The market has done a little too well lately...

The market has done a little too well lately...

Ever since AI took center stage, stocks have been on a near-one-way trip higher. The S&P 500 has soared more than 60% in the past two years, and more than 25% this year alone.

Considering the average annualized return of the index is 9.8%, that's pretty incredible.

It's even more impressive when you consider the many challenges the market has faced... like sky-high interest rates, growing default risks, and a contentious presidential election.

When the market rallies so much for so long, investors start to get uneasy. They wonder if this persistent calm is setting them up for a raging storm in the near future.

Regular readers already know gold has been quietly gaining value in 2024. The popularity of the so-called "safe havens" is a sure sign folks don't trust this rally.

However, as we'll explain today, you don't need to worry about the market's ups and downs – at least, not if you're managing your money right...

The stock market is great for generating wealth... as long as you keep your sense of time...

The stock market is great for generating wealth... as long as you keep your sense of time...

By that, we mean you should only invest money in the stock market that you can afford to leave untouched for the long term. (And by that, we mean at least a decade.)

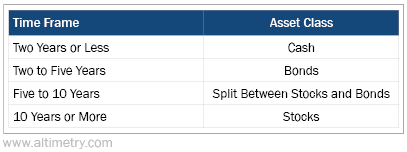

The markets are volatile. If you invest money in them, you might not earn it back in less than 10 years. That's why savvy investors should allocate their money into four buckets.

We cover this strategy at length in the Timetable Investor – our monthly report covering macro market signals and our recommended allocation approach.

Here's how we break it down...

First, any money you need within the next two years should be kept in cash. There's no investment that can reliably ensure you'll earn your money back over such a short time frame.

The second bucket is bonds... and that's for money you'll need in two to five years. While bonds offer lower returns than stocks, they're better at protecting value over a five-year period.

For a broader timeline – five years to a decade – you should allocate your money between stocks and bonds based on your macroeconomic outlook. You might favor stocks if you're feeling bullish... and turn to bonds when you see warning signs in the market.

And as we said, when it comes to being "all in" on stocks, make sure you won't need that money for the next 10 years.

Historically speaking, stocks are the best asset class for wealth generation... as long as you stay invested for at least 10 years.

Historically speaking, stocks are the best asset class for wealth generation... as long as you stay invested for at least 10 years.

The longer the time horizon, the more clear the advantage.

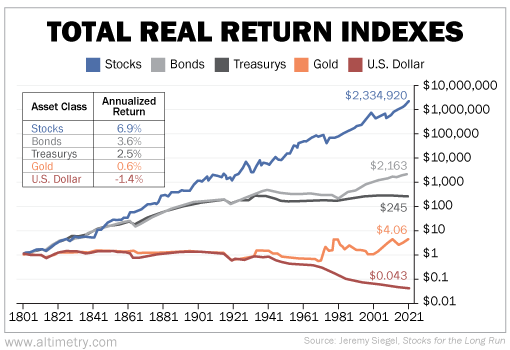

Take a look at this chart from the book Stocks for the Long Run by Wharton business school professor Jeremy Siegel. It shows more than 200 years of performance data for the top asset classes.

And as you can see, over the long term, stocks crush the competition...

The market's favorite safe haven, gold, doesn't even come even close to the annualized return of stocks. Neither does the U.S. dollar, which offers a negative 1.4% return compared with 6.9% for stocks.

Bonds are the closest asset class to stocks in the long term. However, the yearly return on stocks is still nearly double that of bonds.

And thanks to the compounding effect, $1 invested in stocks back in 1801 was worth $2,334,920 in 2021... while the same amount invested in bonds got you only $2,163.

Stocks simply have no competition in the long run...

Stocks simply have no competition in the long run...

Market valuations are at 24 times Uniform price-to-earnings (P/E). That's higher than the market's 20 times long-term average.

Even so, the market has continued its steady rally over the past two years. And the S&P 500 rose 4% in the five days after the election.

All these developments have made investors nervous. But remember, bull markets don't end simply because they've lasted a long time.

Tomorrow, we'll dive into a recent catalyst that could push this market hundreds of percent higher. As you'll see, the rally of the past two years is only the start.

There's no need to worry simply because the market is going strong. If you're following the right allocation strategy, just relax and enjoy the ride while stocks test new all-time highs.

Regards,

Rob Spivey

December 2, 2024

The market has done a little too well lately...

The market has done a little too well lately...