Joel's note: Going forward, each Thursday, we'll highlight one company for which we're seeing interesting signals in The Altimeter – our tool that provides grades for stocks based on their true fundamentals and the market's misleading valuation.

By putting the power of Uniform Accounting directly into users' hands, The Altimeter can help identify which stocks could soon skyrocket... and which ones are ticking time bombs.

Consolidation is a key concept for determining which companies will make it through the current economic environment...

Consolidation is a key concept for determining which companies will make it through the current economic environment...

Businesses with strong balance sheets in challenged industries can be strategic acquirers and thus emerge even stronger from troubled times.

As smaller companies struggle during the coronavirus pandemic, a larger and well-capitalized player can "roll up" weaker competitors at low valuations.

Right now, we're seeing this consolidation in the book publishing industry. Seeking a fresh infusion of cash to invest in its video-streaming capabilities, media giant ViacomCBS (VIAC) is in the process of selling its publishing unit Simon & Schuster.

The sale kicked off a bidding war between two larger players looking to consolidate within the industry: Bertelsmann – owner of Penguin Random House – and News Corp (NWSA).

Bertelsmann gained the upper hand with a massive $2.2 billion offer. A merger would give it one-third of the English-language book sales market. This is more than twice the size of its closest rival, Hachette Livre – owned by Paris-based Lagardère – which also briefly put a bid in.

This bidding war highlights that the so-called death of book publishing may be exaggerated. The industry is consolidating around a few larger players... and if the Simon & Schuster acquisition makes it past regulators, it will lower the number of big players in the industry from five to four.

Furthermore, while most folks think that publisher revenues have been steadily collapsing, they've remained consistent over the past five years. It appears as though the publishing industry is stronger than its public perception would indicate.

If the overall publishing industry is still strong, the textbook and research journal space within it is changing...

If the overall publishing industry is still strong, the textbook and research journal space within it is changing...

Of all the areas of the publishing industry, one of the most resilient and highly profitable has been textbooks and research journals. Students continue to need textbooks, with new editions printed each year.

Additionally, research journals have seen a surge in 2020 due to the coronavirus. More research papers than ever are being consumed thanks to massive interest in the disease.

Today, one of the largest players in this space is John Wiley & Sons (JW-A). Commonly known as Wiley, the company is a multinational publisher with a focus on academic and instructional materials. It publishes both in print and electronic forms. Wiley also owns the popular "For Dummies" book series along with a myriad of other brands and alliances.

The company is focused on integrating digital technology with traditional print media... but as students have continued to transition to online textbooks, Wiley has been unable to monetize this new trend. Furthermore, as students share or buy used textbooks to save money, this puts increasing pressure on Wiley's profitability.

So to better understand how Wiley's stock price could be affected, let's turn to The Altimeter...

So to better understand how Wiley's stock price could be affected, let's turn to The Altimeter...

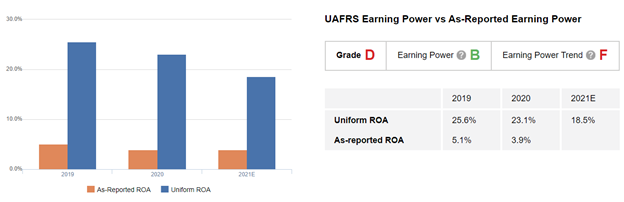

Wiley receives a "B" grade on its Earning Power, which is based on how profitable the business is. Wiley also boasts a Uniform return on assets ("ROA") of 23% – an impressive figure for a book publisher. That's also well above its as-reported ROA of 4%, which is distorted by GAAP metrics.

However, Wiley receives an "F" grade for its Earning Power trend. This represents where returns are headed in the short-term. Considering the reduced demand for textbooks as students adapt to online learning, this is no surprise... though not likely long-lived once the pandemic recedes.

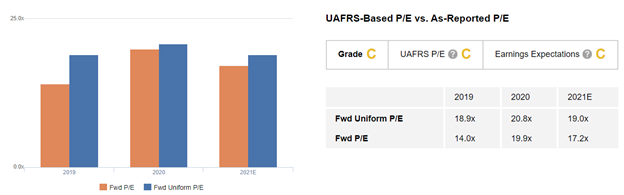

On a price-to-earnings (P/E) basis for valuations, Wiley also receives a "C" grade for both its Uniform P/E ratio and Uniform earnings growth expectations. The market expects Wiley's earnings per share ("EPS") to contract in the future, which is in line with analyst forecasts. Additionally, Wiley's Uniform P/E ratio this year is roughly in line with market averages, at 21 times.

This means Wiley's stock could see upside ahead if returns rebound and avoid the declines that the market expects. The publishing business has been resilient, with a steady stream of new publications each year.

Using The Altimeter, we can quickly understand how to make sense of a company's quality, earnings trends, valuations, and market expectations. These are the key drivers of a company's outlook... and what will ultimately power changes in the stock price.

Stay tuned to future Altimetry Daily Authority issues for more insights like this. And if you'd like to check out other publicly traded stocks using this framework, you can find out how to gain instant access to the grades of the more than 4,400 companies we cover in The Altimeter by clicking here.

Regards,

Joel Litman

December 10, 2020

P.S. What other industries do you think are ripe for consolidation in the current environment? Let us know at [email protected] and we might take a look from a Uniform Accounting perspective.

Consolidation is a key concept for determining which companies will make it through the current economic environment...

Consolidation is a key concept for determining which companies will make it through the current economic environment...