Only the real-life Ari Gold could be so outrageous...

Only the real-life Ari Gold could be so outrageous...

Gold was a talent agent on the hit show Entourage. The show followed movie star Vince Chase and his hometown friends dealing with the ups and downs of life in Hollywood.

And if you've ever watched the show, you probably agree it's hard to imagine anyone acting the way Gold did.

He swore constantly. In one running gag, he regularly fired his assistant... only to hire him right back. When he retook his agency, he made his big reentrance armed with a paintball gun.

In short, his personality seemed made for TV. But as executive producer Mark Wahlberg will tell you, Ari Gold is based on a real person... Wahlberg's own agent, Ari Emanuel.

Emanuel is the man behind talent agency and content powerhouse Endeavor (EDR). He brought the company public a few years ago.

And he doesn't think the market understands how valuable his business is.

In the past few years, the company has grown by buying some big entertainment names... and yet the stock is down double digits from its peak. So Gold is working with private-equity ("PE") firm Silver Lake to take the company private again.

Today, we'll take a closer look at Endeavor to determine if the market is undervaluing Emanuel's company... and what it could mean for investors.

To Emanuel's credit, he has pushed the business beyond the traditional agency model...

To Emanuel's credit, he has pushed the business beyond the traditional agency model...

Emanuel is a big reason Endeavor has grown so much over the past decade. He was instrumental in the business's 2013 purchase of fellow agency IMG... making Endeavor one of the first agencies with exposure to esports.

Then in 2016, Endeavor bought the Ultimate Fighting Championship ("UFC"). UFC merged with World Wrestling Entertainment ("WWE") earlier this year. The post-merger company is now a fighting powerhouse called TKO, which Endeavor controls.

And all of these smart moves have led to fantastic growth. Revenue is up from just $3.6 billion in 2018 to $5.3 billion last year.

However, the stock has not done well since Endeavor went public in 2021. It peaked that December... and is down 30% since then.

That's why Emanuel wants to take the company private.

The market hasn't rewarded Endeavor for its massive growth and its solid profitability...

The market hasn't rewarded Endeavor for its massive growth and its solid profitability...

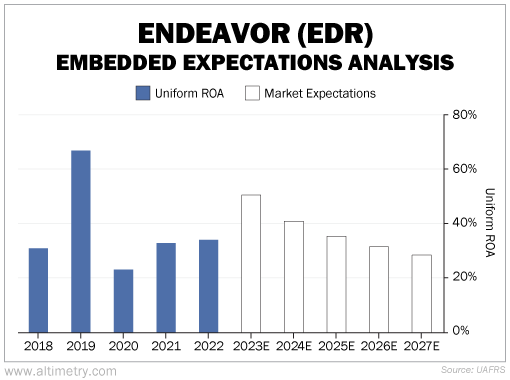

Over the past six years, Endeavor's Uniform return on assets ("ROA") has never been lower than 30%... except in 2020, when a lot of its clients weren't able to work at full capacity.

Even then, it locked in 23% returns... almost twice the 12% corporate average.

The market has decided Endeavor's history of strong returns isn't sustainable. We can see this through our Embedded Expectations Analysis ("EEA") framework...

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At the current stock price, the market expects Endeavor's Uniform ROA to fall below 28% by 2027. Take a look...

Said another way, investors believe Uniform ROA will fall below recent levels... forever.

Endeavor has been a strong and stable business for years. We expect Uniform ROA to remain above 30% at least.

And if Emanuel and Silver Lake take Endeavor private, share prices could change fast...

And if Emanuel and Silver Lake take Endeavor private, share prices could change fast...

Silver Lake is moving as fast as it can. It's in talks with Abu Dhabi-based wealth fund Mubadala Investment to secure funding.

If the discussion goes well, they could announce a deal any week now. And because Silver Lake and Emanuel are major shareholders, they aren't going to accept a deal at current prices. They’ll make sure it's worth their while.

We can get a rough estimate of a good valuation for the business using our EEA framework. Rather than calculating what shareholders are currently pricing in, we can input the company's average Uniform ROA... to see what the company should be worth if its performance remains flat.

Endeavor's stock should be worth more than $32 per share based on our 30% Uniform ROA projection. That's more than 30% higher than today's levels.

The good news for investors is that Endeavor's shares are undervalued... whether or not a deal ever gets announced.

That helps ensure the stock won't fall much if the company stays public. And shares could rise fast if the deal succeeds.

Regards,

Joel Litman

November 8, 2023

Only the real-life Ari Gold could be so outrageous...

Only the real-life Ari Gold could be so outrageous...