Sometimes artificial reality can tell us a lot about the real world...

Sometimes artificial reality can tell us a lot about the real world...

As we deal with the global coronavirus pandemic, one of the biggest issues for epidemiologists and everyone else trying to contain the spread of the disease is understanding human nature and how people will react to the disruption.

Fortunately, there aren't a lot of outbreaks like this in the real world. But that means there isn't a massive amount of data on human behavior in these situations.

But interestingly, in 2005, the online world offered an accidental window into human behavior in the midst of a pandemic.

In 2005 a coding bug started infecting players' characters in Activision Blizzard's (ATVI) online role-playing game World of Warcraft.

A spell would cause players' avatars to lose health as they were battling a "boss" character in the game. It was supposed to be confined to a specific area of the artificial world, but accidentally spread across the whole game.

As the bug arrived in large population centers, more powerful characters with more health weren't affected as badly, but weaker characters were wiped out.

Epidemiologists studied the outbreak afterwards and found that the patterns of behavior almost exactly matched both the actual pattern of infection – and the risks – of the bird flu and SARS outbreaks.

As players' avatars in the game would die and regenerate, they would almost immediately die again. There was nothing players could do. Many fled the game's cities and went into quarantine to protect themselves. Other players would act as healers to try to treat and save others. And on the other end of the spectrum, some players would go out of their way to try to infect others.

Many players soon began claiming they had the disease so others would just stay away from them, thus reducing the risk.

Just as tellingly, there were people who would show what epidemiologists termed the "stupid factor" – rushing in to see what was happening, only to infect themselves and spread the disease further.

From this data and data like it, public policy decisions have changed in ways that help save lives in real pandemics.

Sometimes reality reflects fiction as much as fiction reflects reality, and the virtual world can provide insights for the real world regarding important issues like those we're dealing with today.

The reward for investing in Internet companies comes with risk...

The reward for investing in Internet companies comes with risk...

Think back to 1999, when the bug that was on everyone's mind was Y2K – the fear that computers around the world would cease to work as machines reset their dates from '99 to '00.

This concern over a digital error was only one part of the fervor for the brave new world of the Internet. After the introduction of commercial broadband in the late '90s, Internet speeds weren't constricted by landline dial-up connections. Even though half of internet users still didn't have broadband as recently as 2007, the move was clearly in the direction of increased connectivity.

Broadband meant that traditional businesses could reach customers in new ways and allowed for whole new companies to be created. However, the excitement and novelty of e-commerce meant investors had a hard time valuing these businesses. In November 1998, the book retailer Books-A-Million launched a new website for selling their books online.

Over the course of just three days, the stock price of Books-A-Million rose from $3 per share to $47 per share – a nearly 1,500% increase. However, the bubble soon burst... with shares falling to $10 two weeks later and back to $3 by 2000.

At the height of the bubble in March 2000, network company Cisco (CSCO) was viewed as the provider of the underlying infrastructure that would power the internet revolution. Driven by excitement, Cisco's market cap surpassed Microsoft (MSFT) to reach $555 billion.

Based on its profitability levels, Cisco would need to see revenues approach astronomical levels to justify its stock price. One analyst went even said that to justify its valuations, Cisco's revenues would need to exceed the gross domestic product ("GDP") of the entire U.S.

These valuations were completely unreasonable... and yet it's hard to recognize a bubble while you're inside one. With any new technology comes uncertainty to its potential, and no investor wants to be on the sidelines and miss the next Cisco, Amazon (AMZN), or Google parent Alphabet (GOOGL).

This fear of missing out was on everyone's mind again in 2018, as chipmaker Nvidia (NVDA) reached record valuations...

By October of that year, the company had seen 20% growth over the previous three months on the back of excitement over its GPU development. Scientists, cryptocurrency miners, and PC gamers alike were clamoring for Nvidia's next chipset... and it seemed that its new highs of $290 were a bargain price to get in on the ground floor.

However, I was quoted in U.S. News and World Report in October about the unsustainability of these valuations. Nvidia's stock price was driven by excitement – not unlike Books-A-Million or Cisco. By Christmas, NVDA shares had fallen by more than 50% to $130.

