blue bars represent Albertsons' historical ROA. The light blue bars are Wall Street analysts' ROA expectations for the next two years. And the white bars are the market's five-year ROA expectations.

As you can see, the market doesn't have high expectations for the post-merger Albertsons...

Since the deal was announced, Albertsons' stock has dropped 21%. Investors think Kroger's business will drag Albertsons down... rather than Albertsons pulling Kroger up. They believe Albertsons' Uniform ROA will fall back below 6% by 2027.

This could mean one of two things...

This could mean one of two things...

Either regulators will shred any value out of this deal, or Kroger is buying Albertsons for a steal.

If Albertsons' Uniform ROA remains at 10% after the deal closes, it will have beaten the market's expectations. But it's too early to tell how this will play out.

The deal is in the early stages of what could be a multiyear regulatory process. So it's still possible that the market could change its view.

In the meantime, Kroger faces a steep uphill battle to get any value from the acquisition.

This isn't the time to bet against regulators. It could be well over a year until we know how the deal will turn out.

Regards,

Rob Spivey

October 27, 2022

Kroger (KR) is on the verge of becoming the biggest grocery chain in the country...

Kroger (KR) is on the verge of becoming the biggest grocery chain in the country...