Jamie Dimon isn't going anywhere...

Jamie Dimon isn't going anywhere...

Investors in JPMorgan Chase (JPM) got great news earlier this month when CEO Jamie Dimon announced that even after he eventually steps down from being CEO, he'll remain a steadying hand.

Dimon has been the head of the U.S.'s largest and most profitable lender since 2005 and chairman of the board since 2006. However, even after he retires as CEO, he plans on staying in the chairman position.

Dimon has been one of the most influential figures in the financial industry for many years, having earned the reputation as one of the toughest and most successful CEOs on Wall Street.

Even though the "London Whale" trading loss incident occurred under his watch, which recorded a $6.2 billion loss for the bank in 2012, Jamie Dimon is well-known and respected for his strict risk management approach.

He protected the bank against the 2008 financial crash with his move to unload $12 billion of subprime mortgages in 2006.

Thanks to his vision and disciplined approach, JPMorgan Chase outmaneuvered its rivals during the 2008 financial crisis and has become the world's biggest bank by market capitalization.

His influence has been so important for the firm that shareholders are now concerned about the post-Dimon era.

Investors have a reason to hold onto Dimon beyond just sentiment...

Investors have a reason to hold onto Dimon beyond just sentiment...

Considering how dominant JPMorgan has been with Dimon at its head, investors should be ecstatic that Dimon isn't jumping ship anytime soon.

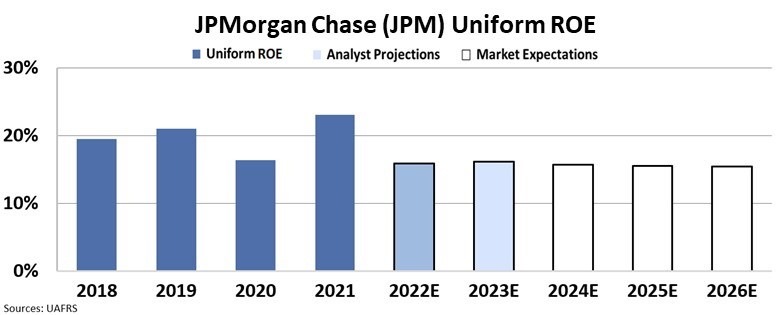

The average bank's Uniform return on equity ("ROE") hovers between 12% to 15%.

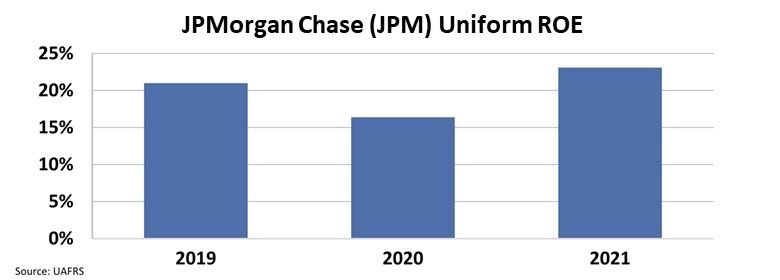

Yet over the past 10 years, JPMorgan has consistently seen ROE above that. Even as the bank took a hit in 2020 because of coronavirus-related issues, Dimon was able to quickly turn the wheel around to a staggering 23% Uniform ROE in 2021.

Dimon's leadership has helped propel the bank to greater heights... Even at its lowest point in the past three years, JPMorgan saw above average returns for a bank.

However, the market is pricing this magic to fade...

However, the market is pricing this magic to fade...

By utilizing our Embedded Expectations Analysis ("EEA") framework, we can see what investors expect JPMorgan to do at the current stock price.

Stock valuations are typically determined using a discounted cash flow ("DCF") model, which makes assumptions about the future and produces the "intrinsic value" of the stock.

Here at Altimetry, we know models with garbage-in assumptions based on distorted GAAP metrics only come out as garbage. Therefore, we use the current stock price with our EEA to determine what returns the market should expect.

The market clearly understands the value Dimon brings to JPMorgan, as it's pricing in ROE to drop to 16% levels going forward.

While that's still above average bank levels, it's not quite as robust as what JPMorgan has seen in the past.

The market is scared that without Dimon as CEO, JPMorgan won't be able to maintain the returns it's known for and its leading position within the banking world.

However, as Dimon recently indicated, he doesn't plan on leaving the bank anytime soon, even if he does step down as CEO. That means the market may be too pessimistic about the bank's prospects in the next few years.

Regards,

Rob Spivey

April 20, 2022

Jamie Dimon isn't going anywhere...

Jamie Dimon isn't going anywhere...