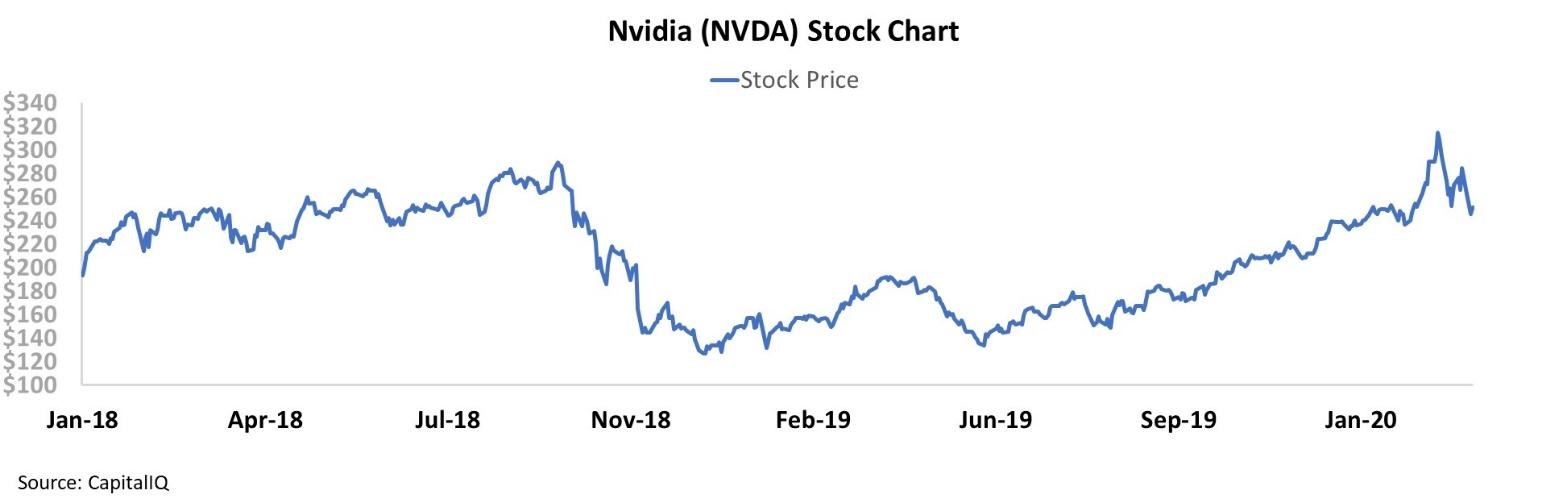

Last month, Nvidia gained the attention of investors once again when shares surpassed the previous high of $290. As you can see below, Nvidia has seen volatile price moves... but had returned to those lofty heights before the recent market correction.

The question on everyone's mind now is whether Nvidia will see a repeat of 2018... or continue to improve.

Before making any decision about a company's valuation, it's vital that investors understand exactly what the market expectations are for future performance.

Without an understanding of the market's position on a stock, it's impossible to know if one thesis is completely different than others, or if it's in lockstep with the rest of the market.

Here at Altimetry, we can understand this by looking at the market's embedded expectations for future performance at a company's current valuations. By cutting out the "noise" of as-reported accounting, we can construct an accurate historical performance for all the firms in our database, and then observe what the market expects at a company's current stock price.

