Deals, deals, and more deals...

Deals, deals, and more deals...

The holiday shopping season is in full swing with Christmas right around the corner.

That means America's retailers are starting to bombard shoppers with deals.

In fact, CNN recently published a list of more than 250 Cyber Monday deals still open even after the online shopping world's biggest day of the year has already passed.

You've probably noticed that those e-mails are piling up even quicker as we enter the heart of the holiday shopping season.

One company is behind all of those deals reaching your inbox...

One company is behind all of those deals reaching your inbox...

If you've paid close attention to the fine print, you might realize something interesting about all of these promotions.

Many of the retailers bombarding you with holiday specials use the same templates and formatting. This is because retail companies outsource these e-mails to just a few companies.

One of the most popular is HubSpot (HUBS). The company offers one of the best cloud-based customer relationship management ("CRM") platforms on the market.

A CRM platform is heavily focused on marketing solutions, helping its customers with website content management and marketing automation around e-mail campaigns.

HubSpot has become extremely popular with businesses over the past few years.

One reason is simplicity. Businesses love its platform because it's so easy to use and deploy.

HubSpot focuses on the parts of a CRM platform that users care about most, including everything from social media and blogging to analytics and reporting.

But what makes HubSpot so powerful is the favorable economics that its Software as a Service ("SaaS") model offers.

Having a SaaS model means businesses that use HubSpot don't have to install software on their own servers or manage their own databases.

This investment-light approach makes the CRM and campaign platform much easier to adopt, even for smaller businesses with fewer resources.

In other words, HubSpot enables better customer management across the business spectrum as its SaaS offerings are easy to use and adopt.

As businesses continue to turn to the Internet for e-commerce solutions, each holiday season will only become more and more focused on customer data management.

But you wouldn't know HubSpot is thriving if you just looked at as-reported data...

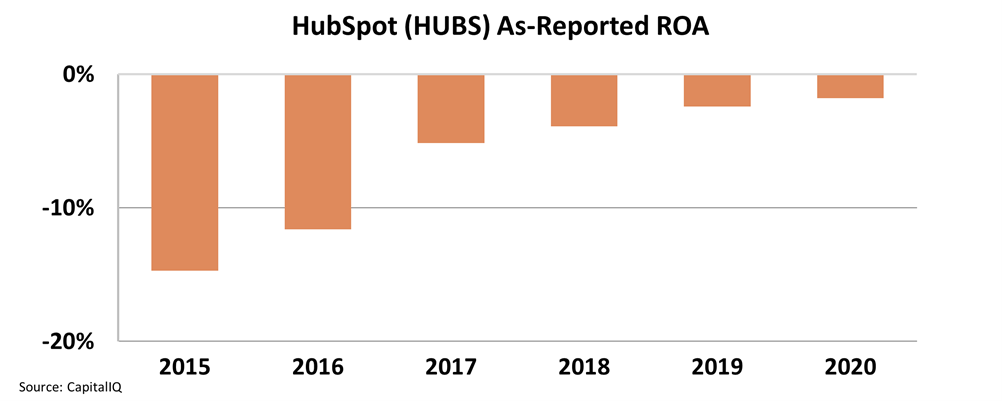

That's because HubSpot's as-reported return on assets ("ROA") has been negative every year since going public back in 2014. Instead of looking like a cutting-edge tech business, as-reported metrics continue to paint the company as a cash-burner. Take a look...

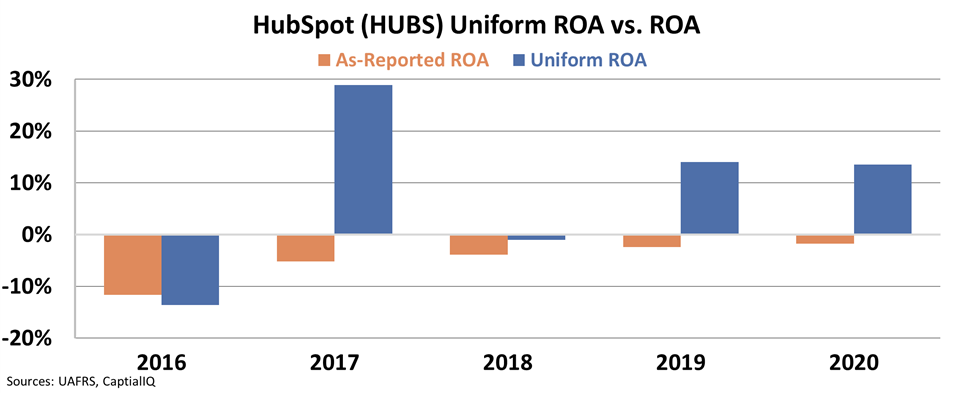

In reality, Uniform Accounting shows us that HubSpot's Uniform ROA turned positive for the first time in 2017, before dropping back into negative territory in 2018. But in 2019, Uniform ROA turned positive again, and the company maintained its double-digit ROAs last year...

HubSpot's double-digit returns over the past two years are a strong testament to its ability to churn out cash with its high-margin SaaS business.

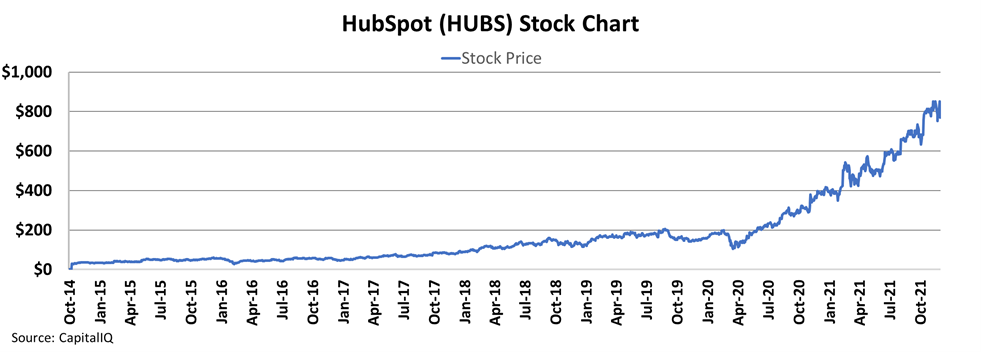

The market has quickly recognized the potential HubSpot offers as a big winner of these trends. That's why the stock has rocketed higher from $30 in 2014 to around $700 today, a gain of more than 2,200% in just seven years...

The biggest gains have already happened for HubSpot, but we think we've found the next big SaaS winner...

The biggest gains have already happened for HubSpot, but we think we've found the next big SaaS winner...

The past few years have shown that the right SaaS businesses can benefit investors immensely. As we've discussed in recent essays, it's what has powered shares of e-commerce company Shopify (SHOP) and software company Adobe (ADBE) higher in recent years.

HubSpot has joined a long list of tech stocks that have skyrocketed – including Microsoft (MSFT), Salesforce (CRM), and more – thanks to the power of the SaaS business model.

My team and I recently crunched the numbers, and 72 of the last 75 times a tech company pivoted to the SaaS model, shares went up – a 96% success rate. Better still, the average gain was 759%... including winners of 2,710%, 3,093%, 5,530%, 3,233%, and 2,694%, among others.

This is no coincidence, and I believe it's about to happen again with a little-known tech company that could see its shares rise 500%, 1,000%, or maybe even 2,000% in the next few years. Get the details here.

Regards,

Joel Litman

December 8, 2021

Deals, deals, and more deals...

Deals, deals, and more deals...