When Fred Reichheld joined Bain & Company in 1977, the firm was already growing fast...

When Fred Reichheld joined Bain & Company in 1977, the firm was already growing fast...

Most strategy consultants, like McKinsey or Boston Consulting, just offered companies advice and sent a bill.

Bain prided itself on going beyond that. It would come up with a plan, then help clients actually implement it. And it tended to work with one company per industry.

Bain's hands-on approach and slimmed-down customer base gave it an edge. But what really set it apart was Fred's focus on a unique business problem.

You see, he understood the importance of loyalty... both from customers and employees.

Fred knew it was crucial for Bain to have loyal and evangelical customers and employees.

His research showed it wasn't enough to keep customers satisfied. You had to provide them with a product and service worthy of loyalty. Doing so could help a company create a lasting competitive advantage.

Decades later, this strategy has transformed how many companies think about their businesses.

It also led to the development of a game-changing metric – Net Promoter Score ("NPS").

Today, we'll dig into NPS... and how it can be as important for investors as it is for companies.

NPS is at the heart of some of the most iconic companies' success stories...

NPS is at the heart of some of the most iconic companies' success stories...

Think Big Tech giant Apple (AAPL), credit-card mainstay American Express (AXP), and even privately owned clothing retailer L.L. Bean.

Reichheld created NPS to go beyond customer satisfaction and capture something more powerful – advocacy.

If you've ever used a service from any of these popular businesses, you've likely seen NPS in action. It involves asking customers one simple question...

How likely are you to recommend us to a friend or colleague?

Based on their answers, customers are categorized as Promoters (9-10), Passives (7-8), or Detractors (0-6).

A company's score is calculated by subtracting the percentage of Detractors from the percentage of Promoters. The higher the score, the stronger the advocacy – and the stronger the customer loyalty.

Apple in particular is a master of loyalty...

Apple in particular is a master of loyalty...

The company didn't just create great products like the iPhone and MacBook. It built a seamless ecosystem that locked users in.

Apple focuses on simplicity, sleek design... and delivering exactly what customers want. It has spent decades turning users into passionate advocates.

These aren't just loyal customers. They're the ones telling everyone they know to buy an iPhone.

That's NPS in action.

In 2023, the company reached an impressive NPS score of 61. And that advocacy has been a key driver of Apple's incredible stock growth and massive wealth creation over the past decade.

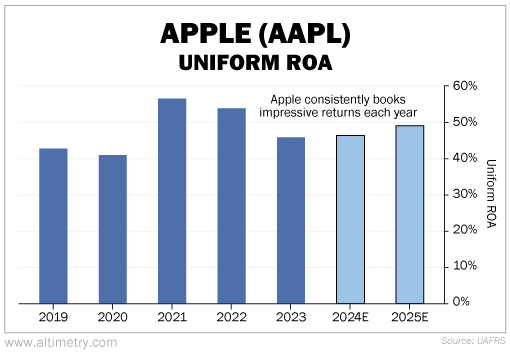

It produces some of the strongest Uniform return on assets ("ROA") scores in the Altimeter database, at more than 40% every year.

Take a look...

And Apple isn't the only company to harness the power of NPS.

American Express turned its focus on premium service into a loyal customer base that's quick to promote the brand. It had a score of 32 in 2023, in the top five for its industry.

L.L. Bean, with its famous lifetime guarantee, has won customer trust and built a deep well of loyalty. Its NPS score is a 53.

These companies didn't just focus on keeping customers happy. They turned customers into advocates. That's what keeps them at the top of their respective industries.

NPS isn't just a powerful tool for companies...

NPS isn't just a powerful tool for companies...

It's a critical metric for investors, too.

Businesses with a high or improving NPS relative to their peers have a strong competitive advantage. When customers are loyal enough to recommend your product, you've built a growth engine that's tough for competitors to replicate.

As you assess your portfolio, make sure NPS is part of your analysis. You can compare scores on websites like Comparably and CustomerGauge. Some companies also self-report.

A strong advocacy score can be an early indicator of sustained, long-term success.

On the other hand, if a company's NPS is stagnant or declining, it can be an early sign that loyalty – and future growth – may be slipping.

Regards,

Rob Spivey

September 13, 2024

When Fred Reichheld joined Bain & Company in 1977, the firm was already growing fast...

When Fred Reichheld joined Bain & Company in 1977, the firm was already growing fast...