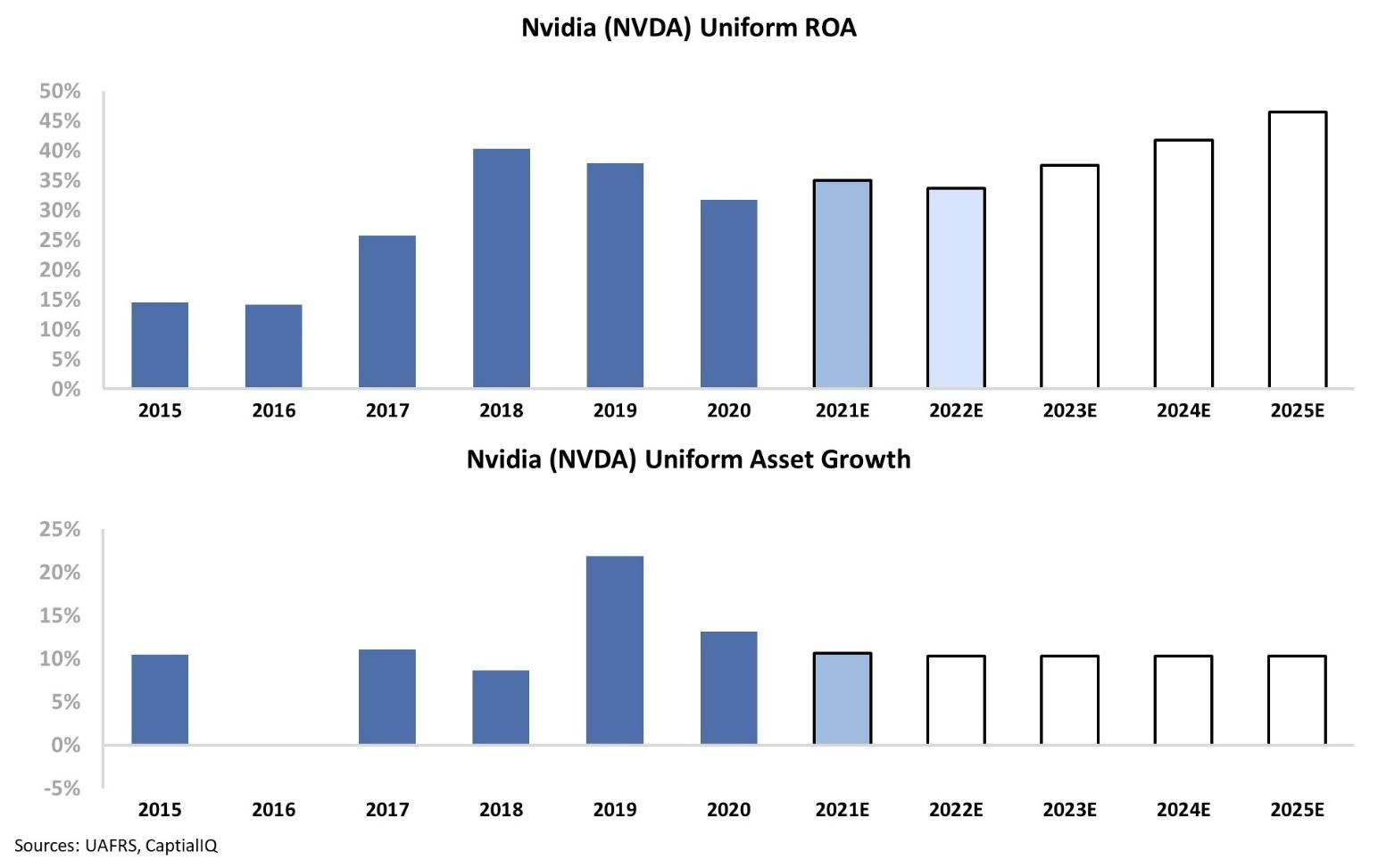

The embedded expectations chart below shows Nvidia's historical corporate performance levels in terms of Uniform ROA and asset growth (dark blue bars) versus what sell-side analysts think the company is going to do for its next fiscal year and fiscal year 2022 (light blue bars) and what the market is pricing in at current valuations (white bars).

As you can see, market expectations for Nvidia are aggressive. At the current price of roughly $215 per share, the market expects Nvidia to be able to improve returns to all-time highs of 46% by 2025, while maintaining a 10% growth rate. Take a look...

The semiconductor market is cyclical in nature – with peaks in profitability driven by the release of the next generation of architecture, followed by regular slowdowns. However, the market is pricing in Nvidia to see returns continue to improve in perpetuity. The power of the embedded expectations tool is to be able to see this at a glance.

While Nvidia could see its profitability continue to expand, it appears that the market is currently pricing in the company to achieve its best-case scenario going forward. This will likely limit any upside potential if Nvidia fails to deliver – much like for Cisco before the dot-com bubble burst. Why pay a premium for Nvidia when the market is already pricing it for perfection?

Regards,

Rob Spivey

March 20, 2020

Sometimes artificial reality can tell us a lot about the real world...

Sometimes artificial reality can tell us a lot about the real world...