It's never a good sign when creditor-on-creditor fights start cropping up...

It's never a good sign when creditor-on-creditor fights start cropping up...

When creditors lend money to a company, they have one goal in mind... getting their initial investment back.

Creditor infighting is becoming a common occurrence these days. Creditors will do whatever it takes to make sure they get paid, even if it means other creditors are worse off.

Lenders are doing all they can to put themselves in the best position possible. So companies looking to issue debt have gotten creative about how they obtain funds.

They're even turning to loopholes and loose restrictions in loan contracts to do so.

Regular readers know we believe bonds have a place in just about every investor's portfolio. They offer stability you simply can't find with equities. And they provide shelter from the market's twists and turns.

But as with any investment, you need to understand what you're getting into before you put money to work. As we'll explain today, contracts are a creditor's best friend... and the only real protection in this fierce loan market.

Companies desperate for financing are turning to 'uptiering'...

Companies desperate for financing are turning to 'uptiering'...

Said another way, they'll negotiate with creditors to issue "super senior" debt that has priority over all existing debt on the books.

This strategy hurts all other creditors because their debt becomes less senior. And seniority is essential for creditors – especially when it comes to distressed debt.

The most senior creditors have claim to a company's assets when it goes bankrupt. Less-senior creditors get whatever's left once those folks are paid out.

And more often than not... there's nothing left.

That's why it's never a good sign when creditors start thinking about bankruptcy scenarios – or finding ways to protect their money over other creditors.

Now, some creditors are stepping up their contract game...

Now, some creditors are stepping up their contract game...

Back in July, once-public printing and packaging firm R.R. Donnelly issued a $1.5 billion bond to raise money for a buyout.

Not wanting to get tricked, investors took a stand against unfair practices between creditors. R.R. Donnelley had to change the bond documents to include new, wide-ranging rules.

These new rules are designed to prevent future debt deals that could favor some creditors at the expense of others.

In other words, R.R. Donnelly can't make any uptier deals with creditors if it needs debt in the future.

While creditors have protected themselves this time, creditor infighting has gotten extreme. It's a big red flag that this language is needed in today's contracts at all.

And that's because bond covenants have gotten looser and looser over the past decade...

And that's because bond covenants have gotten looser and looser over the past decade...

Covenants give creditors protection. They're legally binding clauses included in debt deals to protect the best interests of creditors.

Typically, covenants condition certain actions borrowers must take or avoid. They're designed to ensure the repayment of debt.

For example, covenants can require that a company keeps a certain amount of cash on hand at all times. Or they could dictate that a company can't exceed certain debt levels that would put it at risk of bankruptcy.

In the event of a violation, known as a "covenant breach," creditors have certain rights to intervene.

Covenants were much stronger and more protective several decades ago, especially before the Great Recession. But when interest rates fell to near zero, demand for cheap debt skyrocketed. And lenders struggled to maintain strict rules on their loans.

To attract more borrowers, lenders started offering fewer and less-restrictive covenants... known as "covenant-lite bonds." These are more favorable for companies, as they have fewer restrictions on how a business has to operate.

And since they provide limited protection for lenders, they're riskier from a creditor's perspective.

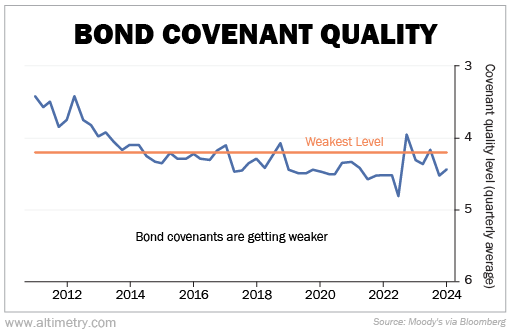

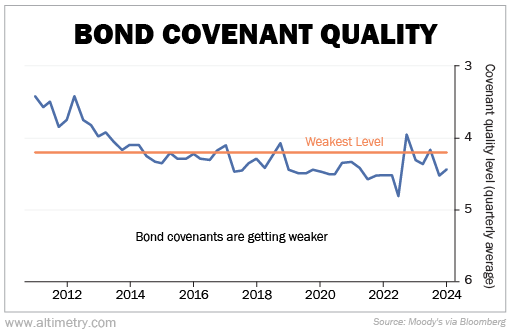

Covenant quality has been in a downtrend since 2011... and it really toppled in the first quarter of 2014.

Covenant quality has been in a downtrend since 2011... and it really toppled in the first quarter of 2014.

Since then, the quality of covenants has been consistently below what credit-ratings agency Moody's considers the weakest protection level.

Take a look...

Excluding some short-term outliers, quality has been weakening for the entire decade.

Although it seems alarming, this isn't always a big deal, especially in a strong economy. But it can lead to serious problems when the economy worsens and companies start struggling to pay debts.

Unprotective covenants leave creditors with limited options when companies go bankrupt. They could even result in creditors returning empty-handed from a debt deal.

And they can make it easier for companies to take on more debt or refinance in ways that favor certain lenders over others.

R.R. Donnelley was just the first step in shoring up credit agreements...

R.R. Donnelley was just the first step in shoring up credit agreements...

Now that the precedent is set, similar deals are expected to follow.

From our perspective, we're glad to see creditors standing up for their money. But this saga also tells us that you need to be careful where you invest in the credit space.

This is true now more than ever, as lenders are starting to get worried and protecting themselves from a wave of bankruptcies.

Hard times for companies could mean exciting opportunities for bond investors. Just make sure you read the fine print.

Regards,

Rob Spivey

September 23, 2024

It's never a good sign when creditor-on-creditor fights start cropping up...

It's never a good sign when creditor-on-creditor fights start cropping up...