After 35 years, Japan's stock market has finally reached a new all-time high...

After 35 years, Japan's stock market has finally reached a new all-time high...

The Nikkei 225 Index – which serves as Japan's version of the S&P 500 Index – finished last Thursday at 39,098.68. Its prior peak was 38,915.87, which it reached in 1989. In other words, Japan's stock market has pretty much been stagnant for the past three decades.

While the country is still one of the world's largest economies, its glory days are clearly behind it...

In addition to a sleepy stock market, Japan also has the fastest-aging population. More than 1 in 10 people are aged 80 or older. Plus, the country has one of the lowest birth rates in the world. It has fallen from about 1.6 births per woman in 1989 to just 1.3 today.

Those decades of sluggish growth are now finally catching up with Japan...

According to the Recruit Works Institute, the country is on the verge of a massive labor shortage. Japan's elderly population (those aged 65 and older) is set to peak in 2042. Meanwhile, its working-age population is rapidly declining. The institute estimates that Japan will be short 11 million workers by 2040.

Unfortunately, Japan's economy is already feeling the effects of that shortage today, with essential sectors like nursing, transportation, and even education falling behind.

As we'll discuss, Japan is racing to solve its demographic problem in a new and innovative way... and one company in particular is likely to be a big winner as a result.

Japan is replacing workers with robots and 'avatars'...

Japan is replacing workers with robots and 'avatars'...

It's a bold move – and one that's taking place across various key sectors, like construction, agriculture, and automotive.

Robots are automating assembly processes in factories... tending to and harvesting rice fields... and helping move vehicles around at car dealerships.

And with the growth of artificial intelligence ("AI"), they're even replacing jobs in customer service... One convenience store in Tokyo uses a technology called an "avatar" to greet customers and offer them advice on what products to buy.

The avatar is displayed on a 4-foot screen and is operated by a remote worker. Eventually, the store plans to have one person controlling several avatars at the same time. That would allow it to more easily staff night shifts and rural locations.

Japanese companies are scrambling to invest in this technology – and they aren't alone...

Many countries in Asia are also struggling with labor shortages and an aging population.

China's population, for instance, is aging rapidly after years of the "one-child policy." And South Korea, which has the lowest birth rate in the world, is forecast to become the "most aged" population by 2044.

As this trend continues, companies that work on robotics and avatars have a major opportunity to capitalize...

Rockwell Automation (ROK) is a great example...

Rockwell Automation (ROK) is a great example...

It is one of the largest robotics companies in the world, specializing in machines and robots that automate industrial processes.

Its products are exactly what nations like Japan rely on as their workforces get older. In fact, Rockwell gets roughly 15% of its revenue from Asia.

Historically, business has proven stable, yet strong...

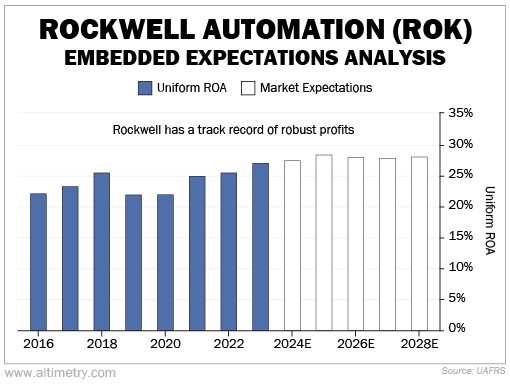

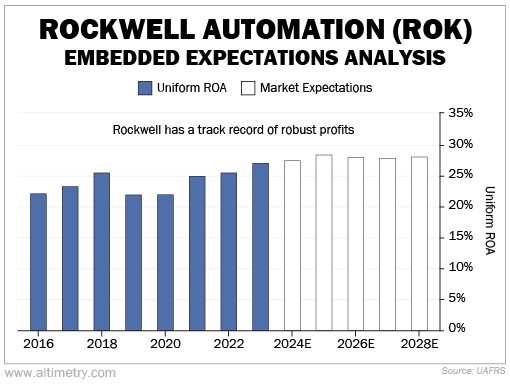

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Over the past eight years, Rockwell's Uniform return on assets ("ROA") has steadily risen from already robust levels. Its Uniform ROA has climbed from around 22% in 2016 to 27% in 2023.

Take a look...

As countries like Japan continue investing in automation, Rockwell's Uniform ROA should keep expanding. And yet, the market is pricing in Uniform ROA to pretty much remain flat from here... only reaching 28% by 2028.

Investors are completely overlooking the huge tailwinds behind the automation trend.

They're giving all of their attention to the big AI plays... and sleeping on companies like Rockwell that are positioned for huge profits.

It's only a matter of time before they realize the massive opportunity in front of them.

Regards,

Joel Litman

February 27, 2024

After 35 years, Japan's stock market has finally reached a new all-time high...

After 35 years, Japan's stock market has finally reached a new all-time high...