Three weeks after the Francis Scott Key Bridge collapsed, Baltimore is still picking itself up...

Three weeks after the Francis Scott Key Bridge collapsed, Baltimore is still picking itself up...

As you likely know, a container ship called the Dali lost power as it was trying to leave the Port of Baltimore in the early hours of March 26.

The crew lost control of the vessel as it was heading straight for the bridge... which was both a city landmark and a critical commuter passageway.

The Dali crew was able to issue a mayday call about two minutes before the crash. But while emergency responders blocked traffic, they couldn't alert the crew of eight construction workers who were filling potholes on the bridge.

Rescue crews were only able to save two of the eight men after the collapse. They've located the bodies of four other victims so far.

Our parent company is based in Baltimore. So this tragedy hit close to home for us. The city's recovery is going to be a long, painful process.

There has been a lot of discussion about what went wrong... what it will take to repair the bridge... and how to ensure a disaster like this doesn't happen again. We expect these important conversations to continue for some time.

Today, we want to focus on two companies that are supporting the city in the meantime – helping to keep the local economy up and running during recovery.

Baltimore is an export powerhouse...

Baltimore is an export powerhouse...

The Key Bridge collapse completely blocked all shipments to and from the Port of Baltimore, which is the 17th-largest port in the country.

Since then, the port remains almost entirely blocked off for cleanup. Remnants of the bridge are still trapped underwater. The Dali is still stuck with the crew onboard.

The port won't be back up and running for some time. All traffic was suspended indefinitely, and it seems like only a limited amount will open up this month.

All that cargo still has places to be, though.

Companies are scrambling to reroute their goods to other East Coast ports. That's going to cause delays... lost sales... and headaches for cargo companies and their customers.

Norfolk Southern (NSC) and CSX (CSX) dominate East Coast freight. These rail companies deliver a lot of cargo to the Port of Baltimore... and are now working overtime to keep the industry stable.

Particularly in Baltimore, Norfolk Southern and CSX deal with pretty much all coal exports...

Particularly in Baltimore, Norfolk Southern and CSX deal with pretty much all coal exports...

Coal is still the second-largest revenue source for railroads in the U.S. And Baltimore is the second-largest coal export terminal in the country.

Both companies were quick to respond once port activity was suspended... adding extra capacity to keep goods flowing.

Norfolk Southern launched a dedicated line between the Seagirt Marine Terminal in Baltimore and the Elizabeth Marine Terminal at the Port of New York and New Jersey.

CSX operates the Curtis Bay Coal Piers near the Port of Baltimore. It donated $50,000 to help fund Baltimore's recovery efforts. And it opened a similar dedicated line.

Without these railway operators' efforts, the port wouldn't be able to operate at all. It could lead to inflation and shortages in industries like coal and cars... the types of goods typically routed through Baltimore.

That's not to mention the dockworkers who could lose their jobs if the port can't get back on its feet.

Efforts to mitigate shipping disruptions probably won't mean a huge transformation for either business...

Efforts to mitigate shipping disruptions probably won't mean a huge transformation for either business...

That said, they'll undoubtedly benefit from their own responses. Norfolk Southern and CSX now own the temporary shipping routes for as long as they're needed.

Over the next few quarters, both companies could publish surprisingly high earnings results... driving Uniform return on assets ("ROA") higher for at least a year.

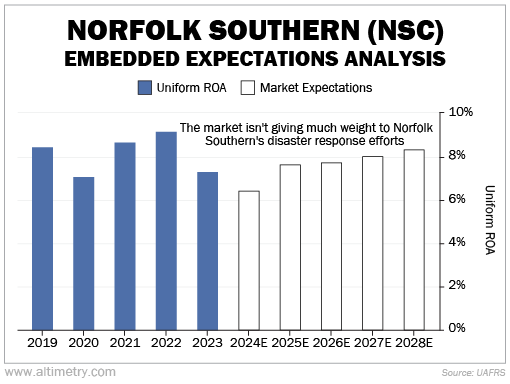

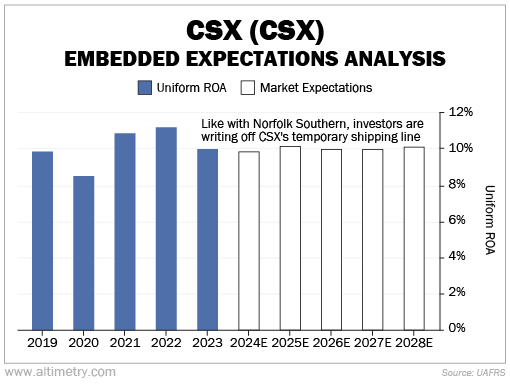

Yet even with these changes already in place, the market doesn't expect much benefit for Norfolk Southern and CSX.

We can see this through our Embedded Expectations Analysis ("EEA") framework. We use these companies' current stock prices to calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well these companies have to perform in the future to be worth what the market is paying for them today.

Investors expect Norfolk Southern to stay at 7% to 8% Uniform ROA levels going forward. That's around where its returns have been for the past five years...

Said another way, investors aren't paying much attention to Norfolk Southern's efforts to keep Baltimore cargo moving.

It's a similar story for CSX. This is a slightly more profitable business, averaging about 10% returns over the past five years. Investors think it'll stay put.

Take a look...

The Port of Baltimore won't be back to normal for a while...

The Port of Baltimore won't be back to normal for a while...

And it will take even longer for the city to recover from this shock. There are still a lot of unanswered questions... and grieving families in need of support.

It could be years before the bridge itself is rebuilt.

In the meantime, businesses like Norfolk Southern and CSX are helping ensure ground activity stays up to speed.

By helping keep local workers employed, they're lightening the economic burden. And their businesses will likely benefit in the process.

Wishing you love, joy, and peace,

Joel

April 19, 2024

Three weeks after the Francis Scott Key Bridge collapsed, Baltimore is still picking itself up...

Three weeks after the Francis Scott Key Bridge collapsed, Baltimore is still picking itself